Nothing Good From A Chinese Industrial Recession

October 2017 continues to show up as the most crucial month across a wide range of global economic data. In the mainstream telling, it should have been a very good thing, a hugely positive inflection. That was the time of true inflation hysteria around the globe, though it was always presented as a rationally-determined base case rather than the unsupported madness it really was.

That was the month the real recovery was supposed to have started. Instead, we can now plainly observe how it was the exact wrong kind of inflection point back toward the opposite way. Euro$ #4 may not have completely shown up until December 2017, surely January 2018, but its seeds can be seen as far back as then.

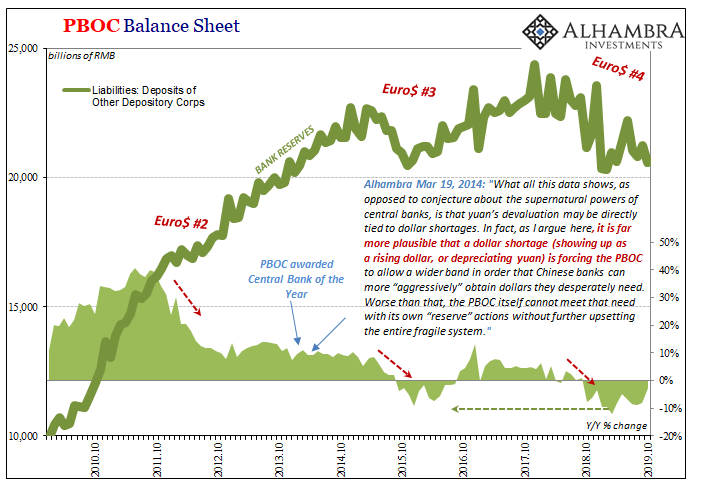

Globally synchronized growth was depending mostly on China’s expected solid contributions. You’ve heard this part many times before: massive early 2016 “stimulus” that would lead the world out of 2015’s unexpected transitory doldrums. The global recovery which was supposed to arrive in 2014 had been temporarily delayed and then put right back on track by the Communist technocrats who remain ever-faithful to the Keynesian textbooks.

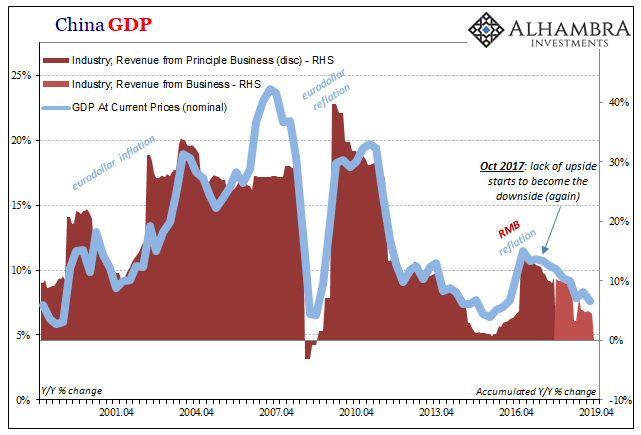

Of course, it didn’t stay that way long – at least not in economic reality. While 2017 became filled with optimism, there were warning signs all the way back at the beginning of that year. Nominal Chinese GDP, for one, peaked in Q1 2017 at a suspiciously low level.

So while globally synchronized growth accelerated in usage and emphasis as a bumper sticker slogan, China’s economy had been decelerating mildly undermining it the entire time. One key reason why global bond and money curves weren’t convinced by the mainstream’s hollow catchphrase.

Around October, the lack of acceleration through the middle of 2017 turned into the beginnings of the downturn. If China wasn’t going to really grow, its supreme leader Xi Jinping said so in that very month, the entire world would be a much riskier place. Thus, Euro$ #4 – long before trade wars. In China.

That point is especially emphasized by data from the Chinese industrial heartland. Forget “rebalancing”, the idea that China’s consumers would save the economy from unrelenting industrial retrenchment was never once a legitimate trend. Like globally synchronized growth, it was pure spin, a mere talking point for emotional assurance.

