Poland’s Current Account Close To Balance In May

Image source: Pixabay

Poland’s external current account remains strong – with a tiny monthly deficit in May but a sizeable surplus of 1.8% of GDP on a 12-month rolling basis. While merchandise imports reflect a gradual recovery of domestic consumer demand, exports struggle due to stagnant German manufacturing, in particular the automotive industry.

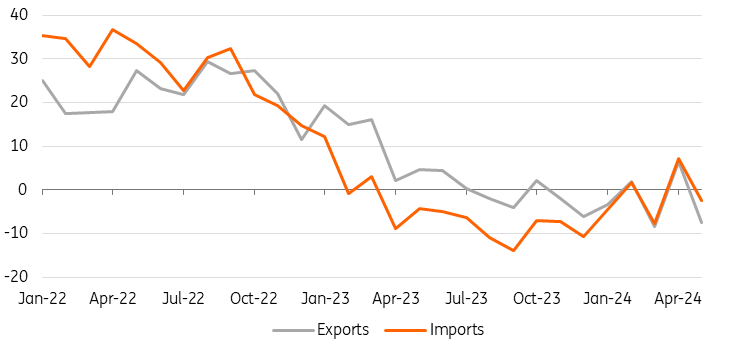

The current account balance closed May with a small deficit of €63m, below our forecast of a surplus of €152m and a surplus of €27m according to the consensus. The goods trade deficit was €613m with exports down by 7.6% year-on-year and imports by 2.4% year-on-year (with two fewer working days in May than a year earlier), compared with +6.5% YoY and +7.0% YoY respectively in April, with a more favorable calendar pattern. We estimate that on a 12-month rolling basis the current account balance surplus remained at 1.8% of GDP.

Trade in goods closed with a deficit of €613m in May, following a surplus of €124m in April. We estimate that on a 12-month rolling basis, the merchandise trade surplus deteriorated slightly in May – to 0.6% of GDP from 0.8% of GDP a month earlier. Largely thanks to two fewer working days than a year ago, euro-denominated exports fell 7.6% YoY in May after rising 6.5% in April, when we had two more working days. Imports fell by 2.4% YoY in May, following an increase of 7.0% YoY in April. The growth rates of exports and imports calculated in zloty remained strongly negative (-12.8% YoY in exports and -7.9% YoY in imports) due to the significant appreciation of the zloty against the euro.

May's current account balance, in addition to the merchandise trade deficit, consisted of a high surplus in trade in services (€3163m), with deficits: in primary income (€2094m) and secondary income (€519m).

Subdued foreign trade performance in May was consistent with a weakening in industrial production growth in May, which, in addition to the lower number of working days, was also influenced by the continued weakness in eurozone manufacturing (down 0.6% MoM in May on a seasonally adjusted basis, deepest in Germany -2.4% MoM and France -2.1% MoM). Data readings and soft leading indicators for Germany (industrial production, Ifo, PMI) do not suggest an improvement in the coming months. The lesser weakening of import growth was influenced by a progressive rebound in domestic consumer demand.

The National Bank of Poland press release, which refers to lower dynamics expressed in zlotys, indicates YoY declines in May in all six main categories of goods exports, most strongly in transport equipment, particularly in products such as electric batteries, car parts, passenger cars and trucks. The NBP points to a smaller scale of decline in exports of intermediate goods than in previous months. Year-on-year declines were also recorded in all six import categories, the smallest in fuels and consumer goods. Imports of passenger cars remained strong, as seen in domestic retail sales data.

Today's data is neutral for the zloty, in our view, as Poland continues to show a solid external balance. The zloty is supported by the "hawkish" rhetoric of the central bank and expectations of significant inflows of unlocked EU funds from the Recovery and Resilience Facility and the traditional cohesion policy budget 2021-27. For 2024 as a whole, we expect a robust current account surplus of 0.8% of GDP (compared to 1.6% of GDP in 2023) due to the revival of domestic demand. We present the latest macroeconomic forecasts for Poland against the CEE region in the CEEMEA Directional Economics report.

Poland's merchandise exports and imports, expressed in euro, YoY, in %

Source: NBP data, ING estimates

More By This Author:

Eurozone Industrial Production Falls Once Again In MayChina’s 2Q GDP Slowed By More Than Expected In New Challenge To Achieving Growth Target

FX Daily: Focused On Macro

Disclaimer: This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information ...

more