Nio Stock Price Analysis: Brace For A Key Event On Aug. 22

Image Source: Unsplash

- Nio share price has crashed by over 50% in 2024.

- The company's growth has accelerated in the past few years.

- However, costs have also jumped, leading to substantial losses.

Nio (NYSE: NIO) stock price will be in the spotlight this week as the Chinese electric vehicle giant publishes its financial results. These are important numbers because its stock has remained in a tight range in the past few months and has crashed by over 95% from its highest point this year.

EV earnings have disappointed

The ongoing earnings season has confirmed that the fear that the global electric vehicle industry is going through major headwinds.

Tesla, the biggest EV company in the world, reported quarterly sales of over $25 billion, an increase from $24.9 billion in the same period in 2023. However, a substantial amount of these funds came from alternative areas like energy and carbon credits.

In July, VinFast, a leading Vietnamese company, slashed its EV delivery outlook and delayed its closely watched South Carolina plant.

Other EV companies like Rivian, Mullen Automotive, and Lucid Group also announced modestly weaker financial results. As I warned recently, Mullen Automotive could file for bankruptcy now that its market cap has dropped to less than $10 million.

Attention this week will be on some Chinese EV companies that will publish their financial results. I did an extensive preview of Xpeng, one of the top firms in the sector that also partners with Volkswagen.

Nio will be the other top EV company to watch this week as it releases its results on Thursday before the market opens.

Nio earnings ahead

The most recent financial results have sent mixed signals about Nio. On the positive side, its annual revenue has been in a strong bull run in the past few years. It jumped from over $1.12 billion in 2019 to over $7.8 billion in 2023. This is a spectacular growth trajectory for a company that was started in 2014.

However, this growth has come at a big cost as evidenced by its soaring net losses. Its financial results show that its net loss has risen from over $1.6 billion in 2021 to over $2.9 billion in the last financial year.

As a result, the company has continued to raise cash, and some analysts believe that it will need to raise more funds if the cash burn continues.

The most recent funding came in 2023 when the company raised $2.2 billion from CYVN, an investment arm of the Abu Dhabi government. This fundraising saw the company issue 294 million new shares, which led to more dilution.

The most recent financial results showed that Nio’s weakness continued as its growth slowed. It delivered 30,000 vehicles, down from its guidance of 33,000 while its revenue came in at RMB 10.6 billion ($1.37 billion), an increase from the RMB 9.9 billion it made a year earlier.

Nio also made a big loss of over $747 million and analysts expect the loss-making trend will continue in the coming quarters.

Therefore, the challenge is whether the company will narrow its losses and avoid a cash raise. On the positive side, it has substantial sums of money on hand. Cash and cash stood at over $3.29 billion in the last quarter while its short-term investments rose to $2 billion. These are adequate funds to last it for a while as it works on its profitability.

Nio to report strong growth

Its most recent delivery numbers showed that the company’s second-quarter deliveries rose to 57,373, a 143% YoY increase. As a result, analysts expect that its quarterly revenue will come in at $2.41 billion, a 90% increase from the same period last year.

The company is also expected to narrow its quarterly loss again, with the earnings per share (EPS) expected to improve from -$0.46 to -$0.31. For the year, its revenue is expected to be $9.7 billion, a 24% increase from last year. Nio has missed its EPS estimate numbers in the last four consecutive quarters.

Therefore, while Nio’s business is doing modestly well, its stock has slipped because analysts expect its growth to slow. Besides, the local Chinese market has become highly saturated, leading to price cuts.

Nio, like other Chinese companies, is working to boost their international presence. Indeed, recent data shows that China has overtaken Japan as the biggest auto exporter in the world. It has expanded in Europe, Mexico, and other countries.

