Poland Central Bank Preview: A December Hike Is Coming

We expect Poland's Monetary Policy Committee to continue its tightening cycle by hiking rates by 50-75 basis points on Wednesday. This is justified by high CPI and core inflation pressures as well as a need to prevent a wage-inflation spiral. Any developments on the Omicron variant shouldn't impinge on the decision.

National Bank of Poland governor Adam Glapinski

Two hikes are not enough in the inflation fight

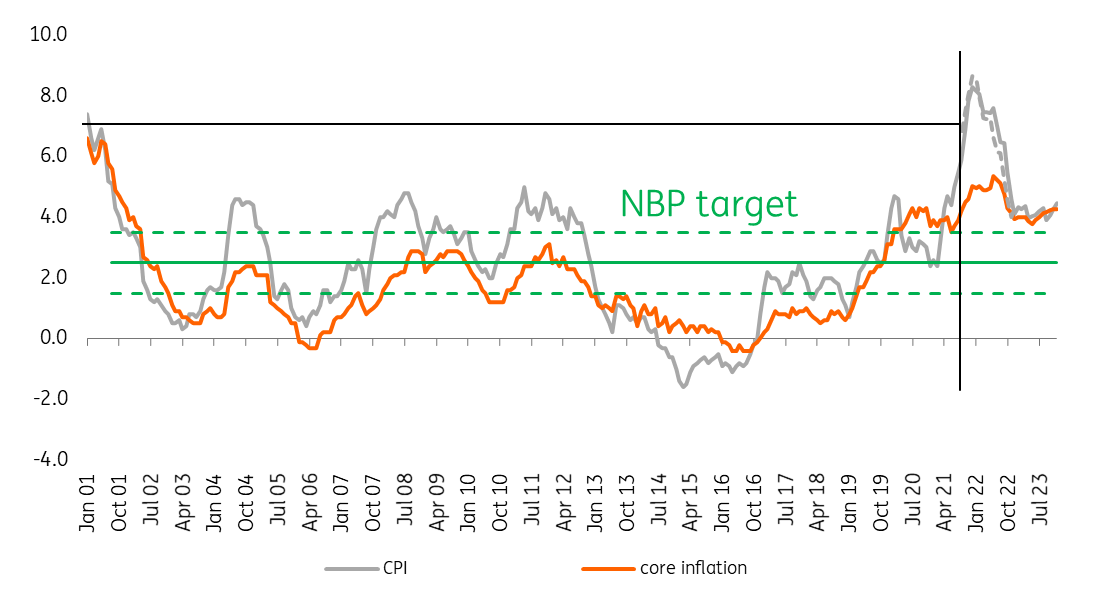

After a 40 basis point interest rate hike in October and a 75bp one in November, we expect Poland's Monetary Policy Council to raise interest rates by another substantial hike of 50-75bp in December. The events between the last hike and today, not least with the coronavirus, and the balance of inflationary risks do little to change inflation prospects. A need to return to an inflation target of 2.5% with a +/-1ppt tolerance band requires restrictive monetary policy.

What has happened since early November? First, the National Bank of Poland staff published its latest Inflation projection, which was known by MPC members in their November meeting. It was significantly revised upwards, but this is not enough and all CPI projections are, to a significant extent, outdated. According to the NBP, for 2021-23 average CPI should reach 4.9% YoY, 5.8% YoY and 3.6% YoY, respectively, which is below our current expectations by 0.2ppt, 0.9ppt and 0.6ppt, respectively. We see average CPI at 5.1% YoY in 2021, 6.7% YoY in 2022 and 4.2% YoY in 2023. The 2023 CPI projection also means that, in the medium term, it will be significantly above the official inflation target of 2.5%+/-1.0%.

Second, the latest flash CPI reading delivered another negative surprise with the headline inflation of 7.7% YoY in November and is further fuelling rising inflation expectations. All three components are on the rise: food, fuel&energy, and other items combined in the core inflation measure. CPI is to exceed 8% YoY in December 2021, also above the Governor's short-term CPI expectations as he had said CPI this month should be close to 7%. In addition, supply chain problems and high foreign inflation increase the risk of de-anchoring inflation expectations. Demand and wage pressures should be significant inflationary factors in 2022 given the tight labour market, and are likely to keep CPI at an elevated level also in 2023.

Third, the government announced its so-called anti-inflation shield. But although lower indirect tax rates should slow down inflation temporarily, the new means-tested social benefits are to speed it up in the medium term. The ‘shield’ will only limit the impact of rising energy and fuel prices for a short while, at the same adding to the ongoing spending spree. The peak of the headline CPI in 1Q22 should be 7.9% YoY on average so 1ppt vs the trajectory without the anti-inflation shield.

In contrast to the three points, fear of the Omicron variant might act in the opposite direction. Theoretically, Omicron is a GDP downside risk. But, in our view, the MPC seems to be so much threatened by elevated CPI that it would rather limit the scale of the hike (to 50bp instead of 75bp or 100bp) than prevent it from hiking at all.

We don't think we'll see a repeat of the same scenarios we've witnessed with other Covid variants. The recently introduced pandemic restrictions in Poland are relatively light and are very far from a real nationwide lockdown. Also, the economy is becoming more resilient to the pandemic, largely thanks to vaccines. There are painful supply shortages on global markets (not just electronic chips) which are pushing prices up, in contrast to full house inventories and no shortages in early 2020. Recent statements from the Fed and the ECB suggest that Omicron is causing more concerns about persistent inflation than transitory hits to GDP.

While monitoring the recent statements of monetary policymakers, we saw a substantial shift in the MPC's stance after the November inflationary projection. Even moderate central bankers, like R.Sura, supported rate hikes after the latest inflation data. Statements from G.Ancyparowicz and the NBP’s Governor A.Glapiński also suggest another decisive hike. Governor Glapiński said that inflation is no longer transitory (as he claimed before), but persistent. Also, G.Ancyparowicz has sounded more hawkish recently.

We see the 2022 average CPI at 6.7% YoY. Inflation should decelerate over the course of the year. However, core inflation will remain elevated as the wage-price spiral intensifies. We see a need for the MPC to act promptly in order to minimalise the social costs of high inflation. We expect a 50-75bp hike this month, and see Poland’s terminal rate at about 3% by the end of next year.

CPI and core inflation, and NBP's inflation target

(Click on image to enlarge)

Source: CSO data and ING projections.

Disclaimer: This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information ...

more