Pound Sterling Falls As UK Starmer Supports Lower Interest Rates And Inflation

Photo by Colin Watts on Unsplash

The Pound Sterling (GBP) trades slightly lower against its major peers on Tuesday as United Kingdom (UK) Prime Minister (PM) Keir Starmer stresses bringing inflation and interest rates down to boost business investment and economic growth.

While addressing reporters on Monday, UK PM Starmer said, “The most important things that we can do for growth, the most important things that we can do for business is first to drive inflation down so that interest rates come down further, and the cost of business investment comes down with it,” Reuters reported.

These comments from Starmer came while praising the Autumn budget announced by Chancellor of the Exchequer Rachel Reeves last week, in which she raised taxes by 26 billion pounds by 2029-30 to fill the fiscal gap.

The scenario of lower UK interest rates bodes poorly for the Pound Sterling.

Meanwhile, traders are also confident that the Bank of England (BoE) will cut interest rates in the monetary policy meeting this month amid weakness in the job market and slowing inflation growth.

Contrary to firm dovish BoE market expectations, policymaker Megan Greene stated on Monday that she would support interest rate cuts only if the labour market and consumption deteriorate further.

Pound Sterling Price Today

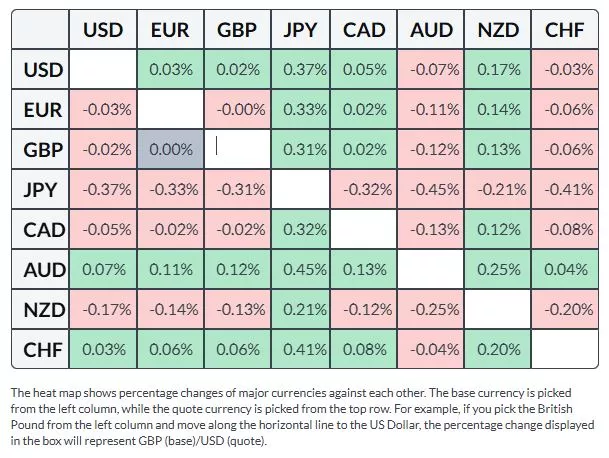

The table below shows the percentage change of British Pound (GBP) against listed major currencies today. British Pound was the weakest against the Australian Dollar.

Daily digest market movers: Pound Sterling ranges vs. US Dollar

- The Pound Sterling flattens around 1.3220 against the US Dollar (USD) during the European trading session on Tuesday. The GBP/USD pair consolidates as the US Dollar turns sideways after recovering on Monday despite weak United States (US) ISM Manufacturing Purchasing Managers’ Index (PMI) data for November.

- At press time, the US Dollar Index (DXY), which tracks the Greenback’s value against six major currencies, holds onto Monday’s recovery move around 99.40.

- The US economic data showed on Monday that activities in the factory sector contracted for the ninth month in a row. Also, the pace of contraction in the manufacturing sector activity was faster than projected. The Manufacturing PMI landed at 48.2, lower than estimates of 48.6 and from 48.7 in October.

- In addition to the Manufacturing PMI, other sub-components of the non-service sector, such as New Orders and Employment Indexes also came in significantly lower than their former readings. The overall weakness in the manufacturing sector exhibits a weak demand environment, which, in theory, underpins the need for further interest rate cuts by the Federal Reserve (Fed).

- Currently, traders are increasingly confident that the Fed will cut interest rates again this year. The central bank has already reduced the Federal Fund Rate by 75 basis points (bps) to 3.75%-4.00% this year. According to the CME FedWatch tool, there is an 87.2% chance that the Fed will cut rates by 25 basis points (bps) to 3.50%-3.75% in the December monetary policy meeting.

- Going forward, major triggers for the US Dollar will be the ADP Employment Change and the ISM Services PMI data for November, which are scheduled for Wednesday. The ADP report is expected to show that private employers added 10K fresh workers, significantly lower than 42K in October. Meanwhile, the ISM Services PMI is seen lower at 52.1 from 52.4 in October.

Technical Analysis: GBP/USD breaks Falling Channel on the upside

GBP/USD trades at 1.3211 during the European trading session on Tuesday on the daily chart. The pair holds marginally above the rising 20-day Exponential Moving Average (EMA) at 1.3187, keeping the short-term bias pointed higher. The average has begun to turn up after a flattening phase, signaling improving trend conditions.

The 14-day Relative Strength Index (RSI) stands at 51.24, neutral, as momentum stabilizes after the recent rebound.

The break above the descending trend line, coming from 1.3726, at 1.3085 earlier in the move, confirmed a shift in bias, with the former cap no longer obstructing the topside.

With the trend-line breach validated, dips would stay contained while buyers defend higher lows. A pullback toward 1.3085 could attract demand, whereas a daily close beneath that area would negate the bullish bias and risk a deeper retracement towards the psychological level of 1.3000.

More By This Author:

Pound Sterling Underperforms Its Peers On Dovish BoE ExpectationsUSD/CAD Trades Close To Weekly Low Around 1.4030 As Fed Rate Cut Bets Remain Firm

Indian Rupee Opens Cautiously Against US Dollar Despite Fed Dovish Bets Swell