Pairs In Focus This Week - Sunday, Jan. 15

Image Source: Unsplash

GBP/USD

The GBP/USD currency pair spent most of the week falling, but after the jobs number on Friday, it started to see bullish pressure again as the report showed that wages are seeing less inflation in the United States, so traders started to focus on the idea that the Federal Reserve may someday slow down its tightening cycle.

In my opinion, that is not going to prove to be true, so it’ll be interesting to see how this market plays out. In the short-term, it looks like the pair will continue to bounce around the 1.21 level.

EUR/USD

The EUR/USD pair initially fell during the week as well, dipping below the 50-Week EMA, only to turn around and show signs of life. The 1.06 level continues to be a significant magnet for prices, and I think that it is probably only a matter of time before the market is pushed into making a bigger decision.

In the short-term, it is going to be very noisy and back-and-forth, so I think that the pair will continue to see a lot of range-bound trading. That being said, if the currency pair is able to break down below the bottom of the candlestick for the week, that could open up a significant selling opportunity. Alternatively, if the pair breaks above the 1.08 level, then that could spark the euro to takeoff.

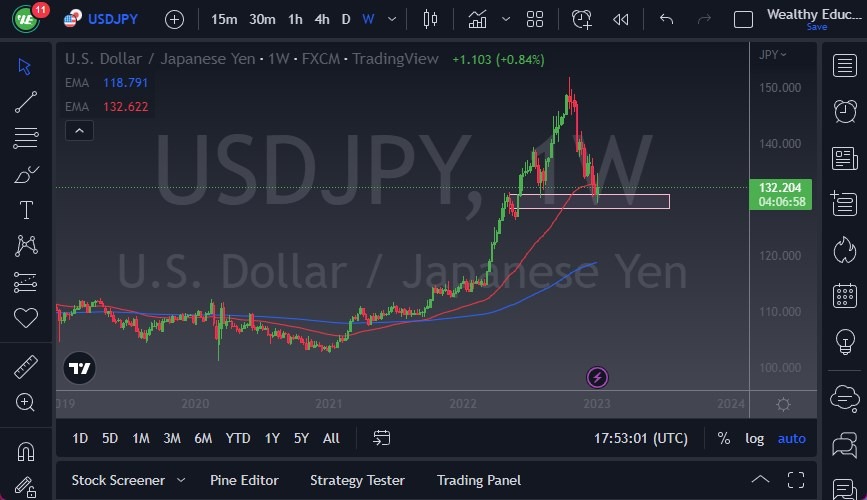

USD/JPY

The USD/JPY currency pair continued to see a lot of noisy behavior around the Japanese yen and the JPY130 level this past week. At this point, it looks as if the pair is going to continue to see a bit of support.

However, if it was able to break down below the JPY130 level, this could see the Japanese yen strengthen, sending the US dollar down to the JPY128 level. Seeing rallies break above the top of the candlestick for the week would open up the possibility of a move to the JPY140 level.

AUD/USD

The AUD/USD pair spent the early part of the week falling, but by the time the jobs report was released on Friday, the pair had seen a complete turnaround. The resulting hammer candlestick suggests that there are buyers out there that are looking to get long again.

That being said, the 0.69 level will be a sticky barrier, but if the currency pair reaches above that point, the market could see the Australian dollar rally to the 0.70 level. Pullbacks at this point will likely continue to be supported by the trend line underneath.

USD/CHF

The USD/CHF currency pair initially took off against the Swiss franc, but after the jobs number, the pair gave back quite a bit of the gains it had seen in what was a very choppy week. Because of this, it looks as though the pair may threaten the 0.92 level.

Breaking below the 0.92 level could open up a move down to the 0.90 level, but when you look to the left on the chart, there is a ton of support present in this area. In other words, I think the pair may experience choppy price action in this general vicinity on the short-term charts.

EUR/GBP

EUR/GBP currency pair traders were bullish during the beginning part of the week, but they started to sell off again against the British pound. The pair stands at the top of a consolidation area that focuses on the 0.88 level, so if there is a selloff below the bottom of the candlestick, it could open up a move down to the 0.86 level.

That’s an area that has been supportive in the past, so a sell-off at this point would probably send the pair back into consolidation. However, if the pair breaks above the highs of the last two weeks, it could cause the euro to takeoff.

NZD/USD

The NZD/USD pair initially sold off during the week, but then turned around to show signs of life again. That being said, the New Zealand dollar has also faced a lot of resistance just above recent trading levels, so it’ll be interesting to see all this plays out.

The 0.64 level looks to be an area of resistance, extending all the way to the 0.65 level. It may very well be that the New Zealand dollar appears bullish at the beginning of the week, only to pull back later on.

GBP/JPY

The GBP/JPY initially fell against the Japanese yen, but it turned right back around toward the end of the week, forming a bit of a hammer. This was preceded by an inverted hammer, showing that the pair has a “fair fight” on its hands. Overall, I think this is a market that will be very noisy and see much back-and-forth price action as the pair hovers around the JPY160 level.

More By This Author:

GBP/USD: Weekly Forecast January 15 - 21S&P 500 Forecast: Continues To Find Buyers On Dips - Friday, Jan. 13

GBP/USD Forecast: Has Yet Another Quiet Day

Disclosure: DailyForex will not be held liable for any loss or damage resulting from reliance on the information contained within this website including market news, analysis, trading signals ...

more