NZD/JPY Price Analysis: Bearish Momentum Intensifies, Threatening 91.00

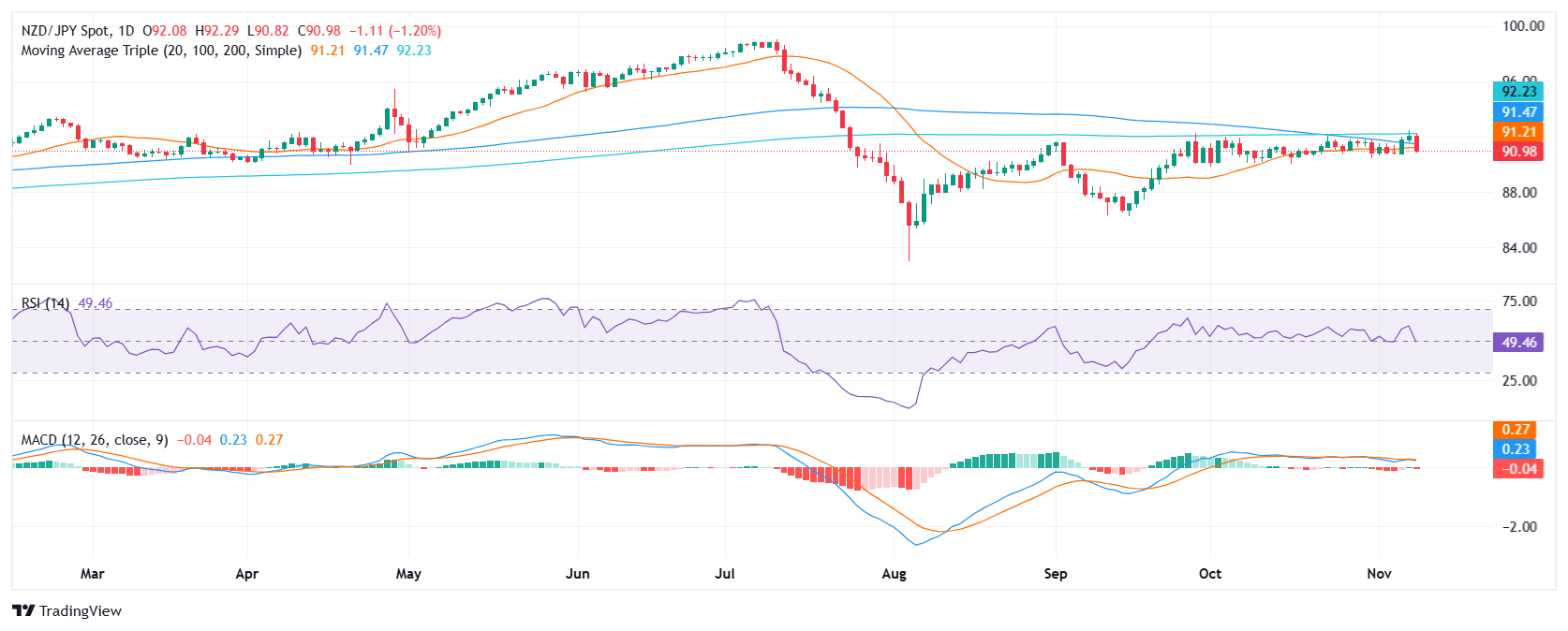

In Friday's session, the NZD/JPY declined by 1.20% to 91.00, continuing its bearish momentum. This break below the crucial 91.00 support level and the convergence of the 20 and 100-day Simple Moving Averages (SMAs) further confirms the strength of the selling pressure.

The analysis of technical indicators reveals a bearish outlook. The Relative Strength Index (RSI) has fallen into the negative territory and is declining sharply, indicating increasing selling pressure. The Moving Average Convergence Divergence (MACD) is also indicating rising selling momentum, as the histogram is red and rising.

Based on these observations, the NZD/JPY pair is expected to continue its downward trajectory. The initial support level to watch is 90.80, followed by 90.50 and then 90.30. On the upside, the first resistance level is 91.50, followed by 91.80 and 92.00.

NZD/JPY daily chart

(Click on image to enlarge)

More By This Author:

US Dollar Adds Ground To Close A Strong WeekEUR/CHF Price Forecast: Triangle Pattern Completing, Breakout To Follow

EUR/GBP Price Forecast: Finds Support At Bottom Of Range

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not ...

more