🖥️ LONG TECH STOCKS = LONG BONDS

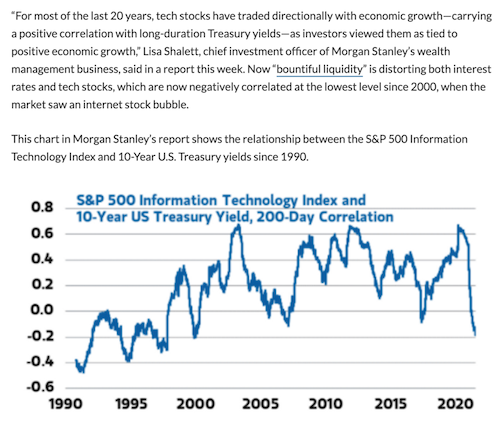

Morgan Stanley is echoing our thoughts on the relationship between bonds and tech.

To us this highlights how interlinked many markets are and how the general stock market (with its huge weighting in tech/growth stocks) is probably not a great hedge against inflation. From the article:

Perhaps you now are beginning to understand why we are “balls to the wall” long commodity based stocks. Not only do we have extremes in tech, but extremes in bonds. And remember, the bond market is roughly 10x that of the stock market. A shift of capital out of both bonds and “growth” could be in the offing.

♻️ GREENWASHING: THE TALE OF TWO ETFS

We’ve spent quite a bit of digital ink discussing greenwashing here at Capitalist Exploits. In case you don’t know, greenwashing is the “disinformation disseminated by an organization so as to present an environmentally responsible public image”.

As Chris pointed out in an article about greenwashing (which, ironically, quickly got censored by Facebook, despite it containing no factual errors):

Greenwashing extends way beyond false advertising in consumer goods. It’s made its way into politics, investment products, journalism, and now mainstream opinion in “the West”.

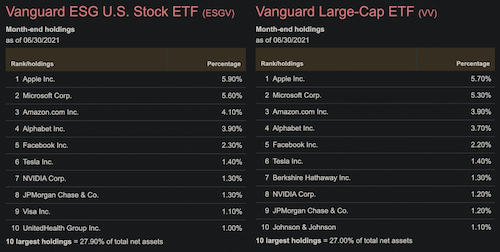

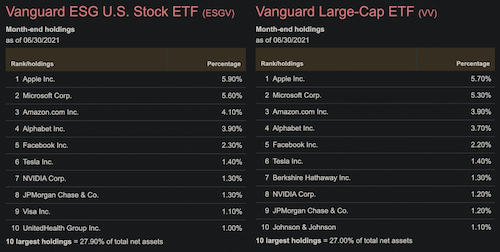

When it comes to investment products, greenwashing has become a yuuge business — to the tune of trillions of dollars. Here’s an illustrative example we came across recently — two ETFs, one branded as an ESG product, the other as… well, just a plain-vanilla ETF.

There’s no meaningful difference between the two when it comes to ETF holdings. Except, you are being charged three times more (0.12% vs. 0.04%) for the “privilege” of investing in a “woke” product.

We’re not the only ones disturbed by this, though. Bloomberg reports the pointy shoes over in Europe aren’t too happy about these kinds of greenwashed investments:

