Oversized Rate Cuts: Red Alert

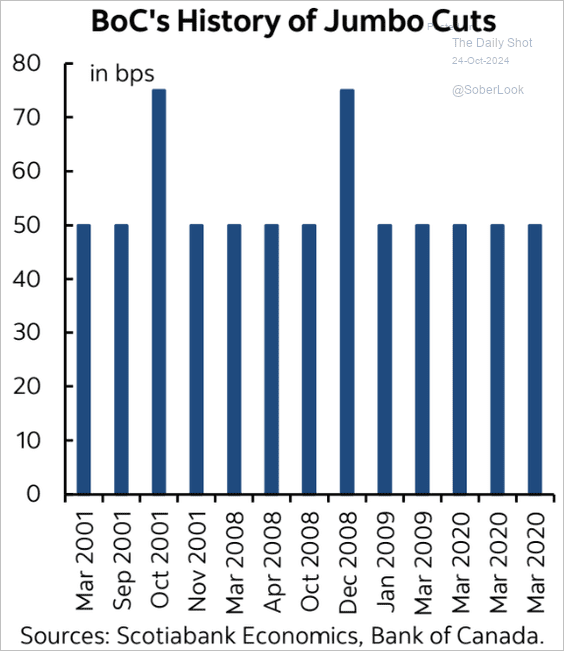

Four easing cycles have seen the Bank of Canada deliver larger than 25 basis point rate cuts at a time: 2001, after the US dot-com bubble and Sept. 11 attacks; during the global financial crisis; in the COVID economic shock of 2020 (see chart on the left); and now, in 2024. See Bank of Canada’s Deeper Cut Aims to Reignite a Sluggish Housing Market.

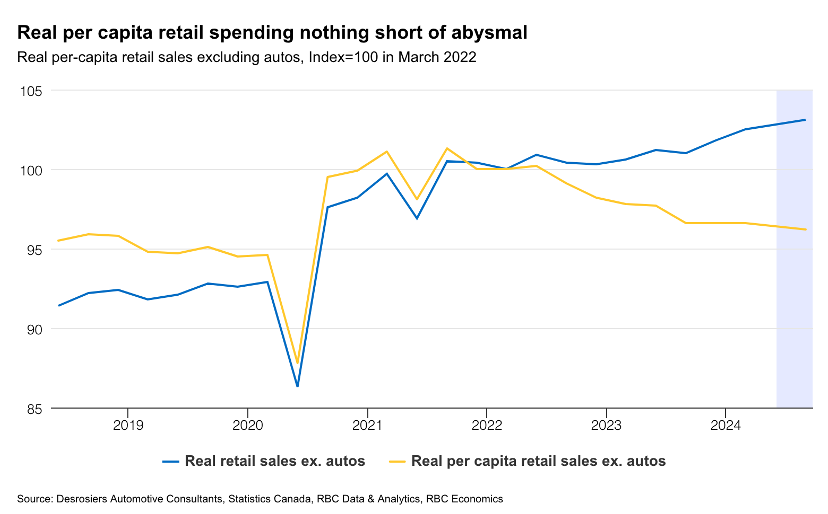

With some 58% of Canada’s GDP growth driven by consumer spending, it matters that Canadian retail sales ex-autos (a coincident economic indicator) have fallen per capita since 2021 (yellow line below since 2018, courtesy of RBC economics). See RBC: Canadians are tapped out.

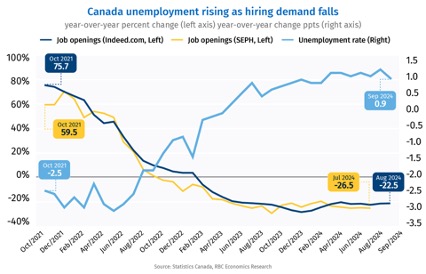

At the same time, Canada’s unemployment rate (a lagging economic indicator) was up 170 bps to 6.5% in September from a cycle low of 4.8% in June 2022 (blue line below since 2021), which is above pre-pandemic levels. Job openings nationally are 25% below year-ago levels (yellow line since October 2021). Deteriorating employment makes it harder for households to make ends meet. See RBC: The job market is a bigger threat to Canada’s economy than mortgage renewals.

