'Putin-Panic' Goes Global: Stocks & Credit Crushed As Bonds & Commodities Soar

The global systemic risk 'boogeyman' is back...

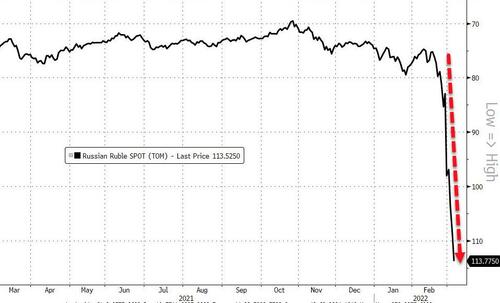

It was a big, bad week for Russian assets as the Ruble collapsed...

Source: Bloomberg

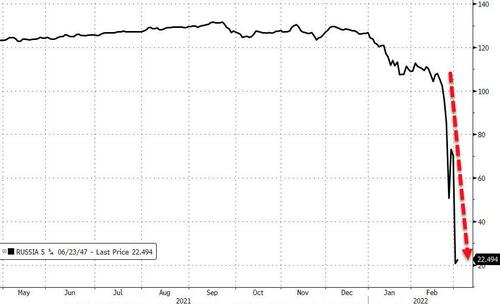

Russian bonds became "worthless" collateral...

Source: Bloomberg

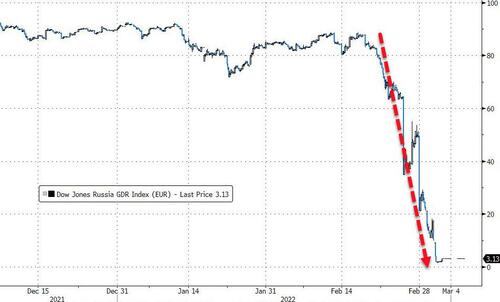

And Russian stock values simply disappeared...

Source: Bloomberg

And finally, the Russians had to basically give their oil away (at a $28.50 discount to Brent) to find a buyer...

Source: Bloomberg

Even as global crude prices soared to decade highs (even with the Iran nuke deal overhang)...

European stocks just suffered their largest outflows on record in the week to March 2...

...which sent European stocks to their worst week since March 2020, with Italy leading this week's collapse, but everything hammered...

Source: Bloomberg

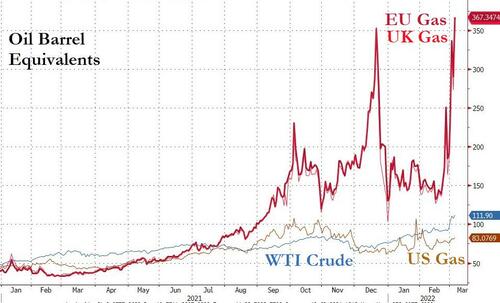

It's likely no wonder as energy costs in Europe exploded this week to a record high (with EU NatGas trading at an equivalent $370 barrel of oil)...

Source: Bloomberg

Swissy has also seen major safe-haven flows, soaring to its strongest since the revaluation in 2015..

Source: Bloomberg

European sovereign yields collapsed this week as safe-haven flows hit - erasing the hawkish ECB spike...

Source: Bloomberg

The last 24 hours or so was a little more chaotic than normal as images of Russian soldiers attacking a nuclear facility sparked some (admittedly) illiquid de-risking last night, then the strong jobs print removed an excuse for The Fed to be dovish in any way. There were some utterly clueless reassurances from Yellen at the end of the day that The Fed will engineer inflation down and a soft-landing for the economy, and stocks did their normal Friday close meltup thing...

US equities had a tough week too - but saw much more volatility than Europeans, chopping up and down 2-3% every day, but unable to hold any gains that were achieved during the pumps. Nasdaq was the week's biggest loser...

Energy and Utes outperformed while financials were clubbed like a baby seal...

Source: Bloomberg

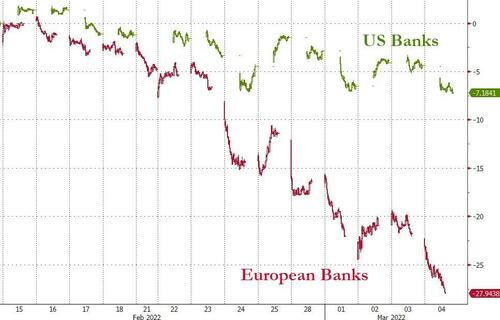

But while US financials were ugly, European financials stole the jam out of everyone's donut...

Source: Bloomberg

Bubble markets continued to blow up - with SPACs, ARKK, and Unprofitable Tech just getting destroyed...

