Nigerian Economic Crisis And Its Effect On Banks

TM Editors Note: This article discusses a penny stock. Such stocks are easily manipulated; do your own careful due diligence.

Nigerian bank share prices have performed poorly as concerns mount over asset quality in the midst of a severe downturn in the Nigerian economy. The lackluster performance does, however, create significant opportunities for patient investors with the necessary risk tolerance. This article will be focused on Zenith Bank Plc (NL:ZENITHB, LSE:ZENB), a Nigerian bank that has managed to maintain its level of non-performing loans (NPLs) at more than 900 basis points below the national average. Zenith Bank shares have performed better than some peers and are up by about 2.94% YTD.

Zenith Bank has also seen its profit rising in a challenging environment during which Nigerian banks collectively saw a decline in profitability. In my analysis I find a fair value of approximately NGN19.5 (US 6.2 cents) for the bank's share price, about 35% above the current price, provided that it can continue to grow profits at a moderate pace and that the level of NPLs does not increase by more than 150 basis points.

Nigerian Economy

The Nigerian economy has been under pressure amidst a decline in the oil price and in the Nigerian Naira (NGN), leading to Nigeria facing its worst economic crisis in more than two decades. Third Quarter economic data was also worse than many had expected but showed signs of improvement as the non-oil sector showed flat growth compared to declines in the two previous quarters.

(Source: Trading Economics)

The IMF also lowered its forecast for the Nigerian economy's growth in 2017 from 1% to 0.6%. The economic growth forecast may be low but would nevertheless represent a substantial improvement over current conditions. Should oil prices also continue trading higher, as they have done in the wake of the OPEC agreement, the Nigerian economy is likely to show further signs of improvement. Improvements in the Nigerian economy will benefit banks as asset quality may witness improvements. It should, however, be noted that a substantial improvement in asset quality is not foreseeable in the near term.

Earnings and Valuation

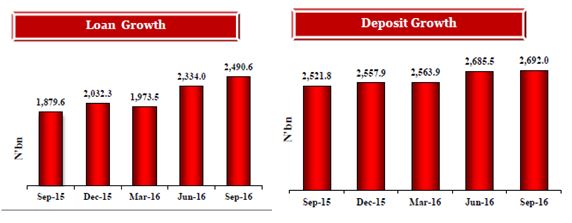

Zenith Bank’s Net Interest Income increased by 17.6% YoY in the first 9 months of 2016. This was, however, negatively impacted by a 124.76% increase in impairment charges for credit losses resulting in a 10.74% increase in Net Interest Income after impairment charges. The bank's NIM has been under some pressure as a result of the increased cost of funding but remains within range. The bank also reported a 20.44% rise in profit after tax and a steady increase in customer loans and deposits.

(Source: Zenith Bank Investor Presentation)

The high profit was strongly supported by a 240 basis point drop in the banks cost to income ratio. The bank's NPL ratio is currently 2.32% which is well below the Nigerian banking sectors average NPL ratio of 11.7%, and about 200 basis points below that of its main competitor, Guaranty Trust Bank Plc. (hereafter “Guaranty”). Zenith Bank's more cautious approach to risk management is further demonstrated by the fact that even at the height of the 2009/2010 Nigerian banking crisis, its NPLs remained the lowest of all Nigerian banks, reaching 6.5% compared to the sector's average level of NPLs at 38%. Moody’s noted that Zenith Bank is:

“a strong and well-established franchise, which allows the bank to attract inexpensive deposits and to lend to high credit quality borrowers (relative to other Nigerian banks), resulting in relatively low NPLs and credit costs.”

The bank also has a high NPL coverage ratio of 117.6%, which, along with its strong capital levels, positions the bank well to deal with any headwinds it may face in the near term. The bank’s capital adequacy ratio at 19% is well above the regulatory minimum of 15% imposed on Nigerian banks with international authorization and systemically important banks. The quality of the capital is also noteworthy, with more than 99% of the capital consisting of Tier1 (core capital).

