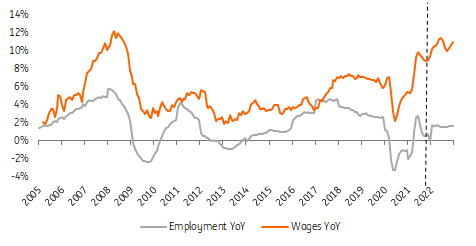

Poland’s Strong November Labor Market

November labor market figures beat expectations, signaling strong demand. Employment rose by 0.7% MoM, faster than expected. Wages increased by 9.8% YoY, likely reflecting that strong labor demand, the payment of bonuses ahead of tax changes from the 'Polish Deal', and a surge in commodity prices, notably coal.

In October employment in Poland increased by 0.5% YoY, while wages rose by 8.4%. The consensus expectations were respectively 0.5% and 8.9% YoY.

The strong labor market performance likely reflects increasing activity in manufacturing and mining. The loosening of Covid-related restrictions in Asia in the past few weeks also probably allowed companies to increase production and employment. This was already visible in euro area leading indicators. At the same time layoffs in services, started after the expiration of the government labor protection scheme, also likely ended.

Strong demand for labor was reflected in wages. The bargaining power of employees is high due to labor shortages but also high CPI inflation. Secondly, those high wage dynamics also reflect the spike in commodity prices, including coal, which has revived mining production and power generation and has allowed companies to pay higher bonuses. Thirdly, we also think that earlier payments of bonuses took place, especially for high earners for whom personal taxes will grow due to tax changes introduced in the 'Polish Deal'. That's in contrast with the rest of society who'll see lower taxation rates.

Employment And Wages In Poland

We expect wages to rise further at the turn of the year, reaching double-digit levels. Surveys show companies are willing to increase wages, passing the rising costs onto consumers. Employers also plan to increase wages for high-earners, to compensate for a higher minimum wage and an effective decrease in the tax rate for low-earners, to preserve the pay scale.

Strong growth in wages is one of the reasons why we expect core inflation to remain elevated in 2022, even as the headline number starts to decelerate. Companies are still passing rising costs (including wages) onto consumers, as confirmed by surveys such as the PMI. It’s hard to say whether the strong rise in wages already reflects the wage-price spiral or earlier bonus payments before tax changes introduced by the Polish Deal or just higher bonuses for miners. Still, we include the risk of wage-price spirals into our CPI and NBP rates' forecast for 2022. We still see the terminal rate at 3% or even higher.

Disclaimer: This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information ...

more