July retail sales fall unexpectedly (down 1.5% Month-on-Month after seasonal adjustment). We think that this reflects shifting consumer preferences (from purchasing goods to buying services). Construction was dragged down by a slowdown in infrastructure investment, something which should prove temporary.

Another apartment building under construction in Warsaw

In July the growth of retail sales dropped from 8.6% to 3.9% YoY. This was significantly below expectations of 4,9% YoY. Deterioration was recorded for most sales groups with the exception of foods. Auto and furniture sales fell 2.9% and 1.9% YoY, respectively. The first one likely due to supply issues.

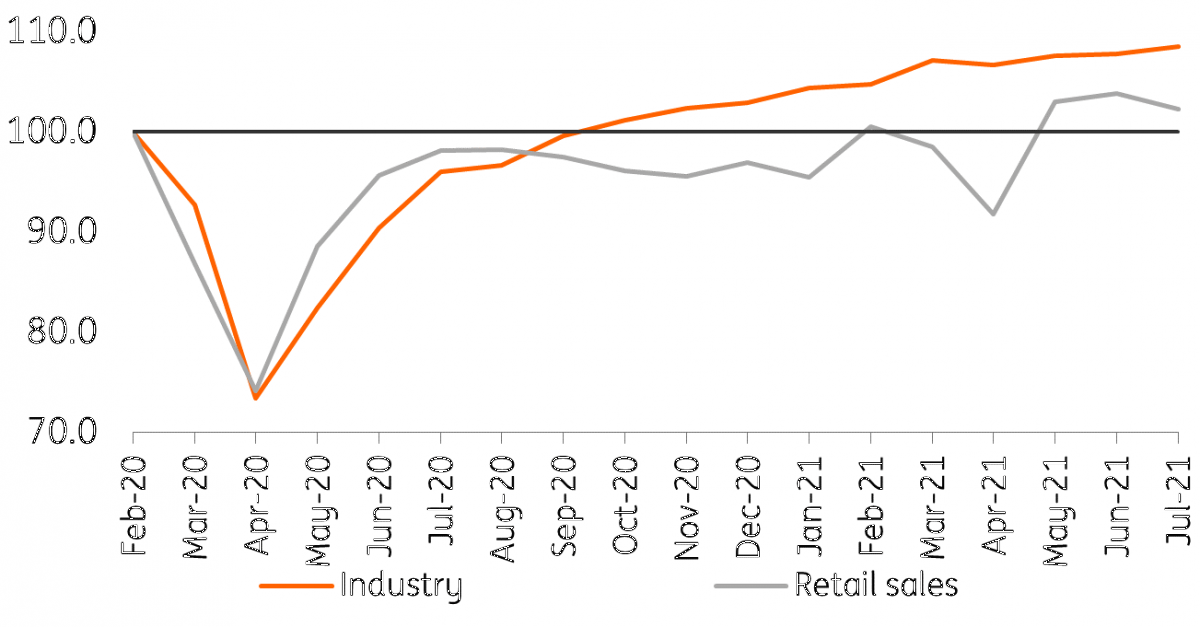

As the economy opens up, retailers must increasingly compete with service providers. The seasonally adjustedretail sales in July fell by 1.5% MoM after a 0.8% increase in June. This indicates a pause in the sales recovery after the pandemic. Moreover, the change in sales was significantly below the monthly growth in industrial production. At the beginning of 3Q21, industry not retail took over the engine of growth in Poland.

Industrial production and retail sales (February 2020=100).

Source: CSO

The pent-up demand effect in trade is no longer present. Consumers seem less willing to spend savings on goods which are getting more and more expensive. In our view, they have also shifted some demand to services, especially in travel and leisure.

July's construction and assembly production disappointed again after weaker-than-expected results in June. Production growth slowed down from 4.4 to 3.3% YoY, compared to 7.1% expected by the market.

In July, weaker results were recorded in infrastructure works (-5.9% YoY compared to +0.4% in June). This is most likely due to a slowdown in railroad tenders after the European Commission challenged the law which prevents participation of civic organizations in the railroad investment process. After this act is amended, investments in this area should accelerate.

On the other hand, the construction of buildings came as a positive surprise. Here, output increased by 5.7% YoY after declines of 0.3% in June and 5.7% in May. This is driven by demand for new apartments as households are looking for opportunities to protect their savings against inflation. However, developer activity is already at historically high levels, which will limit construction output growth in this segment in the coming months.

Disclaimer: This publication has been prepared by the Economic and Financial Analysis Division of ING Bank N.V. (“ING”) solely for information purposes without regard to any ...

more

Disclaimer: This publication has been prepared by the Economic and Financial Analysis Division of ING Bank N.V. (“ING”) solely for information purposes without regard to any particular user's investment objectives, financial situation, or means. ING forms part of ING Group (being for this purpose ING Group NV and its subsidiary and affiliated companies). The information in the publication is not an investment recommendation and it is not investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Reasonable care has been taken to ensure that this publication is not untrue or misleading when published, but ING does not represent that it is accurate or complete. ING does not accept any liability for any direct, indirect or consequential loss arising from any use of this publication. Unless otherwise stated, any views, forecasts, or estimates are solely those of the author(s), as of the date of the publication and are subject to change without notice.

The distribution of this publication may be restricted by law or regulation in different jurisdictions and persons into whose possession this publication comes should inform themselves about, and observe, such restrictions.

Copyright and database rights protection exists in this report and it may not be reproduced, distributed or published by any person for any purpose without the prior express consent of ING. All rights are reserved. ING Bank N.V. is authorised by the Dutch Central Bank and supervised by the European Central Bank (ECB), the Dutch Central Bank (DNB) and the Dutch Authority for the Financial Markets (AFM). ING Bank N.V. is incorporated in the Netherlands (Trade Register no. 33031431 Amsterdam). In the United Kingdom this information is approved and/or communicated by ING Bank N.V., London Branch. ING Bank N.V., London Branch is deemed authorised by the Prudential Regulation Authority and is subject to regulation by the Financial Conduct Authority and limited regulation by the Prudential Regulation Authority. The nature and extent of consumer protections may differ from those for firms based in the UK. Details of the Temporary Permissions Regime, which allows EEA-based firms to operate in the UK for a limited period while seeking full authorisation, are available on the Financial Conduct Authority’s website.. ING Bank N.V., London branch is registered in England (Registration number BR000341) at 8-10 Moorgate, London EC2 6DA. For US Investors: Any person wishing to discuss this report or effect transactions in any security discussed herein should contact ING Financial Markets LLC, which is a member of the NYSE, FINRA and SIPC and part of ING, and which has accepted responsibility for the distribution of this report in the United States under applicable requirements.

less

How did you like this article? Let us know so we can better customize your reading experience.