Poland’s Current Account Balance Significantly Worsens In July

Image Source: Pexels

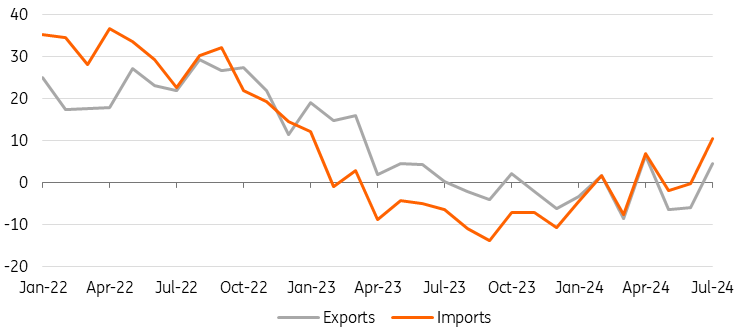

Poland still shows a solid external balance in 12-month terms, although imports are growing stronger than exports. The next few months will show whether the jump in July is a more lasting effect related to the strong pace of domestic consumption or perhaps a one-off jump related to arms imports.

The current account closed with a €1462m deficit (consensus: -€350m) in July, after a surplus of €588m a month earlier. Merchandise exports expressed in euros increased by 4.6% year-on-year and imports by as much as 10.5% YoY, while trade was lower in June than a year earlier. These results were partly influenced by the calendar layout (two working days less in June and one day more in July compared to 2023). The Polish economy maintains a solid external balance, but the 12-month current account surplus narrowed to 1.2% of GDP after July from 1.4% of GDP after June. On the same measure, we estimate that the goods trade surplus fell to 0.3%GDP from 0.4% a month earlier.

The current account deficit was made up of a high goods trade deficit of €1450m (after just a €191 deficit in June), while an elevated primary income deficit of €2853m and a relatively low deficit of €229m in secondary income were covered by a solid - albeit almost €500m lower than the month before - surplus in services trade of €3070m.

The value of imports, denominated in euros, rose by 10.5% YoY from -0.2% a month earlier, the strongest pace since January 2023, reflecting the cessation of earlier declines in energy prices, strong domestic consumer demand and the likely registration of arms import payments by the National Bank of Poland in July. At the same time, merchandise exports expressed in euros rebounded to 4.6% YoY, after falling 6.0% YoY a month earlier, driven by still weak demand in the main export markets and the strengthening of the zloty (by 3.6% YoY).

The NBP commentary, which refers to the dynamics expressed in zloty, points to an increase in exports in two of the six main categories - agricultural products and intermediate goods. Exports of consumer goods were similar to last year's, while sales in the automotive sector, including electric batteries, passenger cars, road tractors and vans, fell strongly. In imports, sales of agricultural products, intermediate goods and consumer goods, especially durable goods, including passenger cars, increased significantly. The NBP also mentioned the worsening terms of trade index, which contributes to the deterioration of the trade balance.

In our view, Polish exporters are facing the great challenge of a weakening in their traditional market - the eurozone (where almost 60% of Polish exports go), in particular Germany (27% of Polish merchandise exports). In its latest projection, the European Central Bank revised its GDP growth forecasts for 2024-26 by 0.1ppt and expects growth of just 0.8% this year, 1.3% in 2025 and 1.5% in 2026, and such forecasts are more optimistic than many market expectations. More importantly, a deeper downward revision has been made to private consumption and investment forecasts for 2024-25. Under such conditions, it is difficult to expect a revival in demand for Polish goods from the eurozone, although the ECB's monetary easing cycle will support a revival in consumption and investment in Western Europe. Maintaining or increasing export sales of Polish companies, however, may require the search for new markets.

However, today's data is moderately negative for the zloty. Against the backdrop of the ECB's monetary easing cycle already underway and the upcoming Federal Reserve rate cuts, the zloty's exchange rate is supported by the rather distant prospect of NBP rate cuts and the significant inflow of EU funds from the Recovery and Resilience Facility and the traditional 2021-27 budget.

Exports and imports growth, YoY, in %

Source: National Bank of Poland data

More By This Author:

Bank Of England To Keep Rates On Hold, But Faster Cuts Are ComingAsia Morning Bites For Friday, Sept 13

After ECB Rate Cut, Lagarde Signals Further Cuts To Come

Disclaimer: This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information ...

more