Nosedives, Blue Screens Of Death, And A Turning Point For The Yen?

Image Source: Unsplash

MARKETS

Stocks took another nosedive on Friday as the New York trading session quickly devolved into a classic selloff. By afternoon, all three major indexes were down, with the Nasdaq Composite and S&P 500 on track to close the week in the red. For the Nasdaq, this would mean an end to a six-week winning streak, and the S&P 500 was on its way to suffering its worst week in three months.

The primary culprit behind Friday’s downdraft appears to be good old-fashioned profit-taking. The tech-heavy Nasdaq had enjoyed double-digit gains for the year leading up to this week, with even the Dow making a brief appearance in the spotlight. However, with gnarly cross-asset shifts, it was time to take some money to the bank and rotate it into cash.

Volatility decided to make a dramatic comeback, fueled by a chaotic week in global markets and politics. On Friday, a global tech outage added to the drama, exacerbating the pullback in mega-cap stocks already reeling from fears of new chipmaker restrictions and lacklustre earnings forecasts.

Major U.S. airlines grounded flights on Friday due to communication glitches, while other sectors like media, banking, and telecoms reported widespread system outages disrupting their operations. This tech sector anxiety was further compounded by the first wave of earnings reports, which failed to meet the market’s sky-high expectations.

Adding to the turmoil, Taiwan’s chipmaking giant TSMC saw its Taipei-listed shares drop by 3.5% on Friday. Despite strong earnings and guidance, concerns over Sino-U.S. trade tensions and the broader U.S. market slump dragged the stock down.

Big tech wasn’t the only thing wobbling; the increasingly frantic Democratic Party also added to the market’s jitteriness.

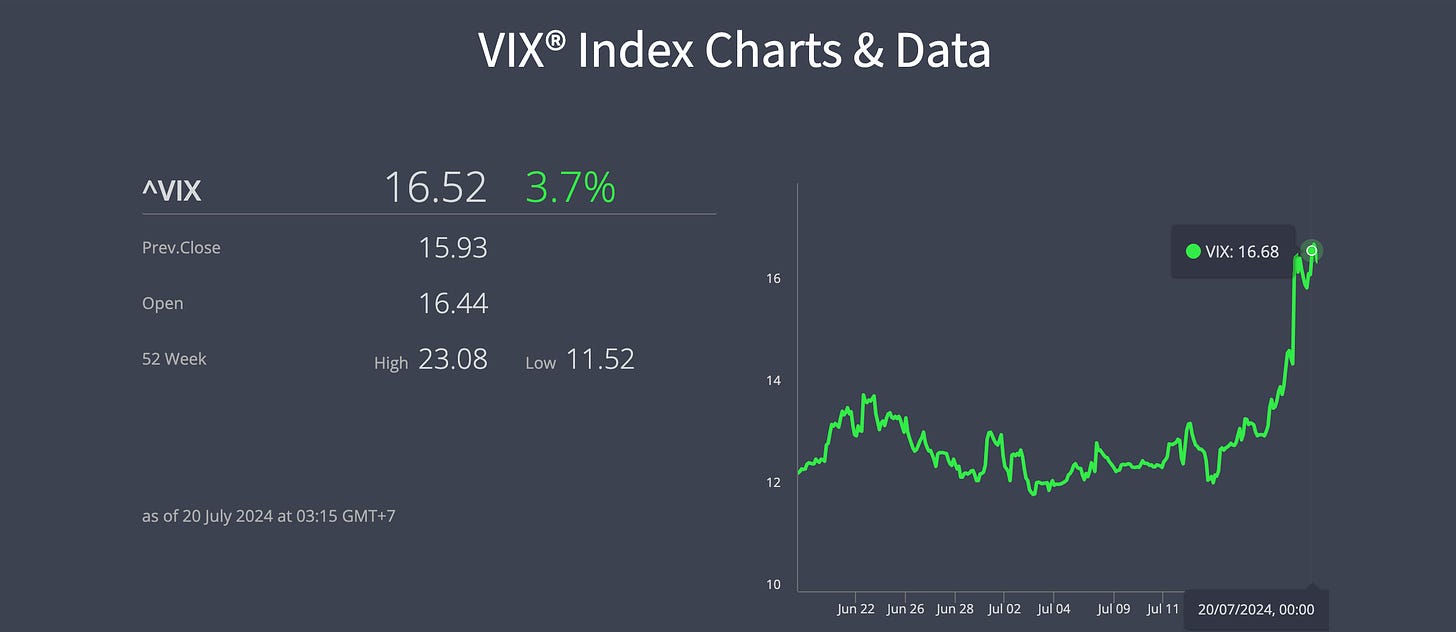

It’s been a rollercoaster of a week, with global equity markets turning risk-averse in the latter half. The VIX index climbed, and the US Dollar ended the week stronger, serving as the first line of defence when broader markets turned risk-off.

