Philippine Growth Set To Moderate Next Year; BSP To Stay Hawkish

Image Source: Pexels

Despite the strong 3Q GDP report, we remain concerned about the growth outlook

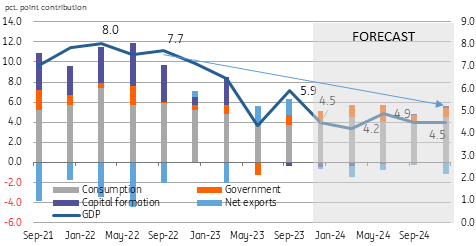

Philippine 3Q GDP blew past market expectations and settled at 5.9% year-on-year. The market consensus was much lower at 4.7% YoY. More impressive was the extremely strong quarter-on-quarter growth, hitting (5.9% YoY) in 3Q, which was only the second fastest pace of 3Q QoQ expansion on record. The stronger-than-expected 3Q growth took year-to-date growth to 5.5% YoY growth, with fiscal authorities confident of still hitting their 6% growth target for 2023 and attaining growth of 6.5-8% for 2024.

Despite the impressive growth report, we believe that growth may not be as robust as projected and that the pace of GDP growth could moderate next year.

Growth is expected to moderate in the months ahead

What’s been good? Government spending and net exports

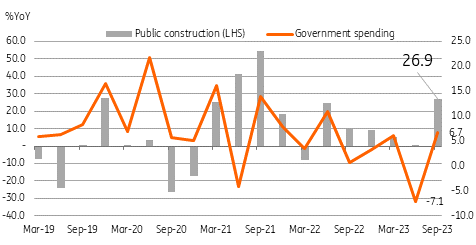

One of the main drivers of the 3Q GDP upside surprise was the strong performance of government spending. After contracting in the previous quarter, fiscal authorities vowed to accelerate outlays to support sagging growth.

Government expenditures rose 6.7% YoY, mirroring the double-digit expansion in public sector construction (26.9% YoY). Total government expenditure delivered a sizable boost to growth of 0.98ppt.

Meanwhile, net exports were another surprising source of growth, delivering 1.6 percentage points to 3Q GDP growth. Contracting imports, due largely to relatively cheaper energy imports in 2023, coupled with a surprise expansion in electronics exports, swung the net exports contribution into positive territory.

Government spending picked up in 3Q, can it be sustained?

What has been disappointing? Consumption and capital formation

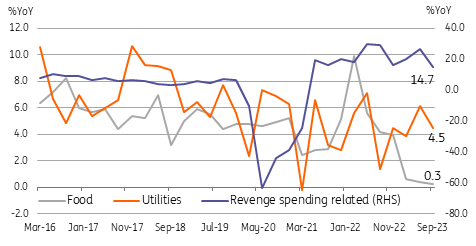

Although still managing to post an expansion, household spending grew at the slowest pace since 2011 (excluding Covid). Spending on basic food items moderated considerably (0.3% YoY) while purchases of clothing & footwear items contracted sharply (-11.4% YoY).

On the other hand, robust pent-up demand possibly linked to the reopening of the economy resulted in strong spending on transport (14.5%), restaurants & accommodation (14.9%) as well as on recreational activities (15.4%).

Taken together, spending on these three items continues to expand by double digits (14.6% YoY) suggesting 'revenge' spending may still have some juice left.

Meanwhile, capital formation contracted, falling by 1.6% YoY which was the worst downturn experienced since 2012 (excluding Covid). The contraction of investment activity has moved in line with the slowdown of bank lending to productive activities (4.3% YoY as of September) possibly due to the aggressive tightening of the Bankgo Sentral ng Pilipinas.

Spending on basic items stalls but 'revenge' spending is still alive

What’s ahead? Government spending possibly capped due to elevated debt levels

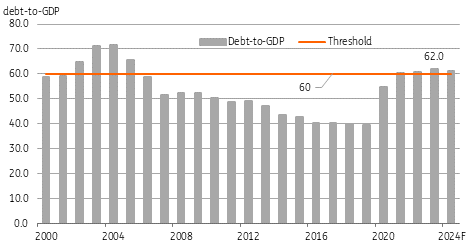

As noted earlier, government spending was one of the drivers of 3Q GDP. However, we remain sceptical that it will be a reliable source of growth to power momentum in the coming quarters. The main reason for this is the limited space for fiscal authorities to increase spending due to elevated debt levels.

