Preparing For The Publication Of Significant Statistics In Japan And Britain

(Click on image to enlarge)

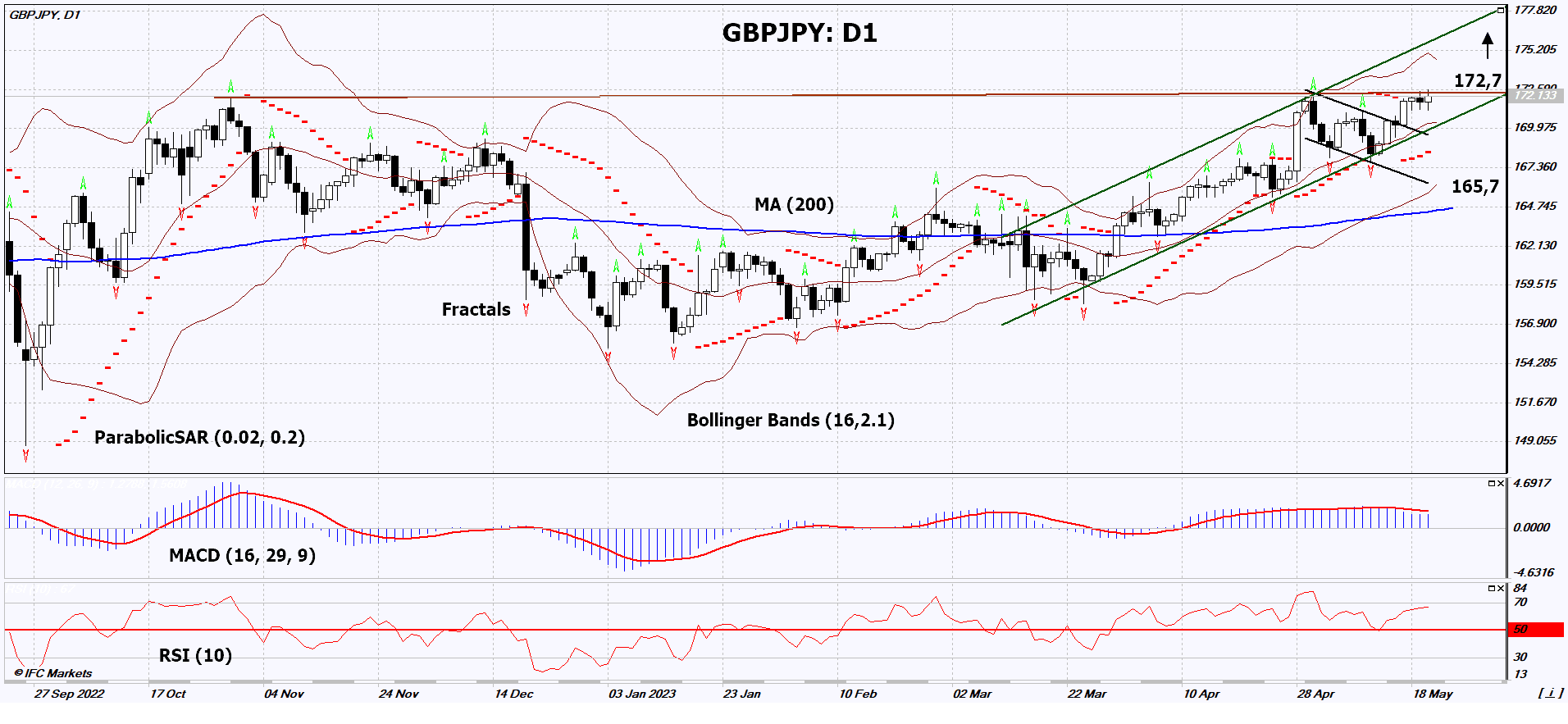

On the daily timeframe, GBPJPY: D1 is in a rising channel. It has broken out of a bullish flag and approached a strong resistance level. This level should be broken upward before opening a position. Several technical analysis indicators have generated signals for further upward movement. We do not exclude a bullish movement if GBPJPY: D1 rises above the last two fractal highs and its recent maximum at 172.7. This level can be used as an entry point. The initial risk limitation can be set below the Parabolic signal, the last two fractal lows, and the lower Bollinger Band line at 165.7. After opening a pending order, we move the stop loss along with the Bollinger Band and Parabolic signals to the next fractal low. This way, we adjust the potential profit/loss ratio in our favor. More cautious traders, after entering the trade, can switch to the four-hour chart and set a stop loss, moving it in the direction of the trend. If the price exceeds the stop level at 165.7 without activating the order at 172.7, it is recommended to cancel the order as internal market changes that were not taken into account may occur.

Fundamental Analysis of Forex - GBP/JPY

Japan and Britain are expected to publish important economic data. Will GBPJPY quotes continue to rise?

Upward movement implies a weakening of the Japanese yen against the British pound. Last week, inflation unexpectedly rose in Japan for April, reaching 3.5% y/y, higher than the expected 2.5% y/y. On May 22, Japan's Core Machinery Orders for March plunged by -3.5% y/y, contrary to the expected growth. On May 23, a group of economic activity indicators will be released in Japan, including the Jibun Bank Manufacturing PMI. On May 25, Tokyo's inflation data for May will be published, which could provide further insight into the forecast for Japan's overall inflation, to be released on June 22. The majority of forecasts appear somewhat negative for the yen. In Britain, there will also be significant statistics this week. On May 23, the S&P Global/CIPS UK Manufacturing PMI will be released, followed by inflation on May 24, and retail sales on May 26. Additionally, this week will feature a speech by the Governor of the Bank of England (BoE). Market participants hope that the data will increase the likelihood of a rate hike (+4.5%) by the BoE at its next meeting on June 22. It's worth noting that the Bank of Japan's rate has been negative since January 2016 (-0.1%), and its next meeting is scheduled for June 16.

This overview has an informative and tutorial character and is published for free. All the data, included in the overview, are received from public sources, recognized as more or less reliable. To further analyze the market, simply download MetaTrader 4 for PC and other devices, When you download a trading platform, you will have access to various tools and features that are essential for forex trading, including real-time market data, technical analysis tools, charting software, and order execution capabilities. These tools will allow you to monitor market trends, analyze price movements, and execute trades efficiently and effectively. MT4 serves as a comprehensive platform for conducting technical analysis in forex trading. It combines charting tools, indicators, drawing tools, backtesting capabilities, and the option for automated trading, enabling traders to make informed decisions based on technical analysis and execute trades effectively.

More By This Author:

Google Stock Price Bias Bearish Despite Alphabet Revenue Beat

Markets Rebound After Bank Fears Subside

GBPUSD Forecast Bearish Despite Better Than Feared UK Retail Sales Data