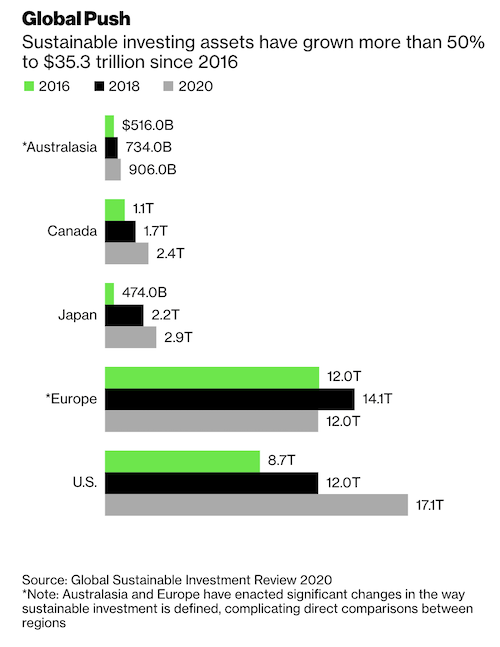

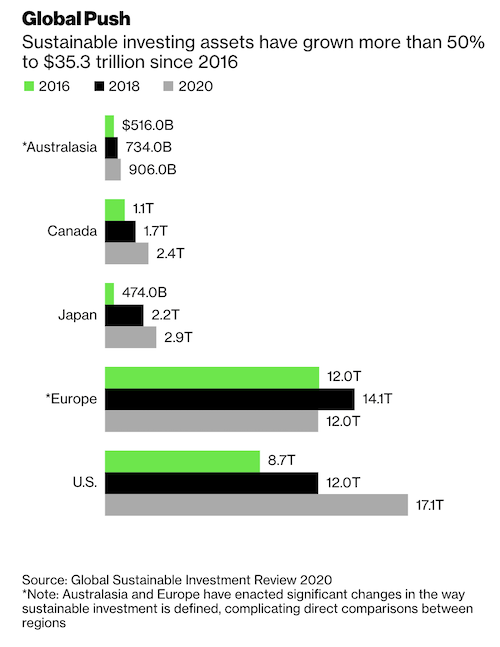

Sustainable investment assets fell to $12 trillion in Europe during 2020 from $14 trillion in 2018, the report states. The decline isn’t the result of dampened investor enthusiasm for ESG investments, it’s because policy makers have tightened the parameters for what can be considered a responsible investment, said Simon O’Connor, chair of the GSIA.

That’s just the EU, though. Everywhere else, the greenwashing continues… and the money keeps flowing.

☢️ THE CASE FOR URANIUM IN ONE PICTURE

The fact is that uranium, pound for pound, is quite simply unbeatable as a source of base load power. Yet, it continues to be priced as if we’ll never need it again. It truly is an amazing time to be alive.

Disclaimer: This is not intended to render investment advice. None of the principles of Capex Administrative Ltd or Chris MacIntosh are licensed as financial professionals, brokers, bankers or even ...

more

Disclaimer: This is not intended to render investment advice. None of the principles of Capex Administrative Ltd or Chris MacIntosh are licensed as financial professionals, brokers, bankers or even candlestick makers in any jurisdiction, anywhere on this big ball of dirt.We do NOT know your individual situation, and you should always consult with your attorneys, accountants, financial planners, and those that are sanctioned to provide you with advice. DO YOUR OWN DUE DILIGENCE.

But seriously, all investments carry risk. Some of what I discuss arguably carries great risk. Investments which can lead to you losing 100% of your capital and maybe more if you are stupid and use margin.If you invest more than you can afford to lose, or borrow money from Joey down at the tavern, Master Card or Visa to make your investments, then you need to go and read a different website.

But really seriously…

Capex Administrative LTD – parent company of CapitalistExploits.at is not a a registered investment advisor or broker/dealer. Readers are advised that the material contained herein should be used solely for informational purposes. Neither CapitalistExploits.at, Capex Administrative LTD purport to tell or suggest which investment securities members or readers should buy or sell for themselves. Readers, subscribers, site users and anyone reading material published by the above mentioned entities should always conduct their own research and due diligence and obtain professional advice before making any investment decision. Capex Administrative LTD, it’s principles and employees cannot and will not be liable for any loss or damage caused by a reader’s reliance on information obtained in any of our posts, newsletters, special reports, email correspondence, memberships or on this website. Like us, our readers are solely responsible for their own investment decisions.

The information contained herein does not constitute a representation by Capex Administrative LTD or CapitalistExploits.at or a solicitation for the purchase or sale of securities. Our opinions and analyses are based on sources believed to be reliable and are written in good faith, but no representation or warranty, expressed or implied, is made as to their accuracy or completeness. All information contained in our newsletters or on our website should be independently verified with the companies and individuals mentioned. The editor and publisher are not responsible for errors or omissions.

Capex Administrative LTD may receive compensation from time to time from the companies or individuals that may be mentioned in our newsletters, special reports or on our web site. If compensation is received we will indicate that compensation in the post or the content, or on this website within this “disclaimer.” You should assume a conflict of interest when compensation is received and proceed accordingly.

Any opinions expressed are subject to change without notice. Owners, employees and writers may hold positions in the securities that are discussed in our newsletters, reports or on our website.Owners, employees and writers reserve the right to buy and sell securities mentioned on this website without providing notice of such purchases and sales. You should assume that if a company is discussed on this website, in a special report or in a newsletter or alert, that the principals of Capex Administrative LTD have purchased shares, or will make an investment in the future in said company.

If you have a question as to what we own and when, we are happy to fully-disclose any and all interests to our readers.

less

How did you like this article? Let us know so we can better customize your reading experience.

As I keep repeating, emotions are a large part of what drive market decisions. That has not changed one bit.