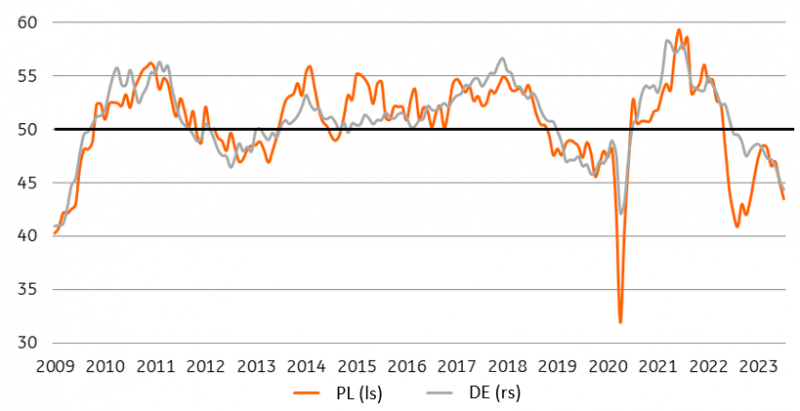

Polish PMI Dips In July On Falling New Orders

Image Source: Pexels

Poland's manufacturing PMI fell to 43.5pts in July, down from 45.1pts in June, the lowest level since mid-2022, when the domestic economy struggled with the effects of rising energy prices, among other factors. The assessment of current production, orders, employment, and purchases all worsened in July from the previous month

The most significant thing to note from this data release is the deteriorating assessment of the acquisition of new orders (the worst ratings in eight months), especially for exports (the weakest performance since May 2020). This was followed by a decline in current production, the fastest since November 2022 and the fifteenth consecutive month of decline. We are most likely seeing the effects of economic weakness in the eurozone, especially in Germany (the industrial PMI there is below 40pts). Around 50% of Polish industry products go to foreign markets, and Germany is Poland's main trading partner.

Planned employment decreased for the fourteenth month in a row. This can be seen in the CSO's employment data, where manufacturing accounts for much of the decline. In June, for example, the business sector lost about 5,000 full-time jobs, of which 3,000 were in manufacturing. Companies also reduced purchasing activity and sought to reduce inventories. In our view, this will translate into relatively weak imports. In addition to energy commodity prices, this should sustain Poland's trade surplus despite the weak export outlook.

Manufacturing PMI in Poland and Germany

External demand affects the Polish industry

Image Source: Macrobond

The bright spot is rapidly decreasing price pressure. The lack of demand has again pushed prices down. Input costs have fallen at the strongest rate since the survey began more than 25 years ago. This was helped by declines in raw material prices and/or the strengthening of the zloty. Selling prices also fell at the fastest pace ever. More than 27% of respondents reduced their prices during the month.

While there are signs of stabilization in domestic industrial production data, recent PMI reports suggest a cautious approach to expectations of a marked improvement in the sector's condition in the second half of the year. Manufacturing is seeing a marginal rebound in the US, and Asia, and sluggishly in China, but not in Europe. We think the PMIs for Poland (and elsewhere) are much more pessimistic than real trends in activity (see graph), but other anecdotal evidence we collect has not provided positive signals so far.

More By This Author:

Why Market Rates May Continue To Rise After The Fed PeaksThe Commodities Feed: Copper Drops From Three-Month High After Weak China Manufacturing Data

Reserve Bank Of Australia Takes Another Breather

Disclaimer: This publication has been prepared by the Economic and Financial Analysis Division of ING Bank N.V. (“ING”) solely for information purposes without regard to any ...

more