RBNZ Preview: Kicking The Pivot Down The Road

We expect the Reserve Bank of New Zealand to hike by 50bp next week and signal a peak rate of around 5.0%. The ongoing downturn in the housing market and worsening external conditions argue against a larger, 75bp move. We are not fully convinced the RBNZ will ultimately deliver all its projected hikes, but a dovish pivot is unlikely on the cards at this stage.

More tightening required

As markets attempt to guess the timing of a dovish pivot by the Fed, another hawkish standout among developed central banks, the Reserve Bank of New Zealand, will announce monetary policy next week. At the October meeting, the RBNZ hiked rates by 50bp to 3.50%, and claimed that “monetary conditions needed to continue to tighten” until the Monetary Policy Committee is “confident there is sufficient restraint on spending to bring inflation back within its 1-3% per annum target range”.

Since the October meeting, domestic data for the third quarter have been released, and unmistakably argued in favour of additional tightening. Inflation (7.2% year-on-year) proved much more resilient than forecasted, unemployment remained low (3.3%) and wage growth accelerated (2.6% quarter-on-quarter). This has led markets to consider a more aggressive 75bp hike in November as an option: currently, the OIS curve embeds 63bp of tightening.

In our view, another 50bp increase looks more likely, especially when considering the ongoing correction in the housing market (more details below) and a challenging external environment: dairy prices, global demand, and the Chinese economic outlook have all deteriorated lately.

Forward-looking message will be crucial

A 50bp hike may be received as a slightly dovish surprise by markets, but we believe that a greater focus will be placed on the forward-looking policy message, in particular: a) any hints in the rate projections that we are close to the peak in rates; and b) other economic projections such as on inflation and house prices.

On point a): we expect a reiteration that monetary conditions need to be tightened further to bring down inflation. There should be a certain degree of acknowledgement that global and domestic conditions have started to deteriorate, but we doubt there is appetite within the MPC to deliver a dovish signal before having seen fourth quarter inflation and employment data.

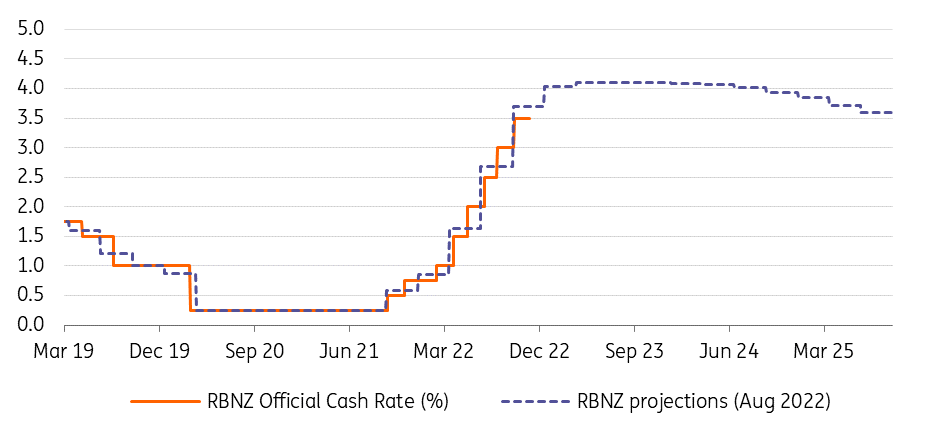

RBNZ current rate projections are unrealistic

Source: RBNZ

The trade-off the RBNZ is facing is not uncommon in the central bank world: signalling much more tightening to cap inflation expectations against delivering a more moderate and realistic rate path. At this stage, we feel the RBNZ may want to risk sacrificing a bit of credibility further down the road (should they underdeliver on hikes) for the sake of fighting inflation. If anything, the incentive to signal less tightening could be to keep mortgage rates capped, but they have not signalled excessive concerns on the housing market for now.

Our estimate is that the rate projections will largely align with market expectations for the RBNZ and the Fed, so showing a peak rate at around 5.00% (90bp higher than the 4.10% shown in the August forecasts). There is also a higher probability some rate cuts (possibly from late 2023) will be introduced in the projections.

Whether the RBNZ will effectively bring rates to 5.0%+ is another question. We are not fully convinced, as an expected acceleration in the house price contraction and further worsening of external conditions in the months ahead may force a dovish turn in early 2023 (next meetings are in February and April).

Housing market troubles to continue

New Zealand’s house price index shows a -4.5% quarterly decline for price in October. The magnitude of this market downturn has now exceeded the worst quarter during the Global Financial Crisis period (-4.4% in August 2008). This is contributed by the rapid rise in mortgage rates and the more stringent 40% deposit requirement.

In RBNZ’s August statement, their projection shows a steeper and quicker decline of 15% from December 2021 to the trough, which is worse than the previous forecast in May. We expect further deterioration to the housing outlook as lending activity continues to fall and more borrowers face higher rates when re-mortgaging.

New Mortgage lending by borrower type (YoY%)

Source: RBNZ

The supply side story is a bit better. Residential construction had remained strong and have finally past its peak. The decline in new dwelling consent is led by rising construction costs and limited capacity from a filled pipeline. However, due to supportive schemes like the KiwiBuild caps, this slowdown is much shallower than the one during and after the GFC.

Ultimately, current projections for the housing market are based upon the assumption that rate is peaking at 4.10% in April 2023. This would imply that the RBNZ only has 60bp worth of hikes to deliver in its tightening cycle – which looks quite unrealistic. If indeed the new projections show a peak rate around 5.0%+, then we suspect they will also need to display a steeper/longer downturn in the housing market. The speed of the house price correction will be crucial both for the pace of further hikes and for the timing/pace of rate cuts next year.

Market impact: NZD still mostly driven by external factors

Given that markets are pricing in approximately a 50% probability of a 75bp hike, a 50bp may come as a dovish surprise. However, if this is accompanied by a hawkish rate path projection – i.e. peak rate around 5.0% – the overall message should remain quite hawkish. So we think the Kiwi dollar could rise after the announcement, even though we don’t expect the impact to prove long-lived, as external factors should continue to prevail.

We have recently revised our NZD/USD forecast profile (more details in our 2023 FX Outlook), and see the pair capped in 4Q22 and 1Q23 (we target 0.60), before a gradual rebound throughout 2023 (0.64 in 4Q23).

More By This Author:

FX Daily: Sterling’s Big DayUK Inflation May Finally Be At Its Peak

FX Daily: Between Geopolitics And A Position Squeeze

Disclaimer: This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information ...

more