Poland’s External Position Remains Solid Amid Better Income And Services Balances

Image Source: Pexels

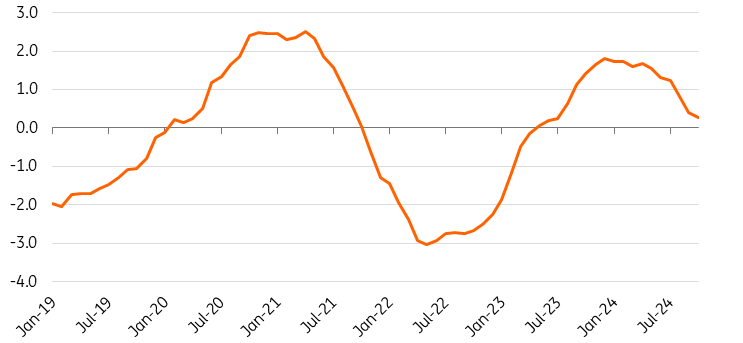

The surprising surplus in the current account of the balance of payments in October was due to a strong improvement in the primary income and services balance. On a 12-month basis, Poland still records a slight surplus which, together with the rising interest rate differential and increasing inflow of EU funds, supports the zloty.

After three months of deficits, October brought a surprising current account surplus of €1064 million, significantly above the consensus of -€300mn and up from a deficit of -€1434mn in September. According to our estimates, on a 12-month basis, the current account surplus slightly decreased to 0.3% of GDP from 0.4% of GDP in September. However, October was the sixth consecutive month with a trade deficit (-€740 million, close to -€690 million in September), with exports, expressed in euro, increasing by 1.5% year-on-year (after 0.5% the previous month) and import growth accelerating to 6.6% YoY from 5.1% the previous month.

The improvement in the current account balance was driven by the income balance, which was €2 billion better than the previous month, and an improvement in the services balance (by €0.5bn compared to September). The strong increase in primary income was partly due to an increase in direct payments to farmers under the common agricultural policy (Information from the National Bank of Poland indicates an increase in these payments of about €0.4bn compared to the same period last year). Finally, the secondary income deficit of €0.4 billion was slightly better than the previous month.

As for trade turnover, its changes reflect economic trends in the country and the external environment of Poland. Domestic demand is growing much more dynamically than foreign demand, which translates into an increase in the merchandise trade balance. In particular, due to an economy fluctuating between stagnation and recession, the share of Germany in Polish exports is decreasing (according to GUS data, to 27% in cumulative terms from the beginning of the year compared to a share of 28% in the same period of 2023). Import expenditures are driven by domestic demand, particularly consumer demand, including for car purchases, and likely related to defence spending. We estimate that on a 12-month basis, the trade balance in October deteriorated to -0.6% of GDP from -0.4% after September.

Yesterday’s forecasts from European Central Bank economists for the euro area, to which almost 60% of Polish exports go, do not bode well for a quick improvement in Poland’s external environment. The ECB lowered its forecast for euro area economic growth in 2025 to 1.1% from the 1.3% forecast in September. This still seems like an optimistic forecast in the face of risks arising from the tariffs announced by President-elect Donald Trump and the erosion of the competitiveness of the European economy amid rising pressure from China, as indicated by Mario Draghi’s report. The Bundesbank lowered its forecasts for the German economy and pointed to risks related to potential tariffs on exports to the USA.

According to the NBP press release, which refers to trade turnover expressed in zloty, a decline in exports was recorded in five out of six categories of goods (the exception being agricultural products). The biggest impact was the decline in the sale of transport equipment and parts, including a decrease in the export of electric car batteries. Additionally, there was a significant drop in the export of investment goods. As for imports, an increase was recorded in three categories of goods, the strongest in the import of consumer goods, especially household appliances and clothing, as well as in the import of agricultural products and transport equipment. In the latter category, we expect strong increases in the last months of the year due to the entry into force of more stringent emission standards from the new year, as suggested by vehicle registration data. Import bills for energy raw materials were significantly lower, according to our estimates, by about 20% YoY.

The surprising surplus in the current account, although largely due to seasonal factors, is positive for the zloty. A slight surplus in the current account balance is still maintained on a 12-month basis, and the trade deficit in the same terms remains small. The outlook for foreign trade in 2025-26 suggests a shift from a surplus to a deficit in the current account balance, although relatively low – of around 1% of GDP. The zloty is positively influenced by the growing interest rate differential between Poland and the euro area, as the ECB continues its rate-cutting cycle, and there is still no agreement in the Polish MPC on when to start discussing monetary easing. The prospect of increasing inflows of EU funds from the bloc's cohesion policy and further transfers from the Recovery and Resilience Facility (the next one still in December) is also supportive of the currency.

Poland’s current account balance, % of GDP

Source: ING estimates based on NBP and CSO data.

More By This Author:

ECB Rate Cuts: Will This Be Enough To Revive Growth In The Eurozone?

Will The Fed Hit The Brakes? Inflation Concerns Shift 2025 Rate Cut Projections

Oil Prices Rise As OPEC Cuts Demand Forecasts; Will The Gains Last?

Disclosure: Invezz is a place where people can find reliable, unbiased information about finance, trading, and investing – but we do not offer financial advice and users should always ...

more