Rates Spark: Transitioning From Level To Duration

Image Source: Pixabay

The European Central Bank has entered the next stage - rates markets are starting to look beyond the peak, with macro concerns guiding rates lower and the curve flatter. This is in contrast to the US where macro resilience holds hawkish tail risks for the Fed, but for now also gradually lifts the floor for longer rates

Dovish relief with the ECB peak being reached

The ECB delivered a dovish 25bp hike – and, a more mechanical increase in very front-end rates aside, the rest of the curve rallied. The decision was supported by a “solid majority” of the Council.

The first reason for that reaction was that the ECB basically said that it had reached the terminal rate. The ECB does add the caveat that this applies given the current assessment of all data and data dependency could still mean that rates will increase – President Lagarde did add that one could not say key rates reached their peak. Indeed, markets are also discounting tail risks of another hike over the coming months. But for all practical purposes, the ECB no longer has a bias in rates and we are at the peak as long as there are no larger surprises to the underlying scenario.

The other reason for the curve flattening is that the ECB did not offer anything to prop up longer rates. As Lagarde remarked during the press conference, neither outright asset purchase programme asset sales nor shortening the pandemic emergency purchase programme reinvestment period was discussed at any point. Riskier assets reacted with relief, in particular spreads of Italian government bonds over German Bunds saw a considerable tightening with the key 10Y spread tightening more than 4bp. That still leaves it somewhat wider compared to the end of last week with the Italian government’s growing budget deficits having come under increased scrutiny. Widening risks linger, but at least the ECB is not adding to those concerns for now.

The EUR curve may flatten relative to USD

Refinitiv, ING

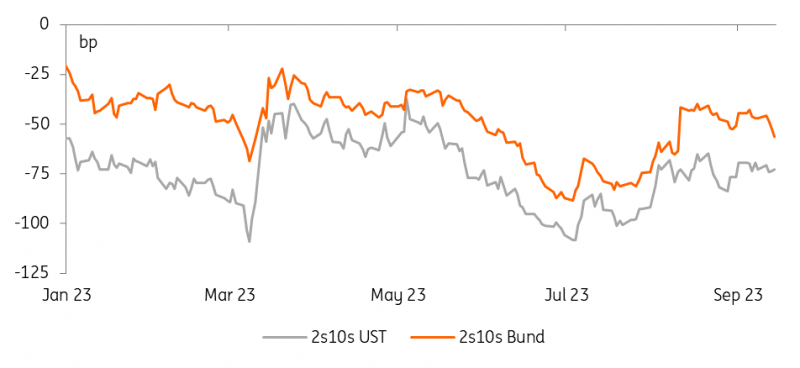

Going into next week’s Fed meeting we have already seen different narratives unfolding across USD and EUR rates. After initial oscillations rates took different directions – the 10Y Bund yield closing down 6bp while the 10Y Treasury rose 3bp. While EUR markets were digesting the potential end of the tightening cycle amid growing concerns surrounding the growth outlook, the US was confronted with another slate of better-than-expected data.

US CPI data earlier this week had seen some of the hawkish Fed tail risk being priced out. This was now reversed with the 2Y rate crossing above 5% again, and the curve a tad flatter. It is widely anticipated that the Fed will hold next week, but at the same time, it will keep another hike on the table. While cooling, for now, the data does not show any signs of the economy really toppling over. It may still mean that we are already at the peak of the Fed's cycle, but at the same time staying pat for longer amid resilient data will mean that gradual steepening pressure from the back end of the curve can take over again.

Today's events and market view

The post-ECB meeting period is usually marked by more background reporting on the Council’s decision and members giving their personal flavours surrounding the decision. Here we will be looking in particular at any differing assessments of inflation versus growth concerns, and indeed in a first FT article some ECB hawks have warned that a hike is still possible if inflation and wages stay hot. But overall the ECB has been quite clear in signalling that it has now entered the next stage, shifting the focus from the level of rates towards the duration that they will now be held steady to achieve its inflation target.

In the US, before we get back to a broader bear-stepping theme the market may well want to first digest the import prices as well as the University of Michigan consumer sentiment survey and its inflation expectations component to round off its assessment of inflationary tail risks. Other US data to watch are industrial production and the Empire manufacturing index.

More By This Author:

Asia Morning Bites - Friday, Sept.15The Commodities Feed: Further Gas Supply Disruptions

FX Daily: ECB To Hike, But Don’t Get Too Excited For The Euro

Disclaimer: This publication has been prepared by the Economic and Financial Analysis Division of ING Bank N.V. (“ING”) solely for information purposes without regard to any ...

more