Poland: Recession Is Over, Stronger Rebound Still To Come

The 1Q21 GDP estimate released today confirms that the economy is doing increasingly well in dealing with the pandemic. We see upside risk for our above-consensus GDP forecast at 4.8%.

Shoppers at the Poznan City mall in Poland

The preliminary estimate by the Central Statistical Office turned out to be better than the flash estimate from mid-May and in line with our original forecast. Poland's GDP in 1Q21 fell by 0.9% YoY compared to the flash estimate at -1.2% YoY. Despite the drop in year-on-year terms, the seasonally adjusted GDP increased by 1.1% quarter-on-quarter. This, in our view, marks the beginning of a more sustained GDP rebound. The Covid-19 recession ended in 4Q20 in Poland. We expect further QoQ increases in subsequent quarters. The rebound effect from the opening of the economy is still to come. Vaccination progress will open up the economy more widely, which should kick-start the rebound in the services sector.

The structure of growth in 1Q21 indicates a continuation of the robust rebound of industry, where value-added rose 7.3% YoY and 1.4% QoQ on a seasonally adjusted basis. Industry is benefiting from the global economic recovery and shifting demand for durable goods.

The services sector, which is more affected by local restrictions than industry, remains weak. Value added in trade fell by 0.3% YoY while accommodation and food services fell by as much as 77.2% YoY. The better performing service areas are these that can benefit from the rebound in global trade, ie, transport and storage where value-added grew by 2.1% YoY in 1Q21.

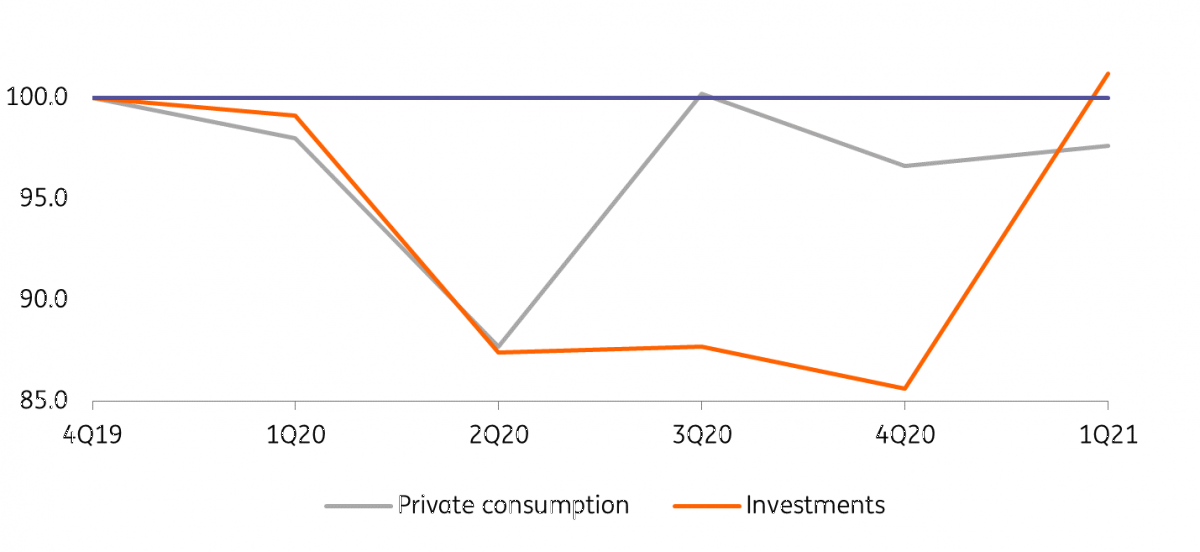

Track of recovery in consumption and investments (4Q19=100)

(Click on image to enlarge)

Source: CSO

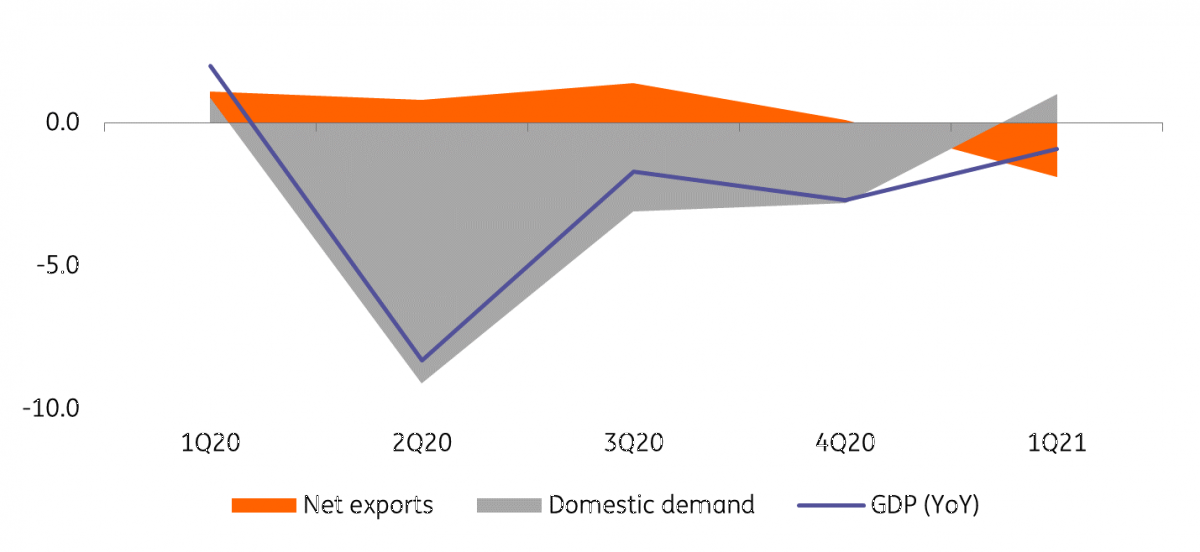

The demand side of GDP came as a strong surprise. Domestic demand in 1Q21 increased by 1.0% YoY, largely due to an unexpected rebound in investment, which rose by 1.3% YoY and as much as 18.2% QoQ. The real investments, seasonally adjusted, are already above pre-pandemic levels. Household consumption increased by 0.2% YoY and has started to recover to pre-pandemic levels again after a temporary QoQ decline in 4Q20. The relatively high share of manufacturing in Polish GDP, given the current pattern of rebound in the global economy, has so far been conducive to the generation of foreign trade surpluses. The contribution to GDP growth from net exports in Poland has been positive since the beginning of the pandemic. In 1Q21, exports continued to grow robustly (5.7% YoY), but imports rebounded even stronger (+10%), so net exports, for the first time since 3Q18, had a negative contribution to GDP growth (-1.9 percentage points).

Composition of YoY GDP.

(Click on image to enlarge)

Source: CSO

The GDP estimate released today confirms that the economy is increasingly resilient to the pandemic. We see upside risk for our 2021 GDP forecast at 4.8% YoY, which is already above consensus. The opening of the EU economies should sustain the high pace of exports and production, although disruptions in supply chains and limited access to components (including chips) may be a temporary constraint here. As the Polish economy opens up, services and trade will also recover and the pent-up demand effect should kick off. Hence, we still see upside risks to GDP growth in 2021. In 2022, we expect GDP growth to reach 5.5% YoY.

Disclaimer: This publication has been prepared by the Economic and Financial Analysis Division of ING Bank N.V. (“ING”) solely for information purposes without regard to any ...

more