Oil Market Set To Be In Surplus Despite OPEC+ Action

Photo by Timothy Newman on Unsplash

2025 oil surplus

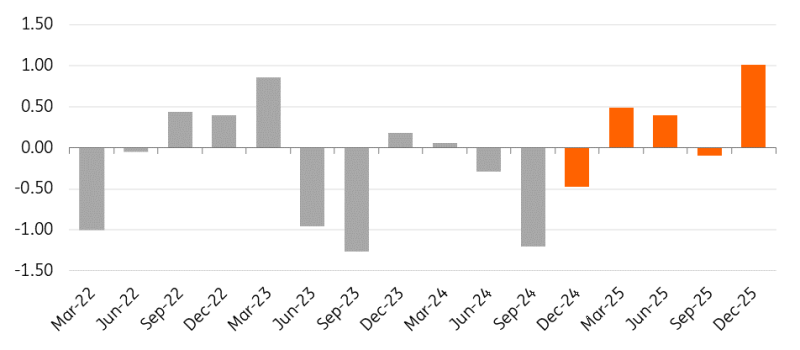

Oil prices have come under a fair amount of pressure this year, with the market worried about demand and the surplus outlook for 2025. Even after a handful of OPEC+ members decided to further delay the return of 2.2m b/d of additional voluntary cuts, our balance is still showing that the market will be in surplus through 2025 – although admittedly the surplus is more modest following action taken by the group. The scale of the expected surplus has shrunk from more than 1m b/d to around 500k b/d now.

Non-OPEC supply in 2025 is forecast to grow by around 1.4m b/d, which exceeds demand growth estimates of a little under 1m b/d next year.

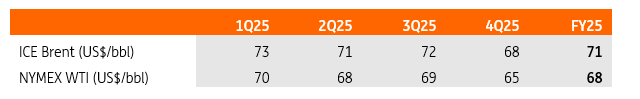

The surplus environment means that prices are likely to remain under pressure and we expect ICE Brent to average US$71/bbl over 2025.

There are clear risks to this view, including a stricter enforcement of sanctions against Iran and OPEC+ deciding to further delay the return of 2.2m b/d of supply. In addition, there is growing instability in the Middle East – something the market remains fairly complacent about.

Global oil market in surplus in 2025 (m b/d)

Source: ING Research, IEA, EIA, OPEC

OPEC+ has proved the market wrong, but can it continue?

Action taken by OPEC+ in early December has shown participants that the group appears committed to trying to keep the market in balance. We were of the view that falling prices, rising non-OPEC supply and some members producing above production targets would make it increasingly difficult for the group to continue with the significant supply cuts we are seeing.

The group proved us wrong at its December meeting by not only delaying the gradual return of 2.2m b/d of supply from January to April, but also by planning to increase supply at a slower pace. This means that the group is planning to take 18 months to return this full supply, compared to 12 months previously. So instead of increasing supply by around 180k b/d every month, the group will increase supply by a little less than 140k b/d.

While the delay in returning supply likely lifts the floor for the market slightly, we do not believe it changes the underlying issue. Eventually, the group will have to accept lower prices. Otherwise, it will continue to lose market share to non-OPEC producers.

Following recent action from OPEC+, it looks more likely that the group will extend cuts further if needed in 2025. However, it is important not to rule out the risk of growing disagreement between the group, particularly if oil prices remain under pressure. Lower oil prices translate to lower oil revenues for OPEC members and this has weighed on many Middle Eastern producers’ fiscal budgets.

The way to try to maintain oil revenues is by pumping more. So, compliance among some members may slip if prices trend lower. We have seen a handful of producers already pumping above their production targets for much of the year. The Saudis raised concerns over some members not sticking to production targets and the risk that oil prices could fall substantially lower – possibly an indirect threat that if members do not stick to cuts, they would increase output, potentially starting a price war. We don’t have to go back very far to see the potential impact this can have on the market. In 2020, a price war between Saudi Arabia and Russia saw oil prices plummet, although this also coincided with the Covid-19 pandemic.

OPEC spare capacity to continue providing comfort to the market

For much of this year, there has been plenty of focus on geopolitical events in the Middle East and concerns that escalation could have an impact on Iranian supply as well as potentially regional supply. However, despite tensions, the lack of disruption to oil supply has meant that the market has become increasingly immune to developments in the Middle East. We would likely need to see an actual supply disruption in order to push oil prices significantly higher.

