Precious Metal Predators: Short Sellers Look To TSX:V Miners

Image Source: Pexels

If you have been watching the inverse relationship between the price of gold and the value of the USD, then you may realize something is off.

Since the Fed started raising interest rates, the dollar started going up, which means gold should’ve gone down. And it did, for awhile.

When the Fed raised rates in 2022, gold sunk into the $1740s. Now it looks like the price of gold is set to go up over $2000 once more, even though the value of the dollar is holding between 103 and 106.

So, something’s off. That’s good for miners, we suppose, but there’s more…

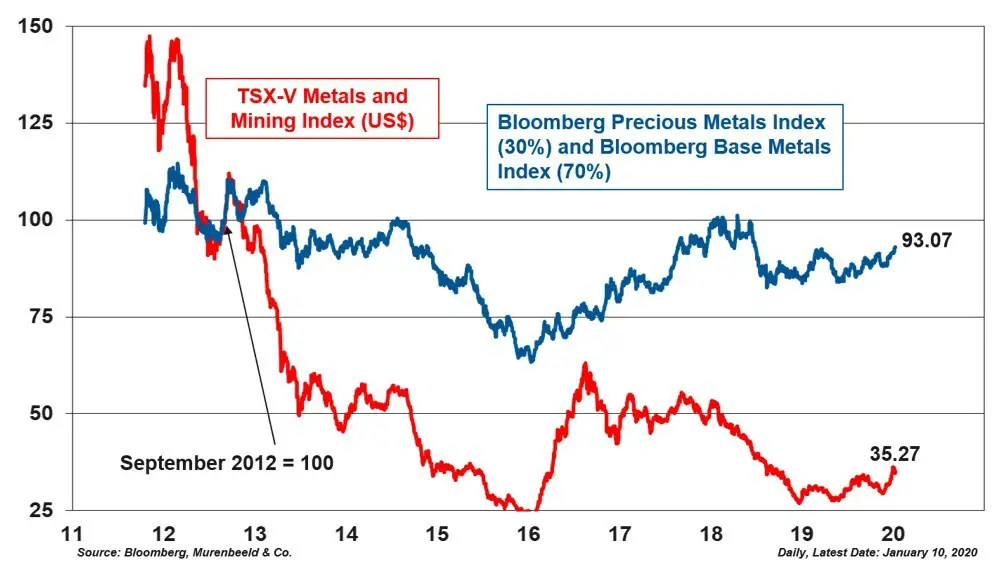

The value of mining explorers on the TSX:V has been off for years. There’s been an even greater dissonance in Canadian Mining exploration companies since 2012.

Pre-2012 a “tick test” was used to verify short sells on the TSX market exchange.

Now prices look like this.

Compare the two indexes below in USD value:

(Click on image to enlarge)

Figure 2 – Divergence of TSXV Metals and Mining Index from Commodity Indexes (CNW Group/Save Canadian Mining)

Canadian Miners are a 35% value commodity markets.

(They’re a steal for any investor if gold goes up, but creating an even vulnerability at the same time.)

First, the TSX is trading priced at spectacularly low levels putting explorers at risk of losing vital funding from investors for operations.

As the dollar rises, some may succumb to mergers and acquisition deals from major gold and silver producers. But owning so many speculative ventures like mineral exploration isn’t a norm for the gold-producing whales. They’d rather spend millions expanding mining projects that are already producing.

So a higher dollar would only create an even bigger discrepancy in pricing, which makes some Canadian explorers a heck of a buy (for contrarians).

If they’re willing to take risks.

Second, Save Canadian Mining is a non-profit dedicated to advocating against predatory short-selling on the TSX:V…

Last Friday, the group issued a press release calling for help.

“The TSXV is trading at all time non-pandemic lows despite robust commodity markets.

This is not a normal cyclical market cycle. This is very different. World leaders are finally recognizing the real root of the crisis. On Nov 5th South Korea banned short selling. Their leadership cited concerns about increasing market volatility and illegal short-selling practices undermining market stability.”

Predatory short sellers can easily take advantage of Canadian Mining companies on the TSX Venture exchange…

According to Save Canadian Mining’s, Terry Lynch, this happens all the time in Canadian Capital Markets.

Instead of declaring a borrow, like a regular short sell, predatory short sellers declare a large sale of stock of a Canadian mining stock, and then everyone else thinks there must be something wrong.

So they hit the sell button too…

Which allows the “short sellers” to come in and buy the stock up at the new lower price.

This doesn’t happen all the time, but it does happen. And with lower prices discrepancies these companies are all the more vulnerable.

So there are big risks for Canadian explorers looking for gold, uranium, silver, copper, and you name it… right now. As well as the industry in general.

But for contrarians willing to speculate, profits may be in store.

For those wishing to remain skeptical, caution is advised.

More By This Author:

Gold: Resistance Is...FiniteRecession Watch: Wow, That Was Fast

Uranium Stocks: What Just Happened To SMRs?