Rates Spark: The BoJ Effect Can Be Very Impactful Ahead

Image Source: Pixabay

There have been occasions in the past decades where movements in Japanese Government Bonds have had a material effect on the wider bond market. There are two elements to watch. First, the likely unshackling of the 10yr JGB opens a vacuum to the upside, and an issue is how far into that vacuum do JGBs venture. Second, the loosening of the reins on the front end through ultimate policy tightening questions the carry trade that has bolstered the performance of spread for an extended period of time. Our gut tells us there is more room for movement in longer-term rates (versus the policy rate), but moves are not likely to be significant.

The thing is it sets a trend in motion that has the capacity to add some volatility to an environment that has become remarkably calm of late. The risk here is for upward pressure on core yields and for some widening pressure on generic spreads. This could be quite a tame affair. But then again it could be impactful. It really depends on how much markets rate the policy pivot being undertaken by the Bank of Japan, now and over the coming months. Here, markets feel vulnerable to such an influence, even if it really should not be. So don’t look at the initial policy changes. Look more at the extrapolation of them.

Steeper JGB curves are attractive for FX-hedged investors

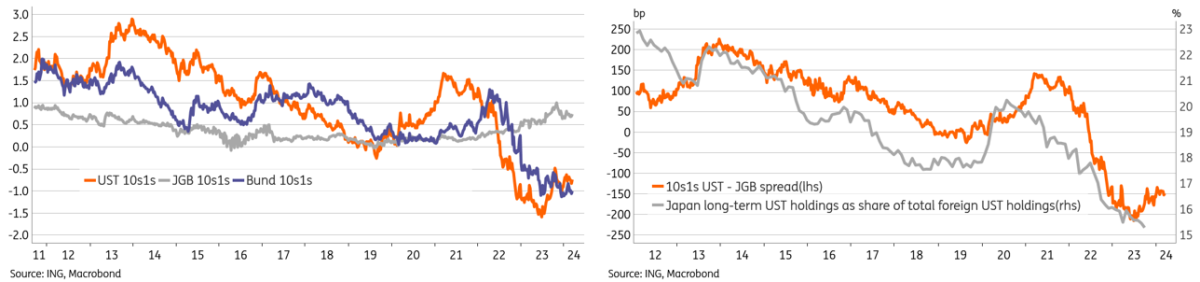

As the yield curve control policy is scrapped it would allow the 10y JGB yield to drift more freely above 1%. Steeper yield curves make JGBs more attractive on an FX hedged basis given the heavily inverted curves in most other regions. Hedging JPY has a positive return due to the low short-end rates. When we proxy the FX hedged 1-year returns as the box trade between 10s1s curves.

The previous decade shows that domestic Japanese investors shed USTs when the 10s1s spread between USTs and JGBs narrowed. The second figure (right-hand chart) shows that the share of Japanese holdings of USTs correlates with this box trade. One could argue that most was driven by the UST curve, but since last year the JGB curve has become more influential and we think will continue to do so going forward.

The 1s10s JGB curve differentials are a proxy for relative FX-hedged bond returns

Tuesday's events and market view

Eurozone data includes consumer confidence and labour costs. The latter is usually not of much interest, but with the ECB's focus on wage developments, it could get more attention than usual. The German ZEW survey will be important soft data to get a grasp of in terms of where Germany's recovery is heading. In the US we have housing starts and building permits, but with the FOMC meeting this Wednesday, we doubt those numbers will move markets.

Regarding issuance, we have a 25y EU green syndication with an expected size of EUR6-7bn. Furthermore in Europe, Italy has a 12y BTPei syndication of around EUR4bn and the UK a GBP2bn auction of 20y Gilts. The US has a 20y bond auction planned for USD13bn.

More By This Author:

The UK’s Improving Inflation Outlook In Six ChartsThe Commodities Feed: Risk Premium Increases For Oil

What Can China’s Key Economic Activity Data Tell Us About Growth Drivers In 2024?

Disclaimer: This publication has been prepared by the Economic and Financial Analysis Division of ING Bank N.V. (“ING”) solely for information purposes without regard to any ...

more