Pairs In Focus This Week - Sunday, April 16

Image Source: Unsplash

EUR/USD

The EUR/USD currency pair experienced a bullish week, breaking above the 1.10 level before giving back its gains on Friday. It may appear as though there was a sudden shift, but the pair has been in such a range for a while, so it's not overly surprising to see a bit of a bounce between the 1.10 mark and the 1.05 level.

Pay close attention to the 200-week EMA where the market stopped, because if the EUR/USD pair can break above there on a daily close, it could send the euro toward the 1.1250 region. If the pair can pull back and break down below the weekly candlestick, then it’s likely it could go looking toward the 1.0750 level.

GBP/USD

The GBP/USD pair tried to rally during the course of the week, but it gave back the gains to form a shooting star candlestick at the end of the week. This is the second one in a row, and it shows just how difficult it is going to be to break above this area.

With that in mind, I think this is where the GBP/USD pair could start to look toward the range underneath, or at least the 50-week EMA. That being said, if it can break above the high of the week, that would obviously be a very bullish sign, opening up the possibility of a move toward the 1.2750 level.

USD/CAD

The USD/CAD duo reached the bottom of its range against the Canadian dollar during the week, and now it looks like it is poised to make a recovery. The pair has been trading between 1.33 and 1.38 for some time, and it looks like it may continue to see more of the same.

That being said, if it can break down below the bottom of the candlestick for the week, it could open up a move down to the 200-week EMA which sits just above the psychologically important 1.30 level.

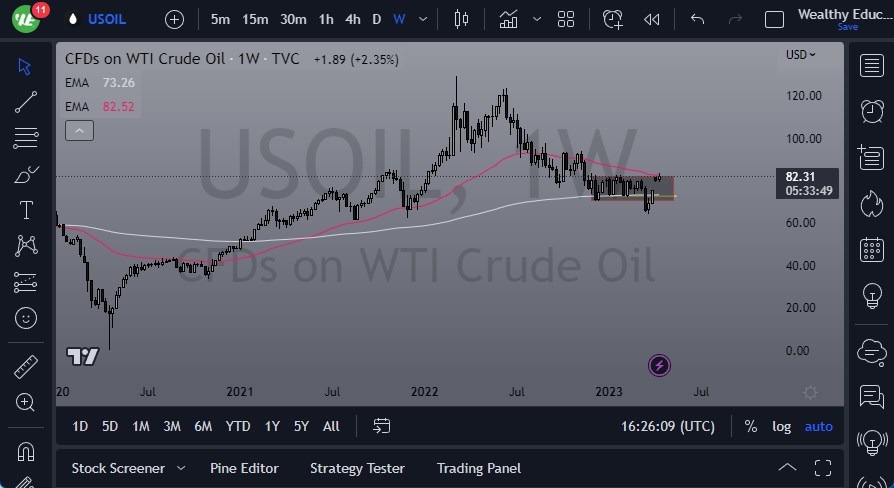

US Oil

The West Texas crude oil market did very little during the week, but it appears to be sitting right around the top of the overall consolidation area that is has been stuck in for a while, so it shows the potential to try and break out to the upside.

If oil were to break above the top of the candlestick, then this would open up the possibility of a move to the $85 level, followed by a move to the $90 level. Ultimately, if it can break down below the bottom of the candlestick, then it would open up the possibility of reaching the $77.50 level.

Gold

Gold markets initially spiked for the week, but they have turned around to show signs of weakness. At this point, it almost looks as if gold is ready to give up, perhaps pulling back toward the $1950 level, or maybe even as low as $1900 level.

Quite frankly, the market got a little overextended, and therefore it would make sense to see some exhaustion in this area. After all, the $2000 region has been significant resistance more than once. In order to continue with upward momentum, gold would almost certainly have to break above the $2100 level.

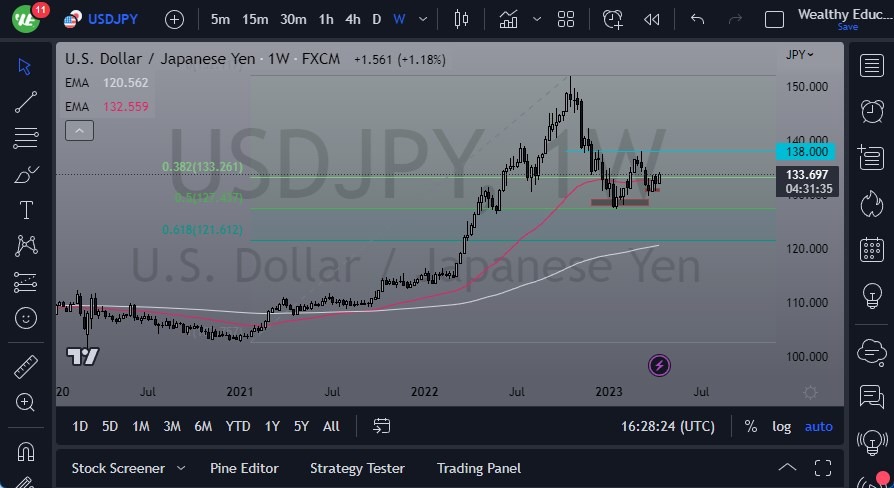

USD/JPY

The USD/JPY currency pair rallied during the course of the week to break well above the JPY133 level. This is a good sign, and it does suggest that perhaps the US dollar is going to continue against the Japanese yen.

Ultimately, the USD/JPY pair has bounced yet again, and it looks like it has formed a little bit of a double bottom. That being said, it looks like it is going to continue to be a very noisy market as the Bank of Japan continues its yield curve control, and it will therefore continue to have an outsized influence on this pair.

USD/CHF

The USD/CHF currency pair plunged against the Swiss franc during most of the week, but it started to see a lot of buying pressure on Friday at what would be considered to be an extreme low in the market.

Because of this, it will be interesting to see if it can maintain some momentum. If it can recapture the CHF0.90 level, it’s likely that the US dollar could continue to rally for at least another 100 pips. On the downside, the CHF0.88 level has been extraordinarily supportive more than once.

AUD/USD

The AUD/USD pair tried to rally a bit during the course of the week, but it gave up most of its gains. Because of this, I think one can continue to see this as a “fade the rally” type of market, and therefore I think it is only a matter of time before the pair can try to break back down to the 0.65 level. Remember, the Reserve Bank of Australia has recently chosen not to raise interest rates.

More By This Author:

AUD/USD Forecast : Rallies, But Faces Significant Issues AboveS&P 500 Forecast: Continues To Look For The Next Catalyst

GBP/JPY Forecast: Continues to Probe Higher Against Yen

Disclosure: DailyForex will not be held liable for any loss or damage resulting from reliance on the information contained within this website including market news, analysis, trading signals ...

more