Price Patterns Show Australian Dollar Strength Against NZD

The AUD/NZD has made a bullish breakout above the ascending wedge pattern on the daily chart. An uptrend is expected to continue higher soon. Let’s review the key patterns in this article.

Price Charts and Technical Analysis

(Click on image to enlarge)

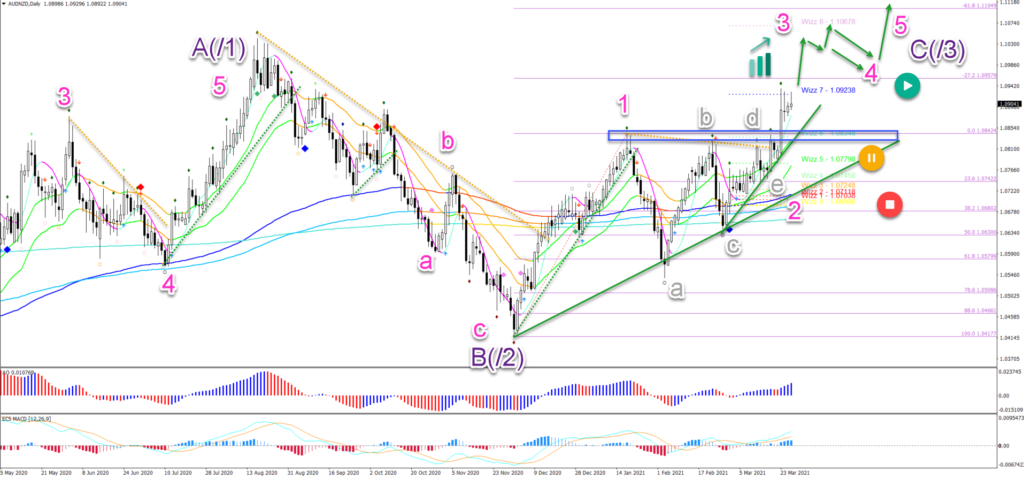

The AUD/NZD is in a long-term consolidation, sideways price action. But the daily chart is developing interesting price patterns.

The Australian Dollar seems ready for more strength, which is useful information when trading AUD or NZD currency crosses.

For instance, it could be to look for NZD weakness and AUD strength when trading against the USD, EUR, GBP, or JPY. Or of course, trading the AUD/NZD might be an option as well.

- The AUD/NZD seems to be building a larger ABC pattern (purple – or perhaps 123).

- The wave B (purple) and wave 2 (pink) seem to be completed.

- The bullish breakout could indicate a wave 3 (pink).

- A bullish breakout (green arrows) above the Wizz 7 level and -27.2% Fibonacci target could indicate a push higher towards the -61.8% Fibonacci level.

- Only a deep retracement below the previous top and below the support zone would place the uptrend on hold (orange button) or invalidate it (red button).

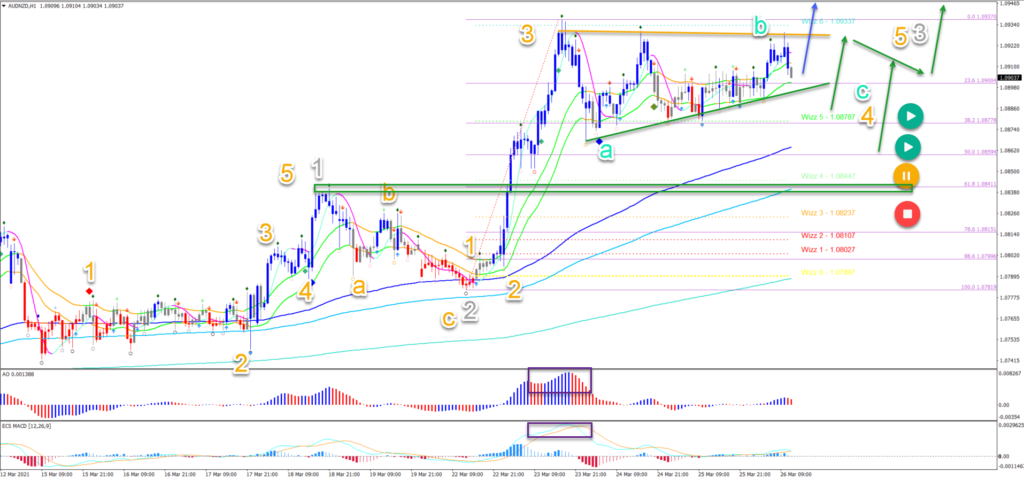

On the 1 hour chart, price action is showing a strong push up (purple boxes). This is typical for a wave 3 (orange).

- The current pullback is choppy and corrective which is also usual for a wave 4 (orange).

- Price action could make an immediate breakout (blue arrow).

- Or price action could retest the shallow Fibonacci retracement levels again. A bullish bounce is expected there (green arrows).

- A break below the 50% makes the current wave 4 less likely.

- A break below the 61.8% Fib makes it invalid.

- The targets are located at 1.11 and 1.12.

(Click on image to enlarge)

Disclaimer: The opinions in this article are for informational and educational purposes only and should not be construed as a recommendation to buy or sell the stocks mentioned or to solicit ...

moreComments

No Thumbs up yet!

No Thumbs up yet!