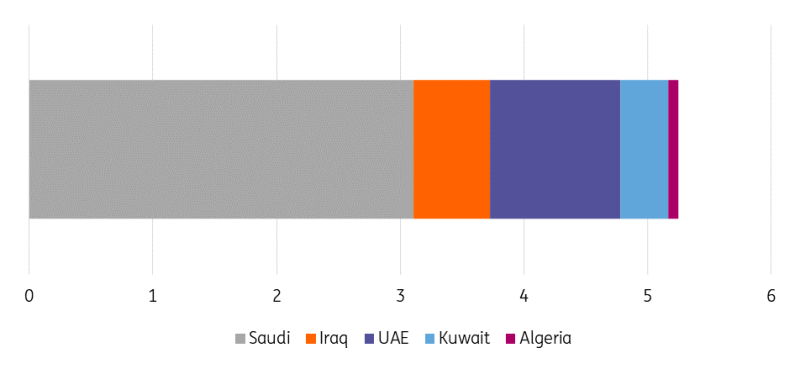

The amount of spare production capacity OPEC is sitting on also provides some comfort to the market. OPEC sits on more than 5m b/d of spare production capacity, so in the event of a supply disruption, there is sizeable capacity to make up for any disruptions. However, OPEC would likely be slow to bring capacity back online, holding out for higher prices. Saudi Arabia’s fiscal breakeven oil price is over US$90/bbl, so they would like to see prices trading closer to this level – although they would not want to push prices too high, given the risk of demand destruction.

In the event that we see disruptions to oil flows through the Strait of Hormuz, this spare capacity wouldn't prove very helpful, given that most of OPEC’s spare capacity sits in the Persian Gulf and this supply would have to move through the Strait of Hormuz.

OPEC sitting on a large amount of spare production capacity (m b/d)

Source: IEA, ING Research

What does Trump mean for Iranian oil supply?

Iran has increased supply significantly over the last two years, pumping around 3.4m b/d, up from around 2.5m b/d in early 2023. The US has not enforced oil sanctions against Iran strictly, which has allowed for export flows to increase. However, with US President-elect Donald Trump set to enter the White House in January, there is potential that he will take a more hawkish stance against Iran, like he did in his first term.

This potentially leaves around 1m b/d of supply at risk, if Trump is able to effectively enforce sanctions. However, with almost all Iranian exports heading to China, it may be challenging to significantly reduce these flows. We are assuming that Iranian supply remains flat at around 3.3m b/d over 2025, with obvious downside risks to this number. However, any reduction in Iranian supply would likely leave OPEC+ more comfortable in starting to unwind its additional voluntary supply cuts as currently planned.

What does Trump mean for US oil supply?

In the near term, we do not expect the incoming Trump presidency to significantly move the needle when it comes to oil supply. US oil producers will be more price dependent and with the global market well supplied in 2025, there will be little incentive for US oil producers to significantly increase drilling activity.

WTI 2025 and 2026 values are trading around the US$65/bbl level, which is not far from levels that producers need to profitably drill a new well. Both the Dallas Fed Energy Survey and the Kansas Fed Energy survey show that producers on average need US$64/bbl.

We are assuming that US oil production will grow by around 300k b/d to a record 13.5m b/d in 2025. This is similar to the growth estimated for 2024, but obviously much more modest than growth rates seen prior to Covid.

In the medium to longer term, a Trump presidency could provide upside through less regulation (which would help lower production costs), fast-tracking approvals for pipeline infrastructure (which will help with persistent bottlenecks in the supply chain) and the reversal of some of President Joe Biden’s policies with regards to federal land leases. Onshore oil production on federal lands accounted for 12% of total oil output in 2023; including offshore production, this number grows to around 26%.

The Biden administration reduced lease sales on federal land and also increased royalty payments and bond requirements for production on federal land. If we compare the number of new leases issued during Trump’s first three years in office, it totalled more than 4,000. In Biden’s first three years, new lease issuances totalled a little over 1,400. However, lower issuances of leases are having little impact on output so far, with oil production on federal lands growing every year that Biden has been in office.

Trade tensions and oil

A ratcheting up in trade tensions is a concern for the oil market and risk assets in general. The recent rhetoric from Trump suggests that he may tackle trade policy sooner than expected, which signals potential for tariffs to start being implemented in the second or third quarter of 2025. The difference between the 2018 US-China trade war and this time around is that Trump is looking to potentially impose tariffs on all trading partners.

