Rates Spark: If Payrolls Come In Line With Consensus, Then Forget The 50bp Cut Narrative

Image source: Pixabay

It’s Friday payrolls day, arguably the biggest number of the month. Strangely there is a reasonable 165k consensus forecast. Hit the consensus and we think rates pop. We suspect the market is actually positioned for a sub-100k number. If we don’t get that type of validation for material slowdown, yields will be under pressure to rise for a bit.

Markets are actually trading as if we are going to get a sub-100k payrolls outcome

We face into Friday's payrolls report with the 2yr and 10yr yields peppering just under the 3.75% area, and a c.40% probability for a 50bp cut from the 18 September FOMC meeting. In other words, a 25bp cut is discounted with overwhelming conviction. Remarkably though, the consensus estimate for the payrolls number is a reasonable 165k, and the unemployment rate is expected to fall back to 4.2%. As a stand-alone, that does not look like a combination that is screaming for a 50bp cut, never mind a 25bp cut.

Despite these consensus estimates, we feel the market is actually expecting a weaker report than these suggest. While the ADP is not a great correlation to payrolls, it came in weak on Thursday, very weak. And other survey and jobs openings data suggest the number should be weaker than the consensus suggests. In fact, the market is trading as if a sub-100k outcome is in the works.

The key benchmark here is 150k, approximately the replacement rate. Anything below this and we likely see a rise in the unemployment rate. And that would be consistent with a growth recession. Not a fall in output, but a slowdown in growth. Far from catastrophic, but the very weak Beige Book released earlier this week foreshadowed a more dour outcome than even a sub-100k payrolls report would suggest. That fits more in line with where markets are actually trading.

Usually, a consensus outcome should leave market levels broadly unchanged, as we get what was expected. However, we feel if we get a consensus outcome of a 165k / 4.2% combination it's far more likely that market rates rise, and the probability for the September meeting collapses back down to a 25bp cut (forget the 50bp). We think we need a sub-100k outcome to help validate recent price action on bonds and to keep the 50bp cut talk alive.

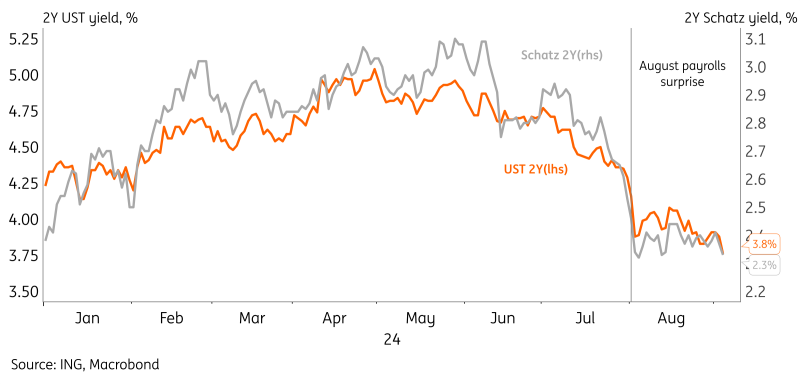

Euro rates will follow the US but the downside is constrained

Euro rates cannot escape the weight of Friday’s US payroll numbers. When the last reading undershot consensus significantly, 2Y Schatz yields joined the move lower and have since traded in the range of 2.3-2.4%. Whilst the US and eurozone economies and financial markets are closely entangled, we do caution that euro markets should not get ahead of themselves based on US developments. The European Central Bank is very likely to cut again in September but thereafter the path of easing is less obvious, and thus the front end of the curve may be constrained from going much lower.

In contrast to the US, the eurozone unemployment rate is still at record lows. Having said that, growth in the eurozone is far from stellar, and if anything is cooling down too. So far these concerns are however not material enough for an acceleration of ECB cuts, especially since a tight labour market means wage growth concerns continue to linger. Currently markets price in 63bp of cuts this year, whilst our view is that a total of 50bp is more likely.

Friday’s events and market view

The highlights are the US payrolls figures and the unemployment rate. Later the Fed's Waller will speak on the economic outlook, which includes a Q&A opportunity to reflect on the job numbers.

Bund yields are trading lower since the last US payroll disappointment

More By This Author:

ECB Preview: Another Rate Cut Without New Forward GuidanceEurozone Retail Sales Continue To Flatline

Asia Morning Bites For Thursday, Sept 5

Disclaimer: This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information ...

more