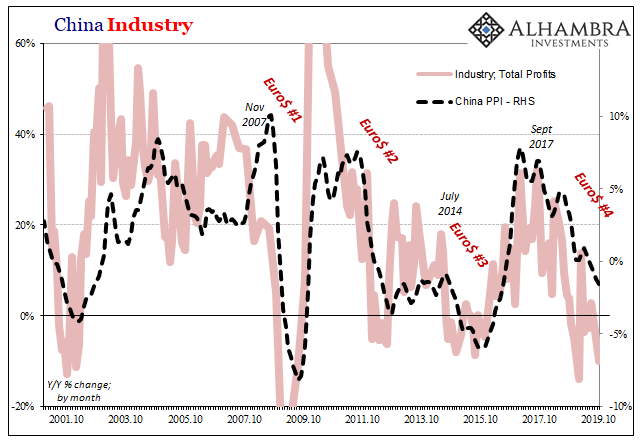

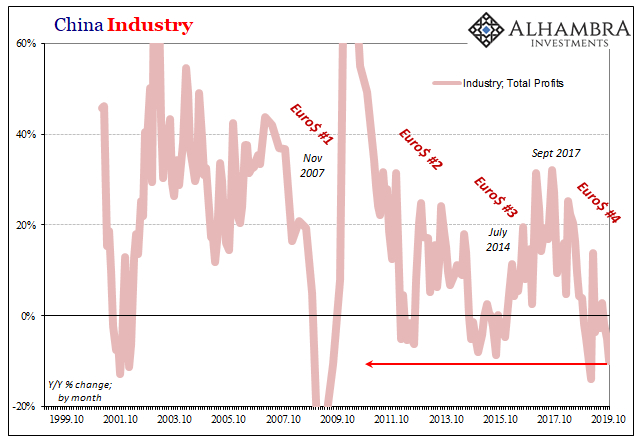

What we find of important indications in industry is, again, October 2017. By profits, the clear peak; by industrial revenues, the point at which the lack of upside transits into this downside.

That much is now completely exposed; for whatever one may have thought about China in 2018 there aren’t any doubts about where it is in 2019. And it is Chinese industry which is pulling the entire system, there and around the world, down with it.

According to the latest figures from the National Bureau of Statistics, Industrial Profits were down 2.9% through October 2019 on an accumulated basis. That means year-to-date, total profits, largely due to persistent troubles with state-owned businesses in the sector, are nearly 3% less than they had accumulated during the same months of 2018.

On a monthly basis, however, Industrial Profits in just October 2019 were nearly 10% less than they were in just October 2018. That made it one of the largest declines in the entire series, alarmingly more consistent with the worst of global recessions than anything else.

Profits reported earlier for February 2019 had sunk -14% year-over-year, but that was skewed by the Golden Week’s rabid calendar effects this year (profits were up 13.8% in March). The -9.9% in October, though, that’s a legitimate and very concerning collapse – a global recession signal.

The reason isn’t just the size of the decline or when it happened, rather it is what it could represent as a leading indication of how the conditions might likely unfold moving forward. Conditions that apply to so much more than Chinese industry.

Again, there is no rebalancing therefore as industry in China goes, so goes the rest of the Chinese economy. It’s not randomness which links industrial revenues and profits, price pressures (PPI, shown two charts above), and ultimately nominal GDP in the country.

When industry is actually performing well, as it once did before the “somehow” Global Financial Crisis (Euro$ #1), and then again in its immediate aftermath before being cut short by the second one (Euro$ #2), China’s economy flourishes and that benefit more than trickles down to every corner of the world. Ever since 2012, however, there’s been no amount of “stimulus” local or global that has been able to get everything back on track starting with Chinese industry.

The reason why authorities started and began perpetuating the rebalancing myth makes sense: industry was dead.

Even 2017’s rebound wasn’t really a rebound; more dead cat than something for every central banker around the world to have banked on. It was all the proof anyone needed, Xi Jinping most of all, that there is no getting around what is a huge problem – the no-growth world economy.

Figuring out why, that’s the real problem, though. Where did global growth disappear to? What is it that really has this stranglehold on China, squeezing the whole worldwide economy in tandem?

Trade wars have been unhelpful on their own, but the real damage they’ve caused isn’t really related to tariffs and protectionism. It is how in desperately trying to explain why globally synchronized growth never matured into RECOVERY!!!, despite emphatic near hysteria about how that was practically guaranteed to happen, Economists and policymakers (redundant) the world over have continually blamed them for it.

They make the most convenient scapegoat; plausible enough given the predicament of China’s industrial sector which seems like it would be vulnerable, while simultaneously suggesting officials weren’t wrong about 2017 – the recovery really was coming, they can now claim, except it got derailed by a few billion in US duties on Chinese goods. Sure.

October 2017 disproves their case.

For the fourth time over the last decade, everyone is looking in the wrong place. Subprime mortgages didn’t cause the 2008 crisis. Greek and Italian bonds weren’t responsible for 2011 and 2012. An overabundance of oil couldn’t have made such a protracted mess in 2014 and 2015.

Thus, the real danger isn’t just in how this #4 might impact China in as-yet nastier ways, the true peril might be in how this means without ever figuring out why there really cannot be any upside.

For as long as the world can tolerate that much what Xi outright declared in October 2017. A no-growth economy for everyone. If only he had also said it was because this is the eurodollar’s world. Not that it would’ve mattered as far as central bankers are concerned, they weren’t listening eight-way. But since Xi’s economic forecasting skills are turning out far better than those of his or any central banker’s, it could’ve at least been helpful to the rest of the world if he’d also been right about why.

A recession signal from China, and that’s not the world’s biggest worry.

Disclosure: This material has been distributed for informational purposes only. It is the opinion of the author and should not be considered as investment advice or a recommendation of any ...

more

Bad mortgage collateral caused 2008. Didn't have to be subprime. Also, Trump threatened China in 2016. China didn't naively ride a boom getting ready for problems.

What can #Trump really threaten beyond more tariffs?