CBOE

Three major catalysts likely spurred this shift in sentiment: First, the lack of concrete policy direction from China’s Third Plenum left markets wanting, even as the meeting hinted at more economic stimulus and innovation support. Second, reports surfaced that the Biden administration might impose stricter trade restrictions on the semiconductor industry. Third, former President Trump, in a sweeping interview, reiterated his plans for hefty tariffs on China and a 10% tariff across all countries.

Japan's yen and China's yuan also tumbled in reaction to the tariff pledge.

CHINA

It was a busy and crucial week on China's economic calendar, but most news leaned towards disappointment. The highlight was the Third Plenum, where Beijing reaffirmed its commitment to boosting technological self-sufficiency. However, real GDP growth for Q2 was weaker than expected at 4.7% year-over-year (compared to 5.3% in Q1), increasing the pressure for more fiscal and monetary stimulus.

Although no major announcements on long-term economic policy were expected, there was hope that the Third Plenum might offer subtle clues about the authorities' primary concerns and future priorities. Instead, Beijing seems to be doubling down on its existing strategies, leaving the markets wanting more concrete action to address the economic slowdown.

FOREX MARKETS

The yen had a volatile week, continuing to strengthen and causing USD/JPY to fall sharply to an intra-day low of 155.38 on July 18th, further correcting from the recent peak of 161.95 on July 3rd. This correction was partly driven by Japan's intervention, estimated at around JPY5.6 trillion on Thursday and Friday, suggesting a more cost-effective approach to intervention.

Lower US yields fundamentally support the drop in USD/JPY. The June US CPI report indicated that inflation is cooling, giving the Fed more confidence to start cutting rates. Additionally, June's inflation data supports the case for a Bank of Japan rate hike on July 31st. With a BoJ hike and a potential Fed rate cut on the horizon, plus strategic BoJ FX intervention, the case for a lower USD/JPY strengthens. Yet, USD/JPY rebounded nearly 2% from post-intervention lows as investor demand for the carry trade persisted.

