Rates Spark: The ECB Pushes Back

EUR curves bear flattened at the start of the week with the European Central Bank leaning against aggressive market pricing. The message remains consistent – much of the wage data will only be available by the June meeting. At the same time, the ECB knowingly limits the reach of any pushback by sticking to overall data dependency.

The ECB counters aggressive cut expectations with consistency

The market’s pricing of ECB rate cuts going into this week were elevated, prompting expectations that that we would start to see more pushback from officials. And observers were not disappointed.

Chief Economist Philip Lane initiated the renewed pushback already over the weekend, when he cautioned against recalibrating policy too early. And specifically with regards to the development of wages he pointed out that the Council would only have the most complete data set available by the end of April, so only in time for the June policy meeting.

Yesterday then saw two of the most hawkish ECB members Robert Holzmann and Joachim Nagel add their takes. Holzmann highlighted that early wage data pointed to relatively high increases. The Austrian central banker also warned that one should not bank on rate cuts this year given the potential price implication of supply chain and energy disruptions from developments in the Middle East. The Bundesbank’s head concurred that it is much too early to talk about rate cuts with wages being the “great unknown”.

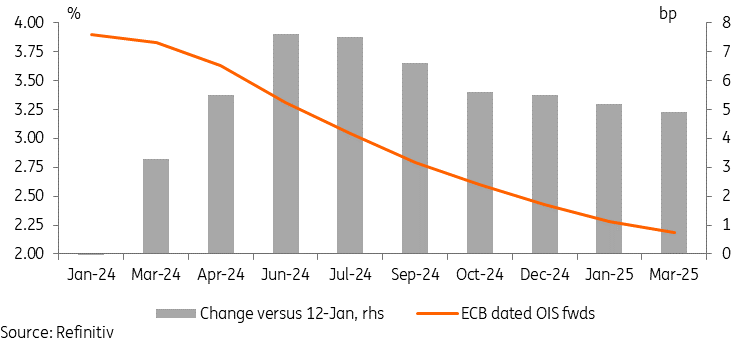

Market rates nudged higher on the back of yesterday’s remarks, even defying a negative GDP figure out of Germany. But they are still more than fully pricing in a first ECB rate cut by April and overall remain close to discounting 150bp in policy easing over 2024.

The ECB probably knows that it is difficult to really move markets away from pricing that is seemingly inconsistent with its communication. But market pricing has to include pricing for tail risks, not just the baseline scenario. Even Lane highlighted downside risks to the outlook and possibly even disinflationary effects of geopolitical tensions – wages are not everything.

To a degree, there is some justification to the market dynamic of anticipating a turning cycle. After all, the remarks by Lane and (most) others including Nagel yesterday seem to indicate that there is a consensus building within the Council that summer could be a possible turning point. And once the ECB starts to move, Lane made clear to not expect this to be a one-off, but signaled a sequence of cuts.

Despite ECB pushback, summer still can't come soon enough for markets

Today’s events and market views

While US markets will return from a long weekend, the focus today should initially remain on EUR rates and central bank communication. The ECB’s François Villeroy, one of the more influential centrists, is scheduled to speak today in a panel at the Davos World Economic Forum.

In eurozone data we will get the German ZEW survey and the ECB’s consumer survey on inflation expectations. The fragility of expectations is a particular worry to officials, which is likely only exacerbated by geopolitical tensions. The US calendar is light, with only the Empire Index of note, but we will have the Fed’s Christopher Waller speaking on the economy and policy.

Today’s highlight in primary markets is the launch of a new 25Y green bond by France via syndication. Germany will auction a new 5Y bond.

More By This Author:

Industry Continues To Decline In The Eurozone, And The Outlook Is BleakHow UK inflation Can Fall To 1.5% By May

What’s Really Going On With Australian Inflation

Disclaimer: This publication has been prepared by the Economic and Financial Analysis Division of ING Bank N.V. (“ING”) solely for information purposes without regard to any ...

more