The current debt-to-GDP ratio remains above the 60% threshold, suggesting that the current debt dynamics remain uncomfortably close to “unsustainable territory”. Debt levels rose sharply during the Covid-19 lockdowns and have yet to come down substantially even after the economy reopened. Revenue collection has improved but we deem fiscal reforms and plans for additional revenue generation taxation relatively limited.

Fiscal reforms in the pipeline are geared towards the granting of tax incentives to attract more foreign investors such as the amendments to the CREATE law (RA 11534).

Meanwhile, additional enhancements to the tax system proposed by the Department of Finance are slated to have only a modest impact on revenue generation, such as the proposed excise tax on sweetened beverages and junk food (Php76bn/year), the excise tax on single-use plastic (Php21bn/year) and the imposition of value added tax on digital transactions (Php30bn/year).

If passed, the additional revenue would amount to a modest 3.4% of the current revenue collection by the national government.

Debt to GDP ratio remains elevated and above key threshold of 60% of GDP

Export outlook remains uncertain

Net exports, which have positively contributed to growth for two straight quarters, are likely to revert to a negative contribution to GDP as early as the fourth quarter.

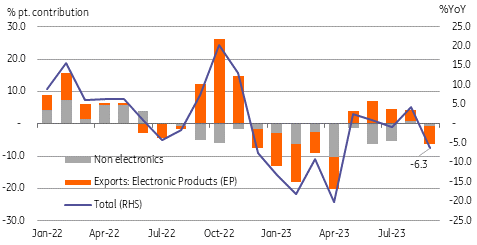

Exports slipped back into contraction in September, due to the drop off in outbound shipments of electronics. This is tagged to the potential global oversupply for lower value-added basic chips. Electronics exports comprise more than 60% of the country’s export base and with the Semiconductor and Electronics Industries in the Philippines (SEIPI) pointing to a potential slowdown next year, we can expect the entire export portfolio to stay in contraction for at least the first half of 2024.

With exports likely to struggle next year, we expect the overall trade deficit to remain substantial enough to keep the current account balance in deficit territory and ultimately weigh on overall GDP growth momentum for next year.

Electronic exports could drag down the entire export sector

Consumption to moderate further as spending on food stalls

Household spending is a major driver of growth in the Philippines. Breaking down household spending, we note that the consumption of basic food items accounts for 33% of household spending and even 24% of total GDP. Thus, we would expect spending on basic food items to help determine the direction and pace of growth in the coming months.

We had initially expected spending on basic food items to recover as inflation moderated by mid-2023. However, spending on these items has remained flat. This trend could be explained by the unexpectedly strong household spending at restaurants, with households substituting having meals at home for dining out.

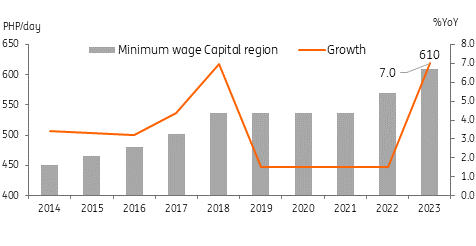

One other possible explanation could be tied to the slow growth in wages. Minimum wage increases for workers in the Capital Region are up an average of only 3.4% over a 10-year period, suggesting that households may be needing to reduce spending on selected items to balance out limited budgets.

With wage adjustments carried out generally once a year, a sharp increase in wages is not likely to take place until mid-2024 at the earliest. The outlook for only modest wage growth suggests that household spending is not likely to rebound sharply next year even if inflation remains within target.

Households will need to continue to allocate limited wages, and a potential pickup in spending on food items would likely necessitate a cutback on spending for items such as “restaurants & accommodation” and “recreation”.

Modest wage growth resulting in tight budgets

Capital formation is likely subdued in the coming quarters given the tight monetary policy

Capital formation turned negative in 3Q likely due to the recent tightening cycle of the BSP. Private construction has slowed this year, contracting in the second quarter and managing to rise only 5.6% year-to-date compared to the pre-Covid average of 9.9% YoY.

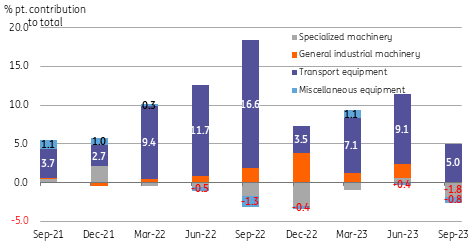

Meanwhile, investment in durable equipment is also in a downtrend, expanding a modest 1.7% YoY by the third quarter, with only imports of road vehicles delivering growth and specialized machinery, industrial machinery, and miscellaneous equipment all in contraction.