The bank also reported a high ROE at 20.7% which is, however, lower than the ROE reported at Guaranty. In comparing Zenith Bank and Guaranty, it is important to consider the higher ROE at Guaranty but also to consider the lower NPL ratio at Zenith Bank. It is for this reason that it can be concluded that Zenith Bank's price to book value should not be substantially below that of Guaranty. Guaranty is currently trading at 1.5 times book value compared to Zenith Bank's 0.64 times book value, which is also below its 5-year average price to book value of 1.1. Zenith Bank's TTM p/e ratio of 2.96 is also well below its 5-year average TTM p/e ratio of 4.8 and below Guaranty’s TTM p/e ratio of 5.19.

The bank's high dividend yield and history of consistent dividend payments can further enhance investors' return. The bank is expected to yield 11.4% in 2016 and 12.6% in 2017. It should, however, be noted that there is a Nigerian dividend withholding tax of 10% which may be reduced by a treaty.

The Nigerian market also offers banks significant growth opportunities given its low level of financial inclusion and a rising middle class. The World Bank’s Global Findex indicated that only about 44% of the Nigerian population above the age of 15 currently has a bank account at a financial institution and that only about 5% of the population has any formal borrowings. Zenith Bank, with its large branch network and strong digital platforms, is well suited to capitalize on this opportunity that further enhances its long term growth prospects.

Takeaway

In the assessment of a fair value for Zenith Bank, we see a number of risks including a slowdown of growth in net profit to below 10% and a 150 basis point increase in NPLs resulting from a further weakening of the Nigerian economy or a deterioration of asset quality where also considered.

The bank's prudent approach to risk management, even though its more risk-averse stance has led to a lower ROE than that of its biggest competitor, is considered a positive factor in this analysis. Its more diversified portfolio is also noteworthy and will ensure that the bank has more protection against any potential rise in downside risk within the oil & gas sector than its peers.

Good read, just read another good post of yours on Seeking Alpha, but I rarely go there anymore. Would enjoy seeing more by you here.

Really interesting piece. What other investments would you recommend?

Hi James,

I will be writing a new article by the end of the week and will reply here with a link. Thank you for the positive feedback.

Thanks Louis, have any updates on these bank stocks?

If you are interested in the banks results for 2016: www.4-traders.com/.../Zenith-Bank-Impressive-Performance-24002439/

Hi Wendel,

I do not have anything material to add at present. I will, however, do an update in March after the release of the banks results for 2017.

Purely in terms of share price the stock is up by about 12% since this article was written but I believe there is still upside potential.

Looks like a promising investment, thanks.

You are welcome.

I had once broached the subject of investing in Nigeria with friends and they thought I was being reckless. I'll be sharing this article with them.

Thank you Bill. I believe the key to investing in Nigeria, much the same as investing elsewhere, is to find high quality companies.

I found this article not only interesting. It covers in depth an area that is filled with opportunity yet often ignored by the masses who always flock to the #FANG stocks or other blockbusters. This is where the real opportunity is at. I'd like to read more articles like this.

I admit, I would have assumed investing in #Nigeria would be an extremely risky undertaking. I never would have even considered it previously. But there's enough here to make me want to learn more. While the risk may be higher than what I am used to, the numbers look good. I'll be taking a closer look at #NigerianBanks.

Yes I was a bit shocked when I first read of the low NPL ratio in a Moody's report and simply had to do more research. I believe this bank is the poster child for a prudent/conservative approach to lending in #Nigeria.

Thank you for the feedback Charles, I will do my best to present more such ideas.

I am glad to see that I am not the only one writing about foreign stocks...

Nick de Peyster

http://undervaluedstocks.info/

I was a bit concerned that this article may not be a fit for the site. I am just hoping it was of some value.

Definitely a fit, because this site has no limits within finance/markets. Personally, I am interested in Nigeria especially, within the long-term African investment theme in general.