Poland: End Of Hiking Cycle May Not Be Near

Image Source: Pexels

June CPI inflation was revised down to 15.5% year-on-year from 15.6%YoY and the coming months will bring some respite from price increases, however, we project further growth of inflation ahead amid rising regulated prices. Declarations that the end of the hiking cycle is near may prove premature.

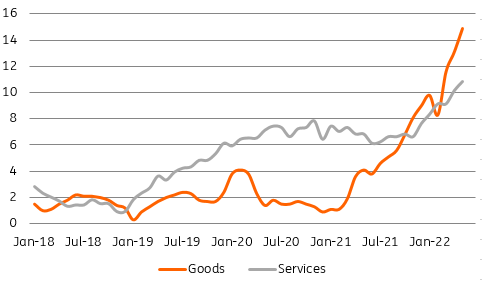

The StatOffice revised its estimate of June CPI inflation to 15.5% YoY from 15.6% YoY. Our initial forecast before the flash reading was for a 15.4% YoY price increase in June. Goods prices rose 16.8% YoY and services prices jumped up by 11.5% YoY, compared to 14.9% YoY and 10.8% YoY respectively in May.

Consumer prices, % YoY

Image Source: GUS.

Energy prices continue to rise sharply. Energy carriers were 35.1% more expensive in June than a year earlier, and fuels became 46.7% more expensive. The increase in the price of energy carriers was mainly driven by higher prices of liquid and solid fuels (10.4% month-on-month). Upward pressure on food prices moderated somewhat as meat prices stabilized (0.0%MoM) and the price of fruits and vegetables declined by 2.1% MoM and 1.6% MoM respectively.

The increase in fuel, electricity, and food prices combined accounted for just over 10 percentage points of the June inflation reading. Despite some deceleration, core inflation also continues to rise. We estimate that it rose to about 9.1% YoY in June, up from 8.5% YoY in May.

The holiday months should bring a temporary slowdown in inflation growth and CPI is likely to stabilize in the 15-16% YoY range. Recent weeks have brought declines in gasoline prices, and the summer period is a favorable season for food prices. This does not change the fact that inflation remains Poland's number one macroeconomic issue. First, it is at a very high level (the highest in 25 years), and bringing it down to the target will require further tightening of monetary policy and curbing domestic demand. Second, the peak of inflation is most likely still ahead of us. In the autumn, we may witness renewed increases in energy prices (coal, LPG, electricity) and the beginning of 2023 will be marked by high increases in regulated prices (electricity, natural gas).

If the abovementioned risks materialize, we are facing further interest rate hikes towards 8.50%. Although National Bank of Poland President Adam Glapiński sees inflation peaking in the third quarter of 2022 and has declared that the end of the hike cycle is near, in our view the macroeconomic situation (rising inflation) and the market developments (weakening Polish zloty) will force the central bank to change its stance. We assume that the anti-inflation shield will be extended until at least the autumn of next year. This means continuing high inflation in 2024 (low reference base). As a result, the inflation outlook will likely not allow for interest rate cuts next year.

More By This Author:

FX Daily: What Implications From Italy’s Latest Political Drama?Asia Week Ahead: Will Bank Indonesia Surprise With A Rate Hike?

FX Daily: The 100bp Narrative Is On

Disclaimer: This publication has been prepared by the Economic and Financial Analysis Division of ING Bank N.V. (“ING”) solely for information purposes without regard to any ...

more