Philippines’ GDP Growth Miss Supports Our 75bp Rate Cut Call

Image Source: Pexels

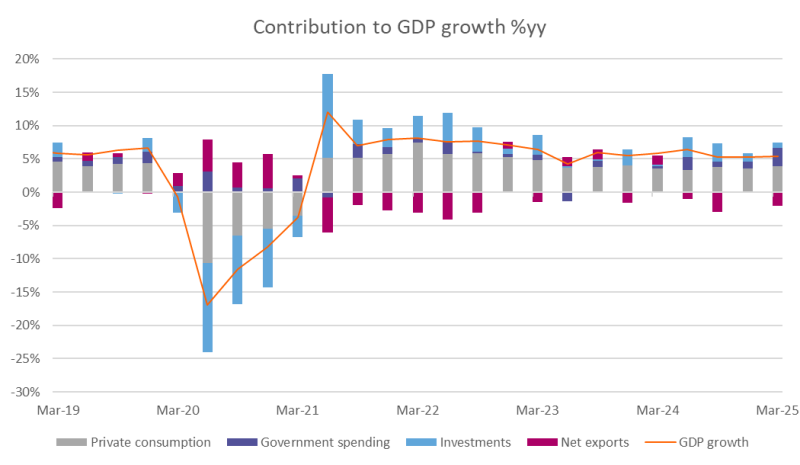

First-quarter GDP growth surprised on the downside

The 5.4% first-quarter increase in Philippine GDP year-on-year fell short of both our forecast and market expectations. While private consumption and government spending growth were strong ahead of upcoming elections, they were in line with expectations. The disappointment was net export and investment growth. This highlights uncertainty around business confidence amid tariff escalations and a slowdown in trade. Net exports contributed a negative 2 percentage points to GDP growth in Q1, a much higher drag on growth than the average of 0.7% over the past year. This suggests there was less frontloading of exports in 1Q ahead of the implementation of tariffs, a dynamic that’s more evident in other export-driven economies. Higher imports as government spending accelerated ahead of the elections also likely contributed to lower net export growth.

Looking at the sector-wise data, manufacturing growing 4.1% year-over-year was indeed a positive sign, indicating robust industrial activity. However, services sector growth moderated to 6.3% from 6.7% in the previous quarter amid weaker professional and business services growth. This indicates a slowdown in business-process-outsourcing (BPO) and related activities.

First-quarter GDP growth at 5.4% YoY

We're lowering our 2025 GDP growth forecast

Looking ahead, the impact of the global slowdown should become more evident in the Philippines' growth numbers. Yet, continued support from government spending and monetary policy easing should offset the drag. The central bank’s substantial easing measures – including 100bp of policy rate cuts since August and 450bp in reserve requirement ratio (RRR) cuts since September – have significantly relaxed monetary policy conditions. Consequently, bank credit growth surged from 6% year-on-year in December 2023 to 11% in February 2025. Moreover, higher fiscal spending ahead of the mid-term elections this month, along with a continued push for infrastructure development and lower oil prices, should help cushion GDP growth from the drag caused by slower exports. Following the downside surprise in 1Q and the expected slowdown in net export growth, we’re lowering our 2025 GDP to 5.6% year-on-year.

Given the recent downside surprise in both GDP growth and inflation, and our subsequent revisions to both forecasts, it’s increasingly likely that Bangko Sentral ng Pilipinas (BSP) will cut rates aggressively this year. We continue to anticipate another 75 basis points of rate cuts in 2025.

More By This Author:

The Commodities Feed: Markets Disappointed As Fed Remains On Hold

Rates Spark: The Fed Is Talking A Lot But The BoE Will Deliver

Fed’s Wait And See Stance Could Persist Through To September

Disclaimer: This publication has been prepared by the Economic and Financial Analysis Division of ING Bank N.V. (“ING”) solely for information purposes without regard to any ...

more