Poland’s 2025 Budget: Manageable But Fiscal Adjustments Needed

Image Source: Pexels

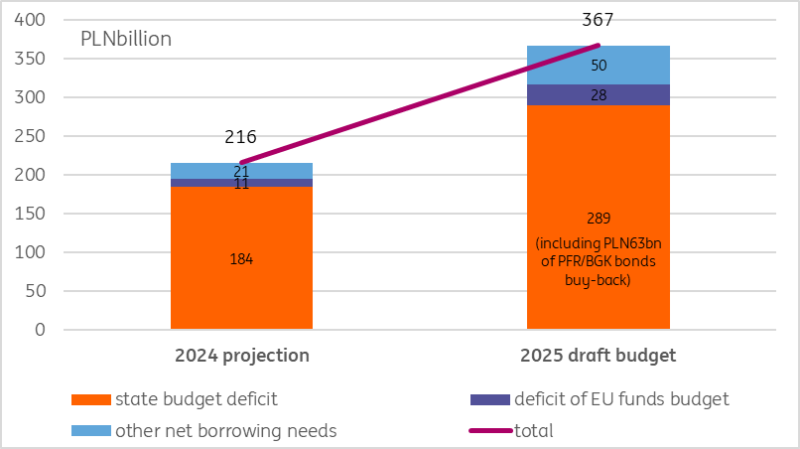

The Ministry of Finance plan

The Ministry of Finance has published a detailed budget plan for 2025, which includes a market-important plan for financing borrowing needs in 2025 and a breakdown of the supply of individual instruments. The net borrowing needs of the state budget in 2025 will amount to PLN367bn vs PLN252bn in 2024. Again, for a second year in a row the nominal borrowing needs are historically high. Below we present our view on that, with the conclusion that actual supply of (market-important) fixed-interest bonds is not growing as much as the overall borrowing requirement figures would suggest. Also, the Ministry of Finance is presenting the market with a number of alternatives to finance these borrowing needs, just as in 2024, which should help them to cover the record-high borrowing needs.

Breakdown of net borrowing needs in 2024-25 (PLN billion)

Ministry of Finance data

Source: Ministry of Finance, ING

The alternative funding sources helps the Ministry of Finance a lot

There are a few important points as to why the Ministry of Finance still has room to manourve when it comes to funding the record-high borrowing needs:

The total net borrowing needs are not PLN367bn (vs PLN252bn in 2024), but actually PLN317bn because the remaining PLN50bn are settlements on the FX account, largely related to flows of EU funds. This is neutral for market liquidity, so should be deducted from net (market) borrowing needs.

The actual net borrowing needs of PLN317bn will be split: foreign funding at PLN113bn and PLN204bn local funding. Out of PLN113bn of foreign funding, PLN42bn will be covered with FX bonds while the rest is mainly the EU money.

Out of PLN204bn local funding, the net supply of PLN-denominated government securities will be split so that fixed-rate Polish government bonds net supply seems much lower than overall borrowing needs are presenting (PLN106bn vs PLN79bn). The rest of the needs will mainly be covered by floaters (their net supply is rising significantly from PLN21 to PLN51bn) and linkers and saving bonds. The Ministry of Finance also plans to tap T-Bills (PLN46bn), which should attract short-term liquidity currently placed in National Bank of Poland bills.

Breakdown of financing of net borrowing needs, by instrument (PLN billion)

Ministry of Finance data

Note: For comparability between 2025 and 2024, we present the planned buy-back of PFR and BGK bonds with a negative sign and correct the headline borrowing needs by this amount.

Source: Ministry of Finance, ING

We have some concerns

We are worried that for the second year in a row the government has presented a budget with all-time high borrowing needs. The 2024 deficit was also revised up, due to the weak performance of revenues, mainly VAT. And on the top of that the 2025 GDP growth assumption was revised up and the CPI forecast seems higher than our assumptions (Ministry of Finance CPI 2025 average 5.0% vs ING 4.6% or lower). The budget performance in 2025 very much depends on a recovery of VAT revenues and in our view higher nominal GDP is not enough to add PLN50bn of VAT proceeds as the Ministry of Finance assumes. We think VAT collection should improve. For example, the Ministry of Finance needs to implement its long overdue project of a digital invoicing warehouse, which should let them better analyse tax compliance.

Summary: 2025 funding is manageable but a more ambitious fiscal adjustment is needed in following years

We think 2025 funding is manageable, but in 2026 – without an increase of foreign holdings in the local bond market – the funding of such high borrowing needs would be increasingly difficult. We think the domestic banking sector should rather fund private investments supporting productive GDP growth than finance excessive public borrowing needs. In order to build credibility, we believe the government needs to set budget priorities and start fiscal adjustments in 2026. We also think that with the general government debt rising close to 60% the EC may also trigger a more restrictive fiscal adjustment path.

More By This Author:

Fading U.S. Inflation Keeps The Fed On The Path Of Rate CutsAsia Week Ahead: Falls In Inflation In Many Economies Could Help To Speed Up Rate Cuts

Bank Of Canada: Three In A Row With 3% Rates Targeted

Disclaimer: This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information ...

more