Poland’s Economic Growth Outshines CEE Peers

Image source: Pixabay

Poland’s economy expanded by 2.9% in 2024, broadly in line with expectations from a year ago, while GDP in other CEE countries fell well short of expectations. Our estimates indicate that the country's economic recovery resumed in the final quarter after a soft performance in the third. We think Poland's 2025 growth should accelerate above 3% as domestic consumption continues to grow and public investments kick in.

Poland leads CEE in economic growth

Initial estimates from Poland's StatOffice indicate that Poland’s GDP growth amounted to 2.9% in 2024, accelerating from just 0.1% in 2023. Household consumption jumped by 3.1% (down by 0.3% in 2023), public consumption rose by nearly 7% (4.0% in 2023), while fixed investment increased by 1.3% (12.6% in 2023). A deterioration in the foreign trade balance knocked off one percentage point from 2024 growth, whereas in 2023 the positive contribution of net exports reached 3.2ppt. At the same time, a change in inventories added 0.5ppt in 2024, after deducting 5.7ppt in 2023.

Economic recovery resumed in the final quarter after a soft third quarter

On the basis of annual growth data and quarterly data published earlier, we estimate that in the fourth quarter of last year, GDP growth amounted to about 3.5% year-on-year as private consumption expanded by some 3.5% YoY and fixed investment remained stagnant (around 0.0% YoY). The negative contribution from net exports reached 1.1ppt and a change in inventories boosted GDP by some 2ppt.

Developments in the final quarter of the year suggest that the economy continues to recover, and its consumption performance improved after a surprisingly weak third quarter – although spending was less vibrant than in the first half of 2024. Investment activity remained weak, and we'd estimate this was mostly the case in the private sector. Monthly data suggests some improvement in infrastructural investment towards the end of last year.

Poland proves a CEE outperformer

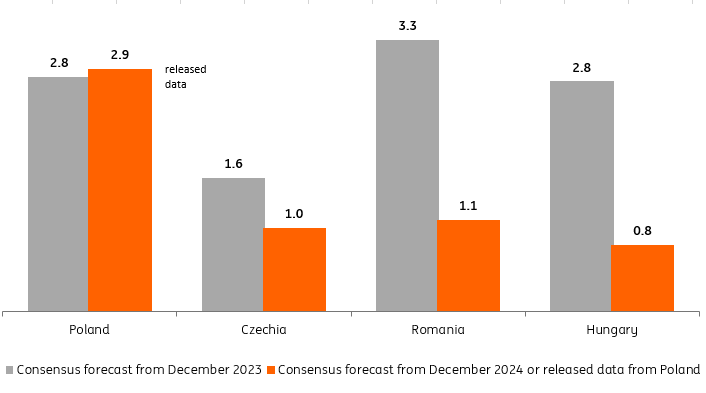

Last year, Poland was the only CEE country whose economic performance didn't disappoint compared to initial expectations for the 2024 growth outlook. Its economic growth last year was close to 3%, broadly in line with forecasts formed a year earlier.

In other economies in the region, growth turned out slower by one third (Czech Republic) or even two thirds (Hungary, Romania) against expectations (consensus formed a year ago). The picture this paints for the Polish economy – along with a hawkish policy stance from the National Bank of Poland (NBP) – should allow the Polish zloty to remain strong, or even firm up further than we had expected. The PLN outlook also depends on developments regarding the ongoing war in Ukraine and actions undertaken by the new US administration on that matter. Initial signs indicate that after taking office, President Donald Trump leans towards a more positive approach for the region than he suggested during his presidential campaign.

Poland delivered growth in 2024, while other CEE economies disappointed

Real GDP, %

Outlook for 2025

We forecast that in 2025, economic growth should accelerate above 3%. Continued growth in private consumption is set to be accompanied by a rebound in fixed investment on the back of Recovery and Resilience Funds (RRF) alongside increased absorption of EU structural funds from the 2021-2027 programme. We expect that some PLN50bn of the RRF grants and nearly PLN40bn of RRF loans may be poured into the economy. At the same time, outlays from structural funds may reach about PLN45bn.

More By This Author:

French GDP Contracts In The Last Quarter Of 2024, With A Grim Outlook For 2025FX Daily: Gilt Measures Worth Only Temporary GBP Relief

Rates Spark: Fed Holds, But ECB To Keep Cutting

Disclaimer: This publication has been prepared by the Economic and Financial Analysis Division of ING Bank N.V. (“ING”) solely for information purposes without regard to any ...

more