Philippines: Another Downside Inflation Surprise Boosts Rate Cut Odds

The odds that the Philippine central bank will continue to cut rates are rising amid lower-than-expected inflation, a stronger-than-expected local currency and high real rates, combined with uncertainty about global growth. We are adding one more rate cut to our 2025 outlook. We now expect the policy rate to reach 4.75% by the end of the year.

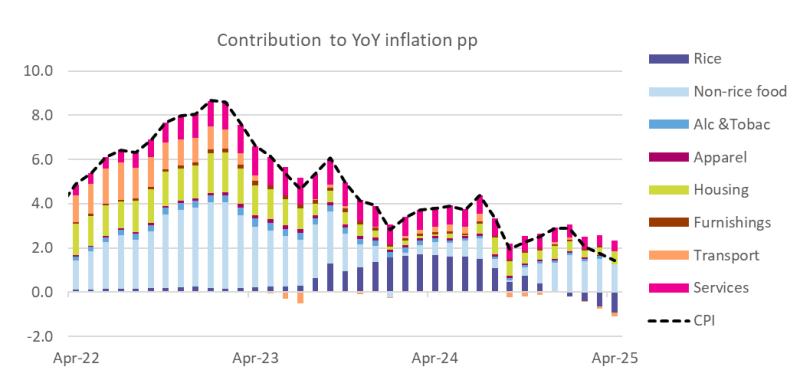

Headline CPI inflation fell further below market expectations

Headline Philippines consumer price index inflation fell further to a 1.4% year-on-year rate in April, much lower than consensus expectations of 1.9%. This marks the third consecutive decline in monthly inflation readings, putting prices firmly below the central bank’s target range of 2-4%. This month’s drop was largely driven by food prices, particularly both rice and non-rice costs. Transportation prices eased, too. Sharp local currency appreciation of 2.2% vs the USD in the month helped lower import prices. Among key components, housing contributed to headline inflation, while others declined.

However, core CPI inflation remained steady at 2.2% YoY, near the lower bound of the central bank’s target range. This indicates that lower inflation is not just driven by food and fuel prices, but also by slowing demand pressures.

Food and fuel prices behind falling inflation

Source: CEIC

Lowering CPI forecasts for 2025

We are revising our CPI inflation forecast for 2025 down to 2.4% from the previous 2.8%. This is based on lower-than-expected readings in the first quarter, a significant drop in oil prices, and a sharp appreciation in the local currency. Our updated ICE Brent forecast for the remainder of the year has been lowered from US$68/bbl to US$62/bbl (2Q25-4Q25), resulting in an average forecast of US$65/bbl for 2025. This is down from the previous US$70/bbl. We estimate that a 10% decline in global oil prices should reduce headline CPI inflation by 0.2 percentage points.

The direct impact of lower global oil prices is evident in local gasoline prices, which fell by over 4% in April. They’re expected to continue declining, given the revised Brent oil forecast and the appreciation of the local currency. Moreover, the second-round effects of lower oil prices appear to outweigh the direct effects on headline inflation, as oil serves as an intermediate input in the production of other goods and services, including food.

One risk to monitor is food prices, particularly the impact of US tariff policies. Global food prices, as captured by the UN FAO index, rose 1.2% month on month in April. Reduced wheat exports from Russia, sanctions, an escalation in tariffs on agriculture imports from Mexico and a weaker US dollar could all continue to exert upward pressure on food prices. As a result, we factor in higher YoY CPI inflation readings in the second half of the year.

Deeper rate cuts

The lower-than-expected inflation trajectory, stronger-than-expected local currency, and high real rates, combined with uncertainty on global growth, reinforce our view that the monetary policy easing from the Bangko Sentral ng Pilipinas (BSP) is far from over. We are adding one more rate cut to our 2025 forecast. We now expect the policy rate to reach 4.75% by the end of the year. Much of the tariff story will continue to unfold before the next policy meeting in June. Fresh threats to global growth and a modest inflation reading for May would keep considerations of a June cut alive.

More By This Author:

Softer-Than-Expected Turkish Inflation In April Despite Recent Lira WeaknessOPEC+ Goes With Another Big Supply Hike

Think Ahead: Europe Loves A Lever, And Has Plenty Of Pulling Power

Disclaimer: This publication has been prepared by the Economic and Financial Analysis Division of ING Bank N.V. (“ING”) solely for information purposes without regard to any ...

more