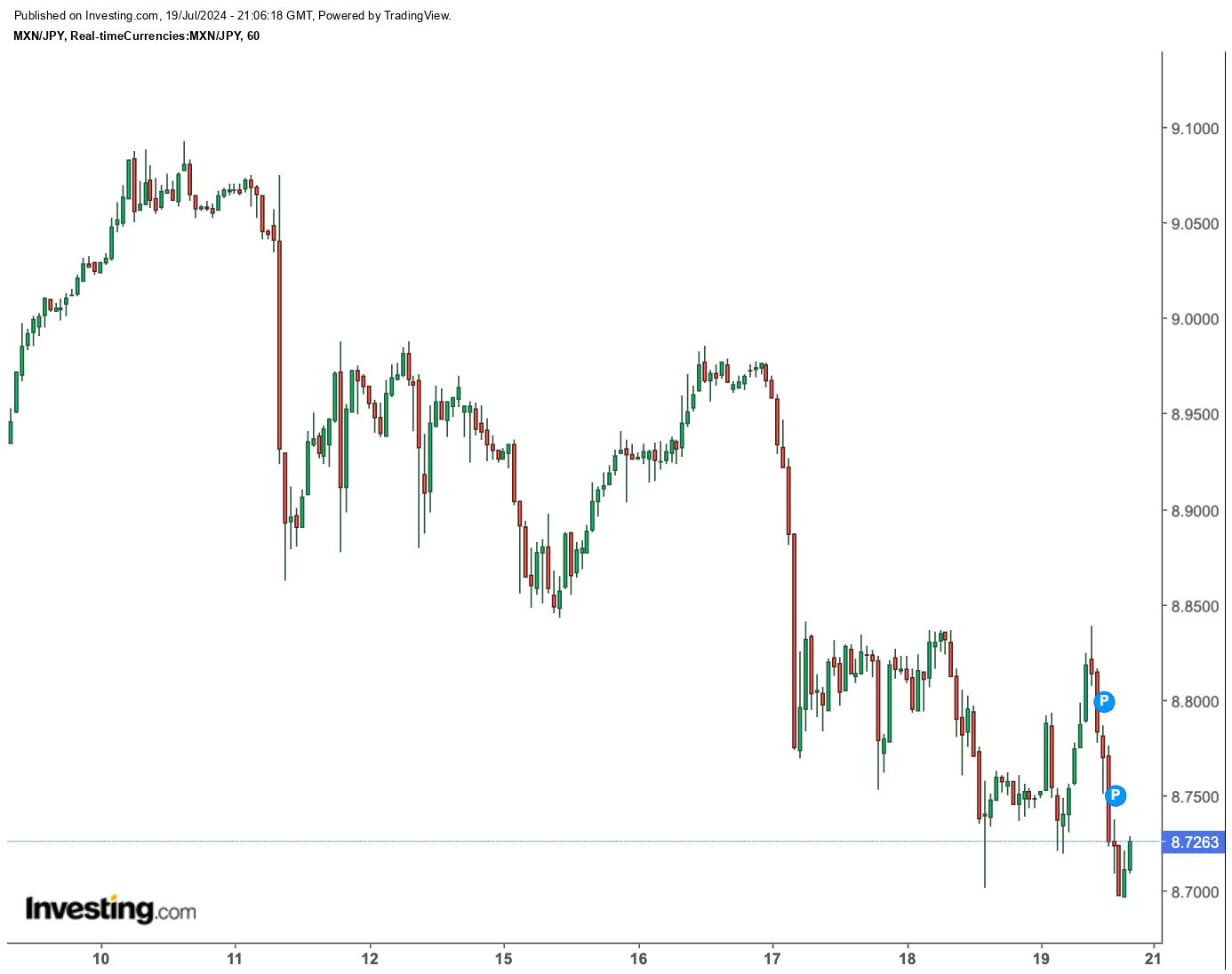

However, carry trades could face significant challenges in an increasing volatility and derisking environment. After stellar returns over the past year, the Mexican Peso swooned as fears over the Trump presidency and US protectionism grew.

Rotating into AUD or NZD carry seemed to be in vogue last week but in a risk-off scenario, that carry trade seems risky, akin to picking up nickels in front of a US dollar freight train, especially if global markets take a steep dive and the Fed falls behind on easing measures and catalyzed into a broader swoon. The AUD is a risk beta, after all. Hence, if VIX climbs past 20, and all the nasty market correlation consequences that go along with that, carry trades could cave or at least wilt, supporting the JPY, which tends to also do well when the market goes pear-shaped.

Summing it all up, recent developments have leaned towards a stronger JPY, with the pair potentially topping out. Are we at the turning point? Perhaps, but there are still two-way risks. Recent JPY gains could quickly reverse if the BoJ disappoints expectations for tighter policy at month’s end, pushing USD/JPY back towards 160.00. Conversely, if the BoJ tightens more than expected, a deeper correction could see the pair falling to 152-153 support levels. FYI, the 200-day moving AVG is around 151.50. Hence, we think that is a massive stop-loss level and trigger. If the stop-loss domino effect kicks in, we could see USD/JPY dipping below 150, especially in a scenario where the Fed signals they will cut rates three times in 2024, the BoJ adopts more aggressive policies, and broader market de-risking occurs. However, this would require a perfect alignment of several factors. An outsized hike by the BoJ might be enough to rock the boat with the market breaking bad.

Meanwhile, Republican challenger Donald Trump, now a clear favourite in betting markets for a White House return, took the stage at his party's convention. Pressure on President Joe Biden to step aside reached a peak, with reports suggesting he might announce a withdrawal over the weekend.

Bookmakers reduced Trump's chances of winning to about 60% from over 70% after last weekend's assassination attempt on the former President. The news cycle plays a crucial role in swinging odds within the small control group, but if the Trump slide sticks, we could see a softer US dollar. Though it doesn’t change overall election odds, if Biden does withdraw, the market may start to move away from a red sweep scenario, with Democrats holding the Senate, leading to a more constrained Trump manifesto and a weaker US dollar.

NUTS & BOLTS

Economic indicators have been so gloomy over the past two months that it’s easy to wonder if stability is a pipe dream and mass layoffs are inevitable. Last week’s 20,000 jump in initial jobless claims to 243,000 might suggest an impending job market slowdown, but this spike likely had more to do with the timing of Hurricane Beryl than an economic collapse.

Amidst these dark clouds, there's a silver lining: moderating inflation. A notable slowdown in consumer housing and services inflation has given Main Street hope that Fed rate cuts are imminent. The Fed funds futures market is pointing to a 25 basis point rate cut by September 18th.

This week, dovish comments from Chair Powell and Governor Waller laid the groundwork for a potential September rate cut. Equity markets experienced a significant rotation out of pricey tech stocks and into sectors likely to benefit from lower rates. Meanwhile, the Treasury yield curve has been steepening, with the short end reflecting anticipation of rate cuts just around the corner.