There’s never been a time when the Canadian unemployment rate increased more than 100 bps from the cycle low when Canada was not in a recession. The consensus hopes that this time will be different.

Canada’s population is aging quickly. As of the latest StatsCan data, seven million Canadians aged 65 and older accounted for more than one-fifth of the total population (21.8%), up from 16.9% in 2016, and compared with six million children (16.3% of the total Canadian population in 2021).

The population aged 85 and older is one of the fastest-growing age groups, with a 12% increase since 2016. Over 861,000 people aged 85 and older were counted in the 2021 Census, more than twice the number observed in 2001. Over the next 25 years (by 2046), the age 85+ cohort will triple (to nearly 2.5 million people).

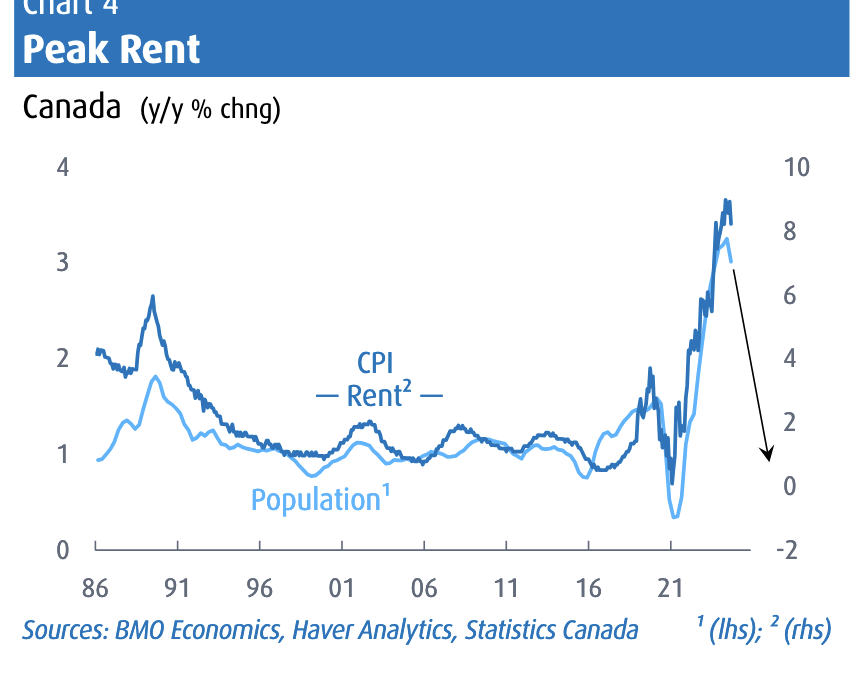

As weak as Canada’s economy has been, over the past couple of years, immigration has been the main driver. Today, the Federal government announced a reduction in immigration targets, implying that Canadian population growth will be zero over the next two years. This should further reduce Canada’s economic growth. On the upside, it should be disinflationary by alleviating some demand pressure on housing just as a surge in new supply is coming to market in key areas. Shelter costs make up 28% of Canada’s Consumer Price Index. See more, BMO: Canada’s Immigration Rethink:

“For housing, this move will dampen price pressures and rents, all else equal (e.g., rate cuts and mortgage rules). That said, the sudden shift in Temporary Resident inflows should clearly soften the rental market just as a torrent of supply is coming online in some regions (e.g., Toronto condos).Growth in average asking rent across Canada has slowed to just 2% y/y according to Rentals.ca, with outright declines seen in some markets. We’ve long argued that Canada has a housing demand problem. This policy change will be felt quickly and will make other supply-side measures look almost like rounding errors.

More By This Author:

The Trouble With Central Bank Rate CutsFinancial Risk At Historic Highs–What’s Your Plan?

Retailers Feeling The Pressure Of Cash-Strapped Consumers