Norges Bank Preview: One Last Hike, Focus On New Projections

Image Source: Pexels

Norges Bank is widely expected to raise rates by 25bp to 4.25% on Thursday. We think policymakers will stop short of formally pre-committing to another hike in November, but the rate projections should at least flag a risk of another hike later this year. NOK could receive some short-term support, but a longer recovery relies mainly on external drivers.

This may well be the last hike for Norges Bank

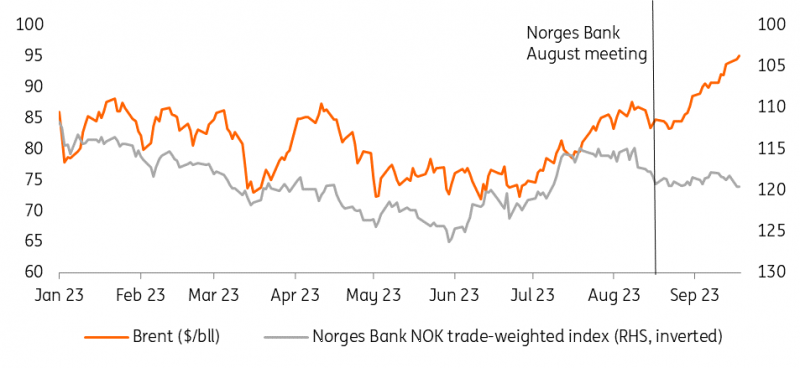

Back in August, Norges Bank all but confirmed it intended to hike rates again this month. The question is whether this will mark the top in the cycle. That was what was implied by the most recent interest rate projection from the central bank in June. Since then oil prices have risen a fair bit, and that’s viewed as a hawkish factor in the Bank’s models. So too is the rise in global market rates over the summer. The krone has also started to weaken again, though on a trade-weighted basis is still slightly stronger than the Bank’s forecasts had been assuming in June. Underlying inflation has also been coming down, in line with the June projections.

In other words, we’d imagine that the bank’s new interest rate forecast, which will accompany next week’s decision, will at least flag a risk of another hike later this year. We suspect though that Norges Bank will stop short of formally pre-committing to another hike in November in its policy statement this week. The recent moves in oil and NOK also suggest that the central bank will stop short of doing what the ECB did last week, and formally tell us that rates will stay on hold for a prolonged period of time.

For now, though, that is what we expect. We think this week’s hike will most likely be the last, but we don’t rule out another move later this year should the recent market moves persist.

Oil prices are higher, NOK slightly weaker since the August meeting

Image Source: ING, Refinitiv

FX: EUR/NOK stable, needs US data turn to move back down

Volatility on EUR/NOK has plummeted recently. The one-month historical volatility gauge is at 8.23, close to the April lows, and the one-week measure recently bottomed out at 6.25 (the lowest since December 2021) before a moderate rebound. The pair has been hovering around the 9.50 line, with good fundamentals and the oil rally attracting it lower, countered by higher US rates and unstable risk sentiment.

We can see roughly 20bp priced in for this meeting in the NOK FRA market. We see some upside potential for NOK if Norges Bank signals the possibility of another hike in its rates projections, but that is unlikely to trigger a sustainable NOK rally. That’s because the illiquid krone is set to remain closely tied to general risk sentiment, and we think will primarily respond to Fed policy and US data. Incidentally, Norges Bank looks unlikely to substantially scale back its FX buying before year-end.

More By This Author:

FX Daily: One Last Quiet DayWhy The Bank Of England Might Not Raise Rates On Thursday

FX Daily: Up And Down - A Big Week For Policy Rates And Currencies

Disclaimer: This publication has been prepared by the Economic and Financial Analysis Division of ING Bank N.V. (“ING”) solely for information purposes without regard to any ...

more