Pairs In Focus This Week - Sunday, April 9

Image Source: Unsplash

EUR/USD

The EUR/USD currency pair rallied slightly during the trading week, but it still saw quite a bit of noise, extending all the way to the 1.10 level. Ultimately, I think the pair will eventually find sellers, but if it were to break above the 1.1050 level, then it would become clear that the market is entering a longer-term bullish run. A lot of this price action ultimately comes down to the Federal Reserve and expectations of monetary policy.

USD/JPY

The USD/JPY pair had shown signs of strength during the end of the week, as the greenback initially fell against the yen. That being said, the market for this pair has shown itself to be somewhat stable, and it looks as if it is trying to form some type of longer-term bottom.

A lot of this price action comes down to the overall interest rate situation as the Bank of Japan continues to deal with yield curve control. It appears as though the pair has been attempting to form some type of base.

Gold

Gold markets experienced a positive week, breaking above the $2000 level and even closing above it. Ultimately, it looks as though the $2050 level will continue to serve as a barrier. However, I think given enough time, the yellow metal could see some exhaustion and drop down below the $2000 level. Any dip at this point could be thought of as a potential value play, as gold has seen so much in the way of strength recently.

GBP/USD

The GBP/USD currency pair has broken above the 1.25 level during the week, albeit only slightly. The weekly candlestick ended up looking a bit like a shooting star, and there appears to be significant resistance just above that point.

If the market were to break down below the bottom of the weekly candlestick, it’s very likely that the pair could move towards the 1.20 level. However, if there was a break above the top of the candlestick, then it’s possible that the GBP/USD pair could go looking to reach the 1.2750 level. Just above there is the 200-week EMA indicator that normally offers a little bit of noise, as well.

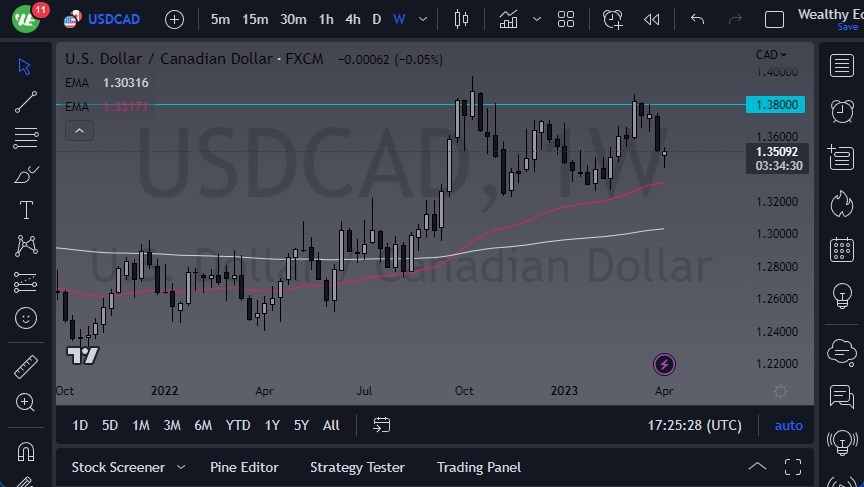

USD/CAD

The USD/CAD pair initially dipped early in the week, but it later turned around to show signs of life by forming a hammer. By doing so, the pair looks as if it could make a move toward the 1.38 level, perhaps even the 1.39 level. The 50-week EMA is sitting just below the 1.33 level, and I think that will offer significant support.

AUD/USD

The AUD/USD pair initially tried to rally during the week, but it found a lot of resistance near the 0.68 level, a barrier worth paying attention to. The fact that the pair formed an inverted hammer suggests that the US dollar is about to have a strong week, so I think it is only a matter of time before the pair breaks down below the bottom of this candlestick and goes looking toward the 0.6550 level, and then the 0.65 level.

Having said that, if it were to break above the 0.68 level, that would be an extraordinarily bullish sign, perhaps opening up the possibility of a move to the 0.70 level.

NZD/USD

The NZD/USD currency pair initially tried to rally during the week, but it encountered enough resistance at the 0.64 level to show just how much selling pressure is waiting above.

By forming a shooting star, the chart suggests that the pair could break down a bit. I would anticipate seeing a certain amount of support near the 0.6150 level, but if the NZD/USD pair were to break down below there, then the it would likely turn towards the 0.60 level, and perhaps even further to the downside. At this point, I think the pair will continue to see a lot of noise in this area.

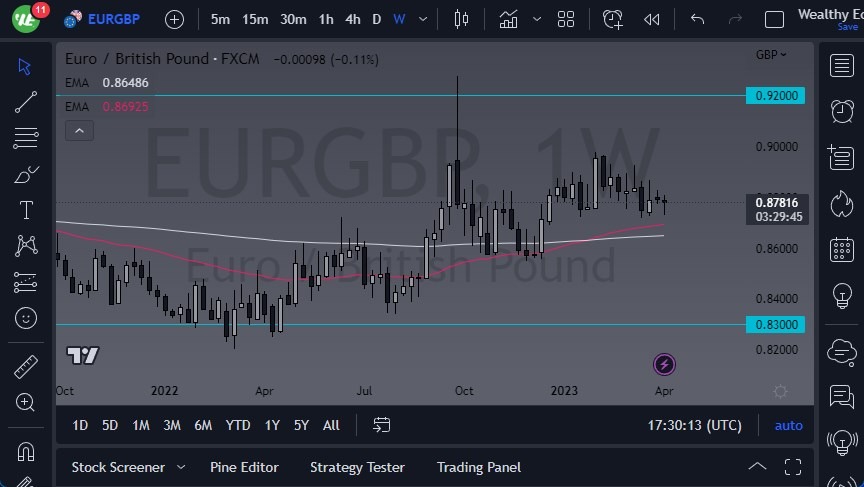

EUR/GBP

The EUR/GBP pair initially fell during the week against the British pound, but it continued to see a lot of support near the 0.87 level. Based on the recent trading history, it’s likely that the pair could see a little bit of a bounce during the week, but I also think that the 0.90 level above could continue to serve as significant resistance.

The EUR/GBP pair appears to be at the bottom of the overall consolidation area, so more of the same price action could be anticipated at this point in time, and therefore I think it’s worth looking for short-term buying opportunities.

More By This Author:

Natural Gas Forecast: Continues To See The $2 Level As An Area Of SupportS&P 500 Forecast: Continues To Reach Above 4100

GBP/USD Forecast: Sterling Looks At Overhead Resistance

Disclosure: DailyForex will not be held liable for any loss or damage resulting from reliance on the information contained within this website including market news, analysis, trading signals ...

more