Oil Surges After OPEC+ Said To Agree On 100Kb/d Production Cut

And there it is: the half life of the infamous fist bump proved to be less than two months, with a delegate telling Reuters that OPEC+ supports a 100kb/d reduction in oil output for October, meaning it's a done deal.

- *OPEC+ JMMC SUPPORTS 100K B/D OIL-OUTPUT CUT FOR OCT: DELEGATE

... just as we predicted.

Will be funny when bin Salman cuts OPEC+ output after meeting Biden

— zerohedge (@zerohedge) June 22, 2022

* * *

The much-anticipated OPEC+ meeting later on Monday has all options on the table for oil, Bloomberg's Nour Al Ali writes, adding that whatever the decision is on production in October, the alliance has the upper hand, which is bullish for the oil futures market.

A delegate has told Bloomberg that OPEC+ will discuss a range of oil-policy options at Monday’s meeting including a 100k b/d output cut - reversing last month's just as symbolic output hike following Biden's begging for more oil. Other options include maintaining production at current levels as well as an output cut before the next month's meeting.

The options I hear OPEC+ is mulling for today's meeting:

— Javier Blas (@JavierBlas) September 5, 2022

1) Roll-over current output quotas

2) ~100k b/d cut (reversing last month's symbolic hike)

3) Roll-over quotas, but keep OPEC+ meeting "in session", potentially cutting before next month if needed#OOTT #EnergyCrisis

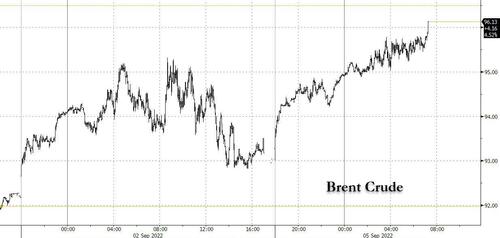

That much appears to be priced into futures markets, which remained about 2.7% higher at around the $95-level in Brent crude futures.

As Al Ali reminds us, we know from Saudi Arabia, that perhaps oil at current levels isn’t a fair reflection of the physical market’s tightness. Historically, the leader of the alliance is known to view prices at around $100 as fair.

Meanwhile, disruptions to global oil supply remain key. As the EU discusses a price cap on Russian oil, many members of the 23-nation alliance struggle to increase their output due to various reasons, and the outcome of a potential Iran nuclear deal remains uncertain. Technical experts at OPEC+ recently slashed forecasts for this year’s supply surplus in half, to 400,000 barrels a day, and expect a supply deficit in 2023.

Finally, as volatility picks up, the futures market (which is now "completely broken" according to oil trader Pierre Andruand) poses a conundrum for the alliance. Even as bearish factors such as a looming global economic slowdown and reduced demand out of China push prices lower, the European energy crisis puts the alliance back in the driver’s seat as an oil-for-gas substitution might be needed to keep the continent warm this winter.

More By This Author:

Bed, Bath & Beyond CFO Identified As Man Who Leapt To Death From Tribeca SkyscraperApple Overtakes Android, Now Accounts For More Than Half Of All US Smartphones

Goldman, Morgan Stanley, Lead Wall Street Push For Employees To Return To Office After Labor Day

Disclosure: Copyright ©2009-2022 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more