Pairs In Focus This Week - Sunday, July 2

Image Source: Unsplash

EUR/USD

The EUR/USD currency pair had moved back and forth quite a bit during the week, as traders attempted to find some clarity in the market. Both central banks are likely to raise interest rates rather soon, so this pair may continue to see some consolidation.

As things stand, the 1.10 level above seems to offer significant resistance, while the 1.08 level underneath looks to be supported. The 50-week EMA and the trend line can bee seen just under that level, and thus there may be continued short-term back-and-forth trading that could allow for range-bound traders to take advantage of the movement.

GBP/USD

The GBP/USD currency pair behaved much like the euro during the week, moving back and forth while many tried to discern where it could go next. It’s worth noting that the pair moved on Friday to show significant support at a previous resistance barrier. By doing so, the market looks as if it has some buyers, but the 200-week EMA above can still be seen offering selling pressure.

In other words, I think the price action is going to be much like what has been seen with the EUR/USD pair; a pair that is likely stuck in some type of tight consolidation. This makes sense, as the GBP/USD pair has been stuck sitting between the 200-week EMA above and the 50-week EMA below.

USD/CAD

The US dollar similarly moved back and forth during the course of the trading week, reaching the 1.33 level at the peak. The 1.33 level was previously support and now appears to be offering significant resistance.

Much like the euro and the British pound, the pair appears stuck between the 50-week EMA and the 200-week EMA indicators, and therefore it is likely that we will continue to see choppy and noisy behavior. With that being said, I think this is a market that is in the process of sorting itself out. Perhaps the pair breaking out of those moving averages will tell you in which direction to trade for a bigger move.

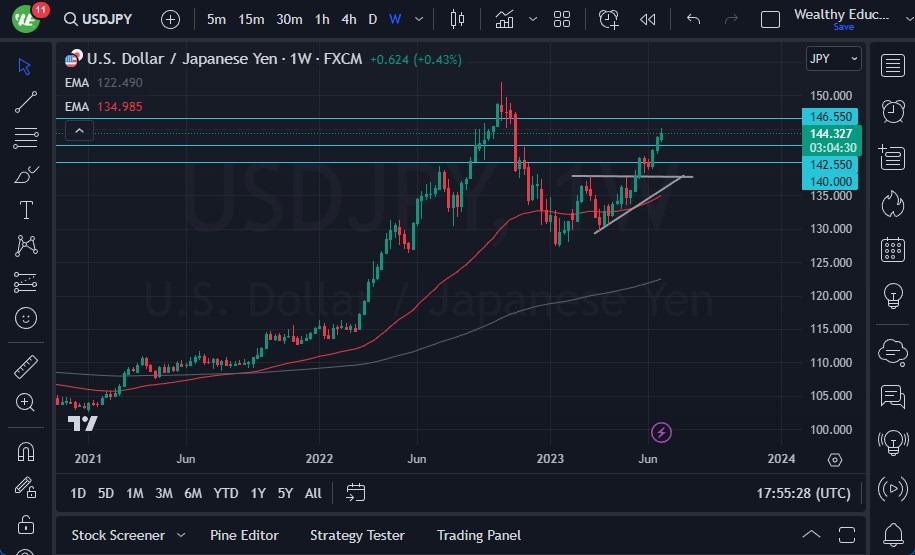

USD/JPY

The US dollar continued to rally during the course of the week against the Japanese yen, as the interest rate differential between the two central banks remained very wide. However, Friday started to see a little bit of a pullback, and I think such movement was necessary.

I will be paying close attention to the JPY142.50 level, which is an area where I expect to see significant support. I have no interest in selling this market, and I think that the pair will eventually reach the JPY146.55 level, possibly even as high as the JPY148 level.

AUD/USD

The Australian dollar has moved rather erratically over the last couple of weeks. However, at the end of this past week, the 0.66 level appeared to offer support. It looks as if the pair may be trying to stabilize within the previous consolidation area, meaning that the 0.66 level should be supported, while the 0.68 level should serve as resistance.

If the pair were to break down below the 0.66 level, then such a move would open up the possibility of a drop-down to the 0.65 level. After that, the 0.64 level would then get targeted. Alternatively, if we were to see a break above the 0.68 level, this would mean that the pair could reach towards the 0.69 level, or possibly even the 0.70 level.

GBP/JPY

The British pound rallied a bit during the course of the trading week against the Japanese yen. As long as the Bank of Japan continues to be loose with its monetary policy, we will continue to see traders jump into this market and try to take advantage of “cheap British pounds.”

With that being the case, the market is likely to see a lot of traders willing to jump into this market every time it pulls back, and I see the JPY180 level underneath as a major support level. On the other hand, if the pair can break above the JPY185 level, then the market really could start to take off again.

EUR/GBP

The euro similarly moved back and forth against the British pound during the week, as it continued to bounce between the 0.85 level underneath and the 0.87 level above. The 200-week EMA appears to be set just above, with the 50-week EMA hanging around the same area.

If we were to see a break down below the 0.85 level, then it’s likely that it could drop down to the 0.83 level. On the other hand, if the pair were to turn around and take out the 0.87 level to the upside, then it could start looking towards the 0.89 level.

USD/CHF

The US dollar continued to see a little bit of base building against the Swiss franc over the course of the last week, with the 0.90 level above offering significant resistance. At this point, if the market were to break above there, then it could try to reach the 0.91 level. Underneath, I believe that the 0.88 level will continue to offer massive support.

More By This Author:

Silver Forecast: Rallies As 200-Day EMA Breaks, Eyes On Key Levels

GBP/USD Forecast: Stagnates Above Key Level

Natural Gas Forecast: Market Sees Resistance At $3.00 And Potential For Recovery

Disclosure: DailyForex will not be held liable for any loss or damage resulting from reliance on the information contained within this website including market news, analysis, trading signals ...

more