The risk is that we see some trading partners responding with retaliatory tariffs against the US, which could have an impact on demand for US oil and refined products.

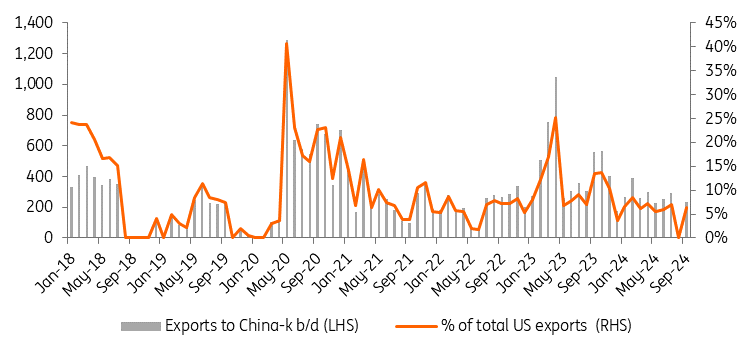

In 2018 during the US-China trade war, Chinese oil buyers were reluctant to purchase US crude oil due to the risk and the eventual implementation of tariffs. This saw the WTI-Brent discount widen from around US$3/bbl to more than US$11/bbl in 2018. A ratcheting up in the trade war with retaliatory tariffs – or even the risk of tariffs – could see the WTI-Brent spread coming under pressure once again. However, we may not see as much pressure on the spread given that in early 2018, close to a quarter of US crude exports went to China and this share has fallen to around 7% currently.

US crude oil exports less exposed to China

Source: EIA, ING Research

Modest oil demand growth in 2025

Global oil demand in 2024 has disappointed, with growth of less than 1m b/d expected this year. China has been a key driving force here. At the start of the year, China was expected to make up more than 50% of global demand growth. It's now set to be only around 20%.

There are both cyclical and structural trends which are driving this slower growth in China. Obviously, the economy has been performing weaker than expected, with the property sector still a drag, while manufacturing activity and consumer spending have not been not great. The government has announced a number of support measures, but the full impact of stimulus is yet to be seen – and with the potential for trade frictions next year, China may have to roll out further stimulus.

In addition, China has been seeing stronger sales of new energy vehicles in the domestic market, which will be displacing oil demand. More than 40% of vehicle sales are now new energy vehicles. In parts of China, there has been a significant pick up in the sale of LNG-powered trucks, which will also be displacing diesel demand.

However, it is not just China where there is demand weakness. Refinery margins around the globe have weakened this year, suggesting weaker demand for refined products.

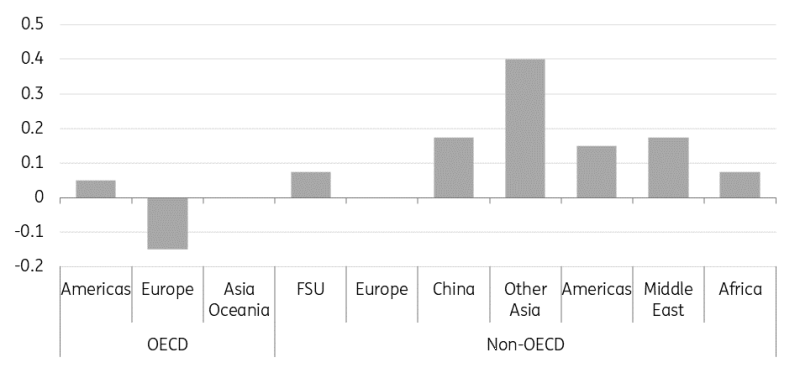

Modest growth in global oil demand is expected once again next year, and is forecast to grow by just under 1m b/d. This growth is expected to be driven predominantly by Asia.

Asia set to drive 2025 global oil demand growth (m b/d)

Source: IEA, ING Research

ING forecasts

Source: ING Research

More By This Author:

Rates Spark: A Fourth ECB Cut IncomingCommodities Outlook 2025: A Bearish Horizon

Another 50bp Bank of Canada Cut, But Smaller Moves Lie Ahead

Disclaimer: This publication has been prepared by the Economic and Financial Analysis Division of ING Bank N.V. (“ING”) solely for information purposes without regard to any ...

more