Rates Spark: Geopolitics Are Only Part Of The Mix

Middle East escalation acted to push bond yields lower. But also in the mix is the ongoing reassessment of the ECB amid a gloomier outlook for the eurozone – the pricing of a 1.75% terminal rate shows recessionary vibes. The reaction of usual safe-haven indicators was more muted. Treasuries are still laser focused on Friday’s payrolls report.

Image source: Pixabay

Lots of pushes and pulls for Treasuries, but still laser focused on Friday’s payrolls

The big deal in the past 24 hours is the spat between Iran and Israel. The unresolved issue is whether Iran’s move is an escalation, or a one-off reactionary impulse. So for the odds favour the latter, which is why the 10yr yield is managing to hang in the low 3.7%’s area.

We still feel Treasuries are eager to see the colour of Friday’s payrolls report before making any further moves in either direction. The Iran story certainly colours a directional impulse to lower yields, and we saw a bit of that when the story broke during Tuesday’s trading. At the same time, a rise in US job openings paints a contrarian upbeat picture for the economy. The China stimulus backdrop is pushing in the same direction, although we, in a contrarian fashion, believe the echo to be seen in the US will be quite minor, given the de-latching seen between the US and China in recent years.

The more glaring issue is the build in rate cut pressure in the eurozone. This is manifesting in wider spreads to the US, and presenting a larger gap to ultimately come under tightening pressure should we see some material weakening in the US labour market. Even though four of the past five months have seen sub-150k readings for employment growth, the labour market continues to hang in.

The November report should be interesting though. On a theory that the striking US dockworkers are deemed to be "not currently employed" that can act to reduce the payrolls number by some 45k. Add to that other ancillary activity that is curtailed. So comfortably in excess of 50k. Not this Friday's one though; but the one next month. Even if a technical thing, it could be enough to pull yields lower.

That all being said, for now we maintain a tactical bearish preference for Treasuries. That assumes that the market expectation for Friday’s payrolls is broadly realised. Although our economics teams expects a weaker number; just maybe not weak enough to cause enough consternation. Really it’s all about that unless something big supersedes it; watch developments out of Iran carefully in this respect.

Geopolitics weigh on yields, but the slide lower already happened well before the headlines

Geopolitical tensions in the Middle East have been brewing for a while now, but with the first headlines of Iran preparing a missle strike on Israel, they seem to have finally met the threshold for markets to react more noticeably – equities turned sharply lower and it also gave bond yields another push lower. The reaction in oil prices was a rise in Brent to the US$75/bbl area, still relatively muted as they only briefly topped last week’s highs. While 10Y Bund yields have dipped towards 2%, the Bund ASW has actually only widened by less than 2bp on the day.

At the start of the month the main driver for direction still appeared to be a repricing of the European Central Bank with the slide in yields beginning well ahead of the geopolitical headlines. The dovish tones coming from the Governing Council had continued with Finland’s Rehn stating that the latest survey and inflation data both tilted the scales in favour of a cut at the October meeting. The more cautious tones about the growth prospect also suggest that the focus is further shifting away from just reining in inflation – with a flash CPI falling below the 2% target on Tuesday that seemed a low bar.

The discount for the October ECB meeting is at 23bp. Perhaps more surprising is that the market is seeing around 55bp of easing with the December meeting and the end point of the ECB next year more firmly at a deposit facility of 1.75% reflecting recessionary vibes. Geopolitics are also at play here to some extent, but any further escalation of the conflict will likely play out in lower 10Y yields rather than on the front end of the curve since the risk to near-term growth or inflation seems limited.

French spreads tighten, also with help from a dovish ECB

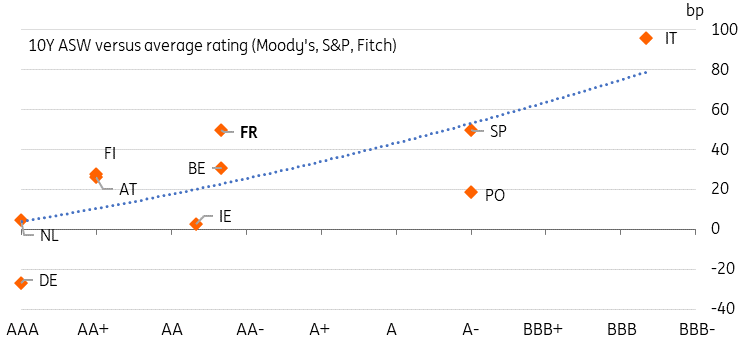

Despite the wider risk-off sentiment, French government bond spreads have actually retreated from their latest highs on Tuesday. While Prime Minister Barnier outlined his government’s plans to bring the deficit down to 5% in 2025 and get it in line with the 3% stipulated by EU rules in 2029, the broader outlines had already circulated in the press ahead of the event. The bigger driver might have been the slate of dovish ECB comments, later framed by the flash CPI falling below 2%. In any case, the French 10y spread over Bunds is still elevated and reflects market concerns about the stability of the government and by extension the longer-term commitments to fiscal consolidation. Spread levels are still in line with expectations of rating downgrades by one notch at least.

French 10Y spreads reflect longer run concerns around the credit

Source: Rating agencies, Refinitiv, ING

Wednesday's events and market view

Geopolitics have made a return as a driver for rates direction and might keep yields more suppressed than otherwise until there is a better sense of Iran’s further engagementin the conflict and Israel's reaction to Tuesday's missle strikes. Data wise markets are gearing up for Friday’s payrolls. Tuesday’s manufacturing ISM employment component turned out particularly weak. Wednesday’s figure to watch is the ADP payrolls report, although it does not have a good track record of predicting the payrolls. There will again be a number of Fed speakers to watch as well including Bowman and Barkin.

Focus in the eurozone will likely be on central bank speakers with numerous appearances including the ECB’s Lane and Schnabel. Data wise the highlight is the eurozone unemployment rate, expected to stay at its record low 6.4%.

In primary markets Germany will be active selling 10y Bunds (€4.5bn) while the UK sells 5y Gilts (£4bn).

More By This Author:

Eurozone Inflation Falls Below Target As The ECB Mulls Faster EasingRates Spark: October ECB Cut More Likely Than Ever

Benign U.S. Inflation Allows The Fed To Focus On Jobs

Disclaimer: This publication has been prepared by the Economic and Financial Analysis Division of ING Bank N.V. (“ING”) solely for information purposes without regard to any ...

more