Source: Bloomberg

Bonds were bid on the week - despite a big sell-off ion Wednesday during the European session - with the belly dramatically outperforming the wings...

Source: Bloomberg

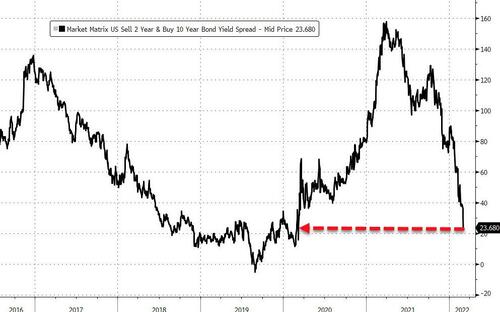

The yield curve collapsed this week - screaming Fed policy error imminent...

Source: Bloomberg

"Shit is starting to get real," warned one trader, "we are going to hear of some big holes appearing in funds books very soon..." Which made this very appropriate...

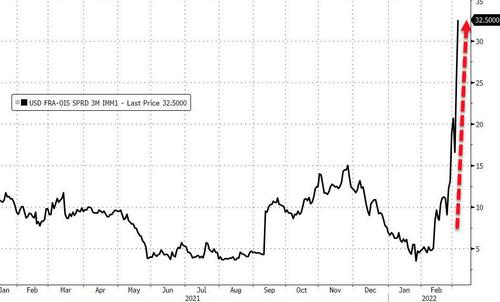

Stresses are starting to show in the financial system with FRA/OIS spreads blowing out...

Source: Bloomberg

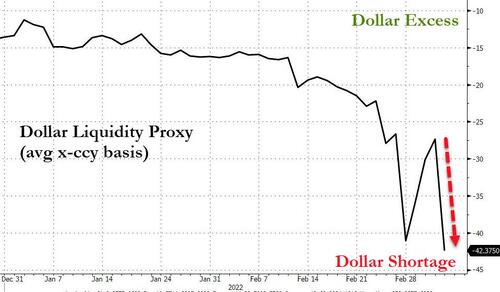

And dollar liquidity becoming a problem fast for someone...

Source: Bloomberg

Which probably explains the surge in the dollar this week...

Source: Bloomberg

...breaking out of the recent range to a key level from pre-COVID-lockdown panic...

Source: Bloomberg

Credit markets are starting to crack hard with HY spreads at their widest since Nov 2020...

Source: Bloomberg

Global financial credit risk is starting to blow out too, with Credit Suisse getting hit the hardest...

Source: Bloomberg

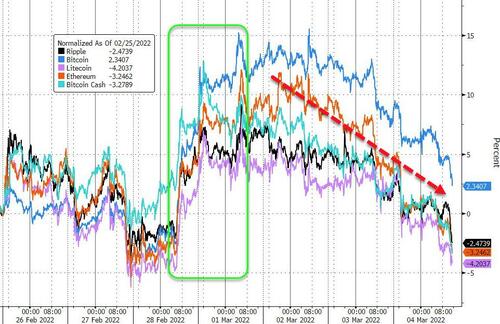

Cryptos had a roller-coaster week with Bitcoin managing to cling to some of the post-Putin gains (but fell back below $40k)...

Source: Bloomberg

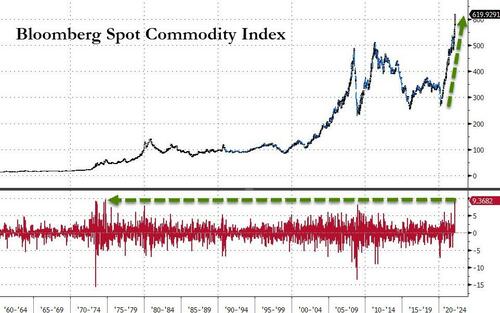

This week saw the biggest jump in Spot Commodity prices since Sept 1974, which closed at a new record high...

Source: Bloomberg

For context of just how insane this week's move in crude was (+25%), here it is compared to PMs and copper (which also had big weeks)...

Source: Bloomberg

Gold saw safe-haven flows as WW3 draws closer...

National average gas prices at the pump exploded higher this week - the 2nd biggest jump ever - and look set to go even further given the price of crude and wholesale gasoline...

Source: Bloomberg

Finally, in case it was not obvious from the charts above, we are in a state of "Extreme Fear"... This is the most fearful the market has been since the cratering lows of the March/April 2020 collapse...

Source: CNN

...and don't expect The Fed to do anything to protect against this plunge this time as while Powell jawboned expectations for a 50bps hike in March down to 25bps, the market is still expecting 6 rate-hikes this year... (and QT)...

Source: Bloomberg

Brace.

Disclaimer: Copyright ©2009-2022 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies ...

more