The downtrend in investment in construction and durable equipment is mirrored in the trends for capital and raw materials imports. Capital goods such as machinery and construction vehicles have been contracting since November 2022, reflecting the souring appetite for investment outlays.

We will likely need to see a sharp rebound in imports of both capital machinery and raw materials before we can expect a recovery for capital formation and given the restrictive monetary policy stance, we could see capital formation staying in the red for at least the first half of next year.

Durable goods orders are boosted by car imports but all other types of machinery are down

BSP staying hawkish despite likely soft demand-side price pressure

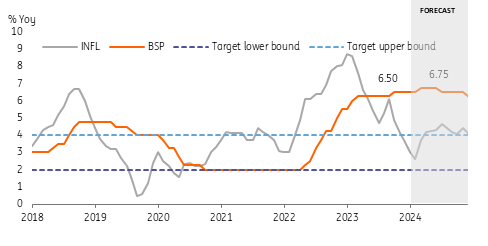

The BSP expects inflation to stay elevated next year (4.4% YoY), noting that risks to the inflation outlook remain substantially tilted to the upside. This is the main reason why Governor Eli Remolona has remained extremely hawkish in his statements, suggesting that monetary policy will remain “sufficiently tight” until inflation enters a sustained downtrend and until inflation expectations are well anchored. Remolona reiterated his resolve to hike even after inflation slowed considerably to 4.1% YoY in November.

Although we believe BSP’s inflation forecast to be too aggressive, we agree that inflation will remain elevated in the coming months. We forecast inflation to average 4.1% YoY next year with much of the price pressures driven by supply-side factors such as drought (El Nino), imported energy price adjustments, and a shortage of fish. However, we believe that demand-side pressures will be relatively muted given our outlook for consumption to moderate and that the government will be unable to ramp up spending in a manner that could be inflationary.

Despite price pressures emanating mainly from the supply side, we believe Remolona will not hesitate to hike rates should inflation indeed flare up next year. Previous BSP governors have looked past supply-side inflation over the years but Remolona appears to be ready and willing to hike to meet his price stability mandate, regardless of the drivers of inflation. Thus we expect the BSP to tighten monetary policy for most of 2024 with only a slim chance for a rate cut towards the end of the year should inflation cool and if global central banks begin to cut rates by mid-year.

BSP could hike again next year

PHP to trail possible regional rally, rates to stay elevated

With the BSP signaling it would prefer to retain a hawkish stance “for quite some time”, we believe local bond yields will be prevented from falling sharply even if global bond yields edge lower. Governor Remolona’s hawkish rhetoric should keep shorter-dated bond yields elevated. Meanwhile, BSP projections for 2014 inflation (4.4% YoY) should also prevent yields for longer-dated bonds from falling sharply as well.

Given our expectations for the country’s trade balance to remain in deficit, we expect the current account balance to stay in deficit, too. This is the fundamental reason why we believe the peso should face bouts of depreciation in the coming months as demand for dollars will outweigh inflows delivered by remittances and export receipts.

During episodes where the Asian FX pack enjoy a rally, due to potential general dollar weakness, we expect the PHP to lag regional peers, with gains capped by its negative external position.

One factor that could be supportive of PHP, however, would be BSP’s consistent hawkish commentary. A rate hike by the BSP at a time of global easing could be one reason we would see PHP appreciate more aggressively than our baseline forecast.

Conclusion: Challenges remain but growth has proved resilient so far

Philippine GDP growth surprised on the upside in the third quarter and has, for the most part, outperformed our expectations. Despite this, we believe challenges to the outlook remain with household spending appearing stretched and fiscal spending possibly reaching its limits. Meanwhile, we believe the impact of the BSP’s ongoing tightening cycle will continue to weigh on investment activity at a time when global trade is expected to slow.

Given these developments and trends, we expect 2024 full-year growth to slow considerably to 4.5% from the projected 5.3% YoY in 2023. We could see an upside to this outlook should inflation slow sharply, which could free up some purchasing power for households while an eventual easing of monetary policy by the second half of 2024 should help bolster investment activity.

The wild card for growth next year, however, will be government spending, which is expected to be capped by elevated debt levels. We believe that GDP growth can outperform our initial base case scenario but only if government spending is able to expand by double digits for all of 2024.

More By This Author:

FX Daily: Dollar Can Get Support From Well-Telegraphed Fed Pushback

Rates Spark: There Is Still A Job To Get Done

Asia Morning Bites For Wednesday, December 13

Disclaimer: This publication has been prepared by the Economic and Financial Analysis Division of ING Bank N.V. (“ING”) solely for information purposes without regard to any ...

more