Pairs In Focus This Week - Sunday, July 30

Image Source: Pixabay

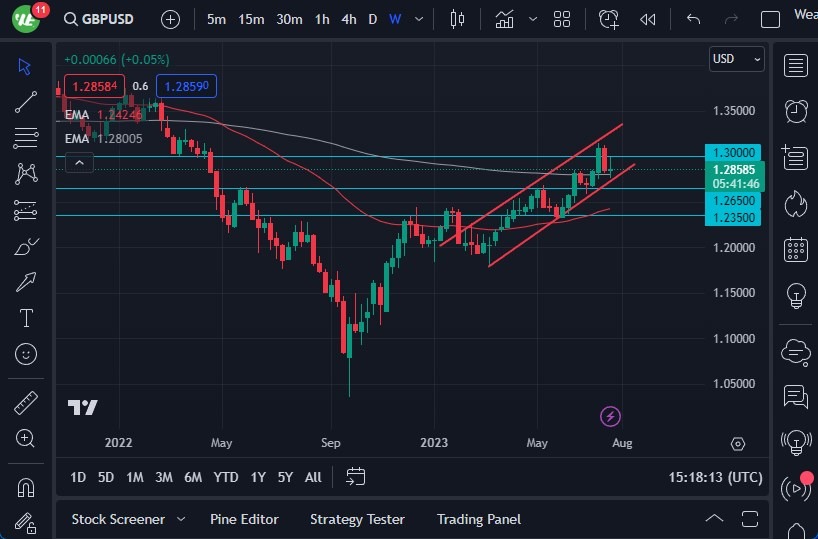

GBP/USD

The GBP/USD currency pair moved all over the place during the week, as it was seen hanging around the 200-week EMA. The 1.30 level above has been a significant resistant barrier. Therefore, I think if the pair can break above that point, the British pound could likely continue to go higher.

On the other hand, if it were to break down below the 1.2650 level, the British pound would start dropping. All things being equal, I suspect that this is a currency pair that will probably consolidate over the next week or so.

EUR/USD

The EUR/USD currency pair fell a bit during the trading week, breaking down below the 1.10 level after the European Central Bank shocked markets by suggesting that the economy in the European Union is slowing down. At the end of the day, the pair turned around and showed signs of support, bouncing back above the 1.10 level.

If the pair were to break above the top of the weekly candlestick, then it’s possible that it could looking to the 1.1250 level, and perhaps even to the 1.15 level after that. Underneath, significant support can be seen at the 50-week EMA, closer to the 1.08 level.

GBP/JPY

The GBP/JPY pair initially plunged during the training week, only to turn around and show signs of life again. The massive candlestick seen in the chart was formed after the Bank of Japan suggested that they were going to loosen yield curve control, and traders started to run toward the Japanese yen.

However, the interest rate differential between the British pound and the Japanese yen appears set to continue to favor the upside. In general, I think this pair may continue to see plenty of 'buying on the dip' type of behavior. Eventually, I think the pair may go looking toward the JPY185 level.

USD/CHF

The USD/CHF currency pair has shown itself to be somewhat resilient over the last couple of weeks against the Swiss franc, but it has still been lingering below the crucial 0.88 level. If it can break above that level, then it could go looking to the 0.90 level after that. Any move above that level would then send the US dollar screaming higher.

In general, I think that next week will probably see more back-and-forth consolidation to build up some type of support for a potential recovery. If the pair were to break down below the 0.85 level, then the bottom could fall out.

Nasdaq 100

The Nasdaq 100 rallied during the course of the week, as it looked like it was trying to reach the 16,000 level. As we continue to go through the earnings season, it certainly looks as if it is going to remain very bullish.

At this point, I think short-term pullbacks may offer plenty of support, with the 15,250 level being a bit of a short-term floor. In general, this is a market that I think will continue to find plenty of buyers based on the number of people seemingly taking advantage of the “AI narrative.”

Copper

Copper markets experienced a strong rally during the week, but the metal continued to bounce between the $4.00 level and the $3.75 level underneath. All things being equal, I think the coming week will continue to see some noise as many try to sort out what is happening with the overall global economy.

Remember, copper is highly sensitive to global growth and demand based on construction and manufacturing. Keep an eye on this market, as it could give you an idea as to where overall risk appetite is heading.

WTI Crude Oil (US Oil)

The crude oil market rallied a bit during the trading week, breaking toward the $80 level. The $80 level courses a large, round, psychologically significant figure. If it could break above that level, then the market could really start to pick up from there, perhaps even reaching the $82.50 level.

At this point, any short-term pullbacks should be considered buying opportunities, as it looks like oil may be trying to reach the $90 level. On the other hand, if it were to break down below the bottom of the weekly candlestick, then it’s likely that the $70 level could be targeted instead.

Gold

The gold market continued to move back and forth during the past couple of weeks. The $2000 level above is a large, round, psychologically significant figure that a lot of people will be paying attention to. If the yellow metal breaks above there, such a move could bring in a rush of more buying. Underneath, the $1900 level continues to be a massive support. I anticipate a short-term pullback may occur, followed by more of a “buy on the dip” situation.

More By This Author:

Gold Forecast - Market Continues To Cause Headaches Amid Central Bank DecisionsNatural Gas Forecast: Analyzing The Outlook Amid Summer Slowdown And Geopolitical Tensions

Crude Oil Forecast: Volatility With Eye On The Upside

Disclosure: DailyForex will not be held liable for any loss or damage resulting from reliance on the information contained within this website including market news, analysis, trading signals ...

more