Nio stock price analysis

(Click on image to enlarge)

NIO chart by TradingView

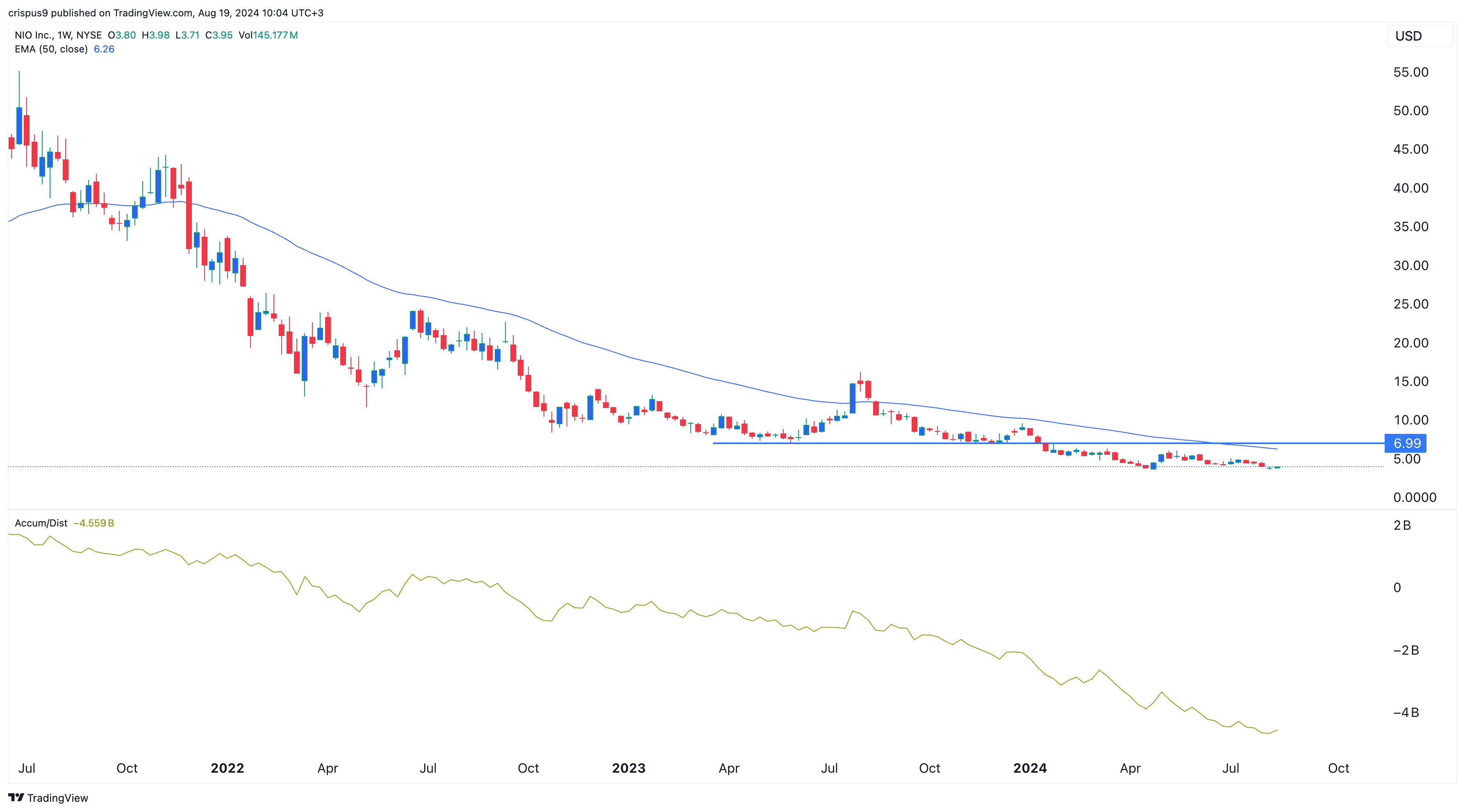

The weekly chart shows that the Nio share price has been in a strong freefall for years. Earlier this year, it crossed the important support level at $7, its lowest point in May 2023. The stock has remained below all moving averages.

Also, there are signs that investors are not accumulating it as the accumulation/distribution indicator has dropped to the lowest point in years. Therefore, the path of the least resistance for the stock is downwards, with the next point to watch being at $3.

However, the stock is still a bargain, making it a speculative buy, as interest rates are expected to fall. Besides, Nio is a highly shorted company with a short interest of 9.25%, meaning that it could go through a short squeeze.

More By This Author:

Half Of OECD Countries See Real Earnings Decline Since Covid-19 PandemicThis Bitcoin price chart should cheer all of BTC bulls

Charles Hoskinson’s Cardano And The $11 Billion Crypto Ghost Chain

Disclosure: Invezz is a place where people can find reliable, unbiased information about finance, trading, and investing – but we do not offer financial advice and users should always ...

more