Poland Joins Other CEE Countries With Upward CPI Surprise

Image source: Pixabay

Following higher-than-expected January CPI readings in Hungary and the Czech Republic, Poland’s CPI inflation also surprised to the upside in January. Data implies no progress in the moderation of core inflation at the beginning of 2025, allowing the central bank to postpone rate cuts until 2H25.

CPI inflation rose to 5.3% year-on-year in January from 4.7% YoY in December (ING: 5.0%; consensus: 5.1%). On a monthly basis, prices went up by 1.0%. Neither the increase in energy prices (1.4% MoM), boosted by a rise in distribution charges on gas bills, nor the increase in fuel prices, came as a surprise. By contrast, we did not expect such a large increase in food and beverage prices (1.6% MoM vs. our estimate of 1% MoM). The composition of January's CPI data suggests that core inflation was close to the December level of 4.0% YoY, despite expectations of a gradual decline in this area. The National Bank of Poland will release official core inflation data in March, together with the publication of data for February. The calculations will be based on updated CPI basket weightings.

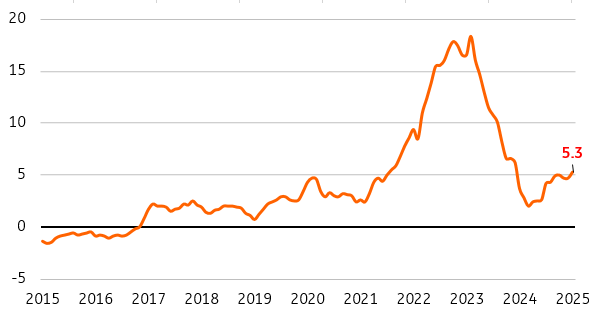

Polish CPI back above 5% again

CPI, %YoY

Source: GUS, ING.

Poland joined other countries in the region, which reported higher-than-expected headline inflation in January. In the Czech Republic, inflation came in at 2.8% YoY (consensus 2.6%) and in Hungary, it rose to 5.5% YoY (consensus 4.8%). Given that the US CPI was also higher than expected, this suggests broader upward pressure on consumer prices in early 2025.

We forecast that inflation may peak near 6% YoY in March, with the following quarters bringing a decline in inflation – down to the upper bound of deviations from the central bank's target by the end of the year. This forecast assumes that the Energy Regulatory Office's (URE) update on energy tariffs will result in their reduction and the removal of the maximum price of PLN500/MWh will not cause significant increases in electricity bills. Future contracts for 2H25 electricity (BASE) are still clearly below the current tariff (PLN623/MWh) and close to the price frozen until the end of 3Q25.

January CPI data indicates that inflation remains high and core inflation is persistent. We therefore expect the NBP to maintain its hawkish stance and keep interest rates unchanged in 1H25. We will see a more decisive drop in inflation from July onwards. At that time, new energy tariffs should also be known. We expect the MPC to cut interest rates by 50bp in September and then by another 25bp both in October and November, bringing the reference rate to 4.75% at the end of 2025.

More By This Author:

FX Daily: Markets Temporarily Shake Off Reciprocal Tariff ThreatKorea: Jobless Rate Fell Sharply In January While More Policy Support Is Expected

Rates Spark: Swap Spreads On The Move In Opposite Directions

Disclaimer: This publication has been prepared by the Economic and Financial Analysis Division of ING Bank N.V. (“ING”) solely for information purposes without regard to any ...

more