Polish Construction Rebounds In September After August Slump

Image source: Pixabay

September’s stronger-than-expected industrial output was followed by a rebound in construction activity, which returned to positive growth after August’s sharp decline.

Construction and assembly output in Poland increased by 0.2% year-on-year in September (ING: +1.0%; consensus: -2.3%) following a 6.9% YoY decline in August. Seasonally adjusted data indicate a month-on-month rise of 2.6%.

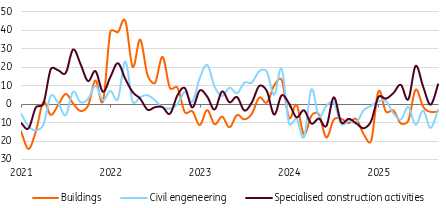

The most significant improvement was seen in specialised construction activities, which rose by 10.7% YoY, after a 0.3% decline the previous month. The downturn in civil engineering works also eased considerably – a 3.0% YoY drop compared to -12.8% in August. Meanwhile, building construction activity remained subdued: -3.8% YoY in September, following -4.1% in August.

Construction rebound underpinned by specialised activities

Industrial output, %YoY (NSA)

Source: GUS.

Monthly data from the construction sector is exceptionally volatile. In September, activity increased by 20.7% vs August. It is encouraging to see a return of strong growth in specialised construction activities, which in previous months also proved most resilient to the generally weak conditions in the construction sector. This is a highly diversified category, encompassing both activities related to the initial stages of construction projects, such as demolition and site clearance, as well as tasks typical of the final stages, including building installations (electrical, heating, water and sewage, etc.) and finishing works (plastering, painting, etc.).

We expect that the acceleration of projects financed through the National Recovery Plan (KPO) and the absorption of structural funds will support civil engineering works, although this is likely to have a greater impact on construction and hence fixed investment in 2026 than in the second half of 2025. At the same time, building construction, particularly residentials, continues to struggle with oversupply and faces a price correction. However, the decline in interest rates, which improves the credit eligibility of potential homebuyers, should support a recovery in this segment of the construction market as well.

Despite some recovery in September, construction remains a sector where conditions are still unfavourable, with a recession recorded in the third quarter of 2025 as a whole. There was a slight improvement compared to the second quarter in the industrial sector, although the outlook for the fourth quarter does not appear promising. The situation in retail trade in goods and services should continue to look solid.

Based on available data, we estimate that GDP growth in 3Q25 was close to 4% YoY (the preliminary estimate will be released on 13 November), and for the full year, the Polish economy is expected to grow by around 3.5%. Service industries continue to play a key role in value-added growth, while on the demand side, household consumption remains the main driver. The rebound in investment is delayed due to the slow implementation of projects under the National Recovery Plan (KPO).

More By This Author:

FX Daily: Tentative Calm Fuels Dollar ReboundRates Spark: There’s Resistance To The Push Lower In Rates

Poland’s Industrial Awakening Might Prove Temporary

Disclaimer: This publication has been prepared by the Economic and Financial Analysis Division of ING Bank N.V. (“ING”) solely for information purposes without regard to any ...

more