However, election uncertainty could shake consumer confidence and make companies hesitant to invest and hire until they have a clearer picture of the political landscape. The economic forecast may be murky, but moderating inflation, potential Fed rate cuts, and political dynamics will shape what I think could be the bumpy road ahead.

With four months to go until the election, anything can happen, as that is an eternity in market terms. Expect plenty of twists and turns. The mainstream media will do their best to influence the Democratic momentum, at least in the news cycle. If you follow Bloomberg Opinion or Businessweek, you've likely seen the bias. One email header even read, "2 Trolls Sit Atop The Republican Party," which is mild compared to major mainstream networks.

The Democrats might pivot to Harris as their lead candidate, which could energize their base heading into the convention. Unlike the Republicans, Democrats could capitalize on a convention surge given the media frenzy, as news cycles significantly impact polls.

Love or loathe him, Trump has his fans and often comes across as a modern-day P.T. Barnum. I don’t know much about J.D. Vance, but after reading "Hillbilly Elegy" and watching the Netflix movie, he seems as American as apple pie. The election run certainly won't be like watching paint dry.

TWEET OF THE WEEK

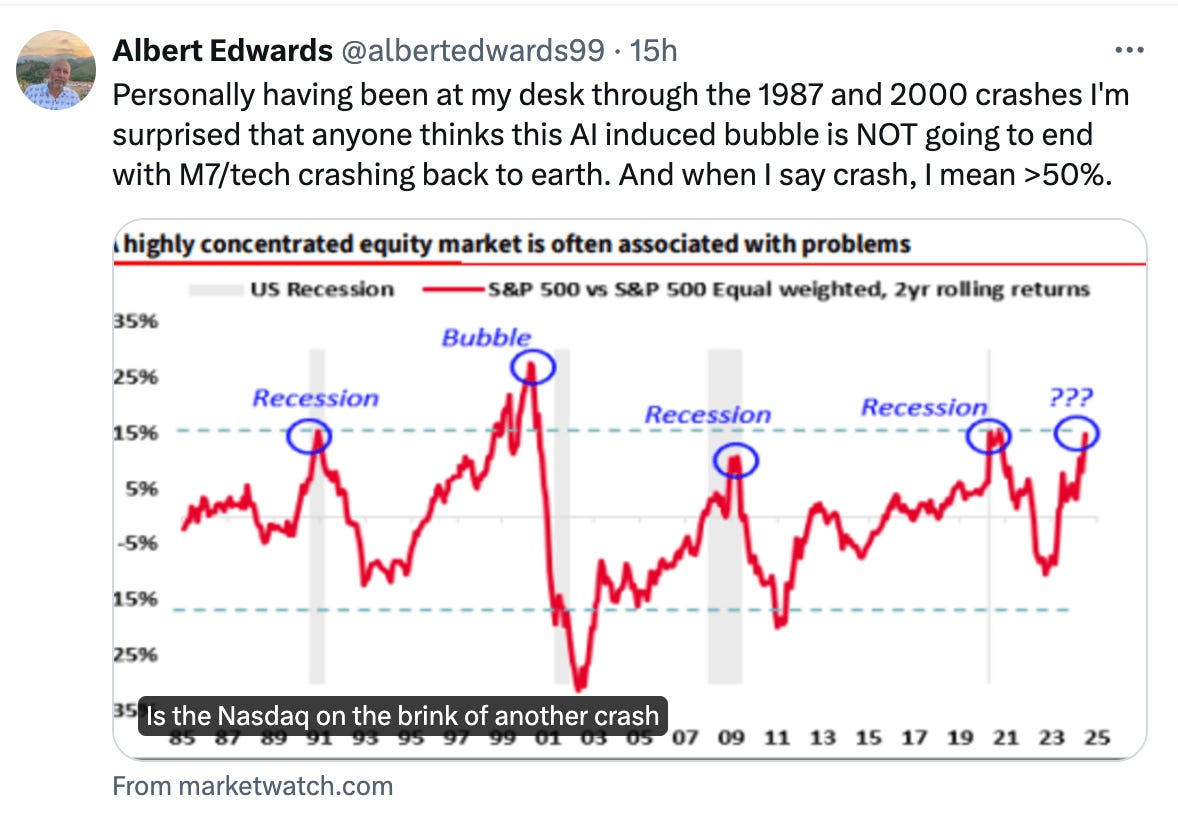

As one of the old guard, affectionately known as dinosaurs, I can relate to Albert Edwards' tweet. Though I'm no longer in the hot seat at the bank, the sentiments expressed resonate deeply.

More By This Author:

Forex: Trump & The Dollar

Jitters On Wall Street: Yet Another Tech Shakeout

Forex: A Yearning For The Yen