Rates Spark: Still Upside After A Hawkish Fed, BoE Next

The hawkish Fed saw a bear flattening as an impact reaction. In particular, longer rates still hold the upside near-term, but a curve-steepening impulse is probable in the weeks ahead. Investors are split on which strategy the Bank of England will think is best suited to convey a high-for-longer message today.

The 10Y UST yield still has an upside. The 2Y looks fine as is

The Federal Reserve will be content that the market is sitting up and listening to its hawkish tilt. Another rate hike was left on the table as the Fed is still in the process of feeling its way towards “the right level of restriction” to get inflation to target but is "fairly close to where [ it ] needs to get."

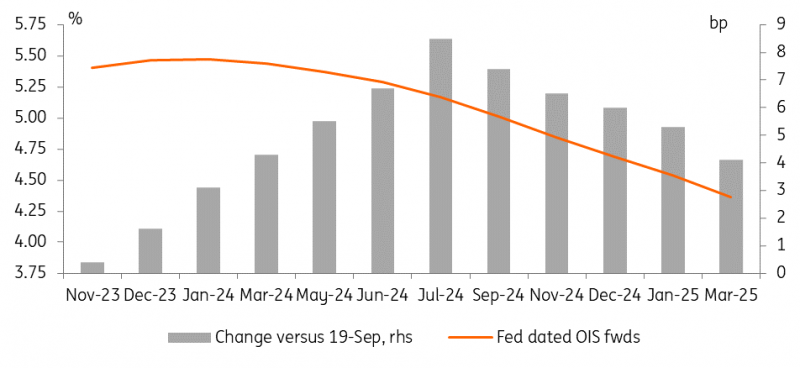

The main surprise was the upgrade in growth and unemployment projections beyond this year, alongside a 50bp shift higher in the median Fed funds projection for 2024 and 2025 – a higher-for-longer move amid growing hopes that a soft landing can be achieved.

Even with unchanged rates today, the 10yr above 4.4% is suitably more restrictive than it was at the last FOMC meeting when it was below 4%. And it still has an upside. The market discount for the bottom of the rate cycle has the funds rate at around 4%, and it has been drifting higher. That places fair value for the 10yr in the region of 4.5%.

The 2yr story is different. We now find the 2yr above 5.15% after rising on the back of the shift higher in the dot plot. That's likely as high as it needs to be. The bigger picture over the next two years will be for the funds rate to be much lower than it is today. That does not need to break even versus a 2yr much above 5%. In fact, this is an area of the curve that can crash lower once it is confirmed that the Fed has peaked. The bottom line is that a curve steepening (dis-inversion) impulse is probable in the weeks ahead.

Rate cuts are priced out after the Fed meeting

(Click on image to enlarge)

Refinitiv, ING

The BoE decision has become a closer call than anticipated

With the Fed out of the way, the focus is now on today's Bank of England decision. The surprising drop in the CPI data yesterday morning has seen markets price out the chances for a hike to just below 50% from around 80% previously. Markets are still eyeing a good chance that the BoE will hike by the turn of the year, and that profile is a significant change from mid-August when three more hikes were fully priced. Chief Economist Huw Pill's ‘Table Mountain’ analogy has clearly had its impact.

Our economists are still leaning towards a final BoE hike today, with some of the downside surprises in services inflation down to volatile travel categories. It is a close call, and the BoE may also draw its own conclusions from market reactions to the European Central Bank's dovish hike and the Fed’s hawkish hold earlier.

Rates aside the BoE will also have to set the pace for its quantitative tightening for the next 12 months. As our economist notes, the nominal value of gilts due to mature over the next year is roughly £10 billion higher than over the last. The Bank has also completed its unwind of corporate bonds over the past year and may want to increase active gilts sales to compensate. A planned reduction of gilt holdings by roughly £100 billion over the next 12 months seems plausible, up from £80 billion over the last.

Today’s events and market view

The BoE policy decision is the highlight of the day, and investors are split on which strategy the Bank will think is best suited to convey a higher-for-longer ‘Table Mountain’ narrative to the market. But there are also Swiss and Scandinavian central bank decisions to follow today, both of which appear set to hike.

In the US, the market's impact reaction to the Fed was a bearish curve flattening, but compared to adjustments made by the Fed to its own projections, the rise in market rates was still modest. The market discount now sits well below the Fed’s projection, which reflects a good dose of skepticism about whether the soft landing can be pulled off – even Powell was reluctant to call it a baseline scenario.

As usual, the market will follow the data closely to make its own calls and in the US, the weekly initial jobless claims have gained more prominence in that context. Today’s numbers are seen a tad higher at 225k versus 220k. In the eurozone, the main data point is the consumer confidence index.

In government bond primary markets, the focus is on the regular French and Spanish auctions as well as a 10Y TIPs reopening in the US.

More By This Author:

The Commodities Feed: Hawkish Fed Pause Caps OilAsia Morning Bites - Thursday, Sept.21

Fed Holds US Rates Steady, But Markets Are Reluctant To Buy Into The More Hawkish Messaging

Disclaimer: This publication has been prepared by the Economic and Financial Analysis Division of ING Bank N.V. (“ING”) solely for information purposes without regard to any ...

more