Negative-Yield Bonds Are Back In Style. Why That’s A Bad Thing

Paying someone in order to lend them money seems kind of pointless.

Yet the practice of stashing wealth in places where it yields nothing (and maybe even costs a bit for storage) is more common than you might think. Chinese, Russians, and Brazilians, for instance, buy US and Canadian condos and leave them empty as a way of moving their money beyond the reach of their rapacious governments. The taxes and condo fees produce a negative return, but most of the original investment will be there when needed. Other people store gold and silver in overseas vaults, paying 1% or so each year in fees. As the saying goes, such people are more concerned with return of capital than return on capital.

Even so, the spread of this kind of attitude beyond a small group of rich-and-worried is a sign of potential trouble. Which is why the surge in negative-yielding European bonds is worth watching.

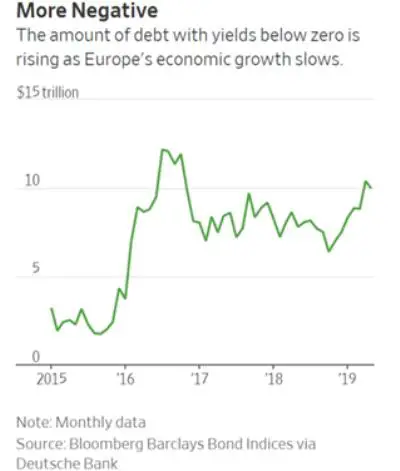

In a healthy economy with lots of profitable opportunities, few investors have an interest in, say, a government bond yielding -0.3%. Europe is clearly not that kind of place anymore, as the outstanding amount of negative-yielding government bonds is up by 20% this year to about $10 trillion. That’s the highest since 2016, when the ECB was depressing rates by snapping pretty much every available eurozone sovereign bond.

Now QE has been scaled back but interest rates are still plunging. And it’s not just government bonds. Brand-name European companies like Sanofi SA and Moet Hennessy also have outstanding bonds that trade with negative yields.

Clearly, growth is slowing in Europe and investors are scrambling to protect their capital against the coming wave of defaults.

Some implications:

Negative yields during an expansion (this one is now 10 years old and counting) deprive central banks of the ability to cut rates to fight the next recession. Yes, a -0.4% lending rate can be cut to -1% and maybe even -2%, but somewhere down there is a line that can’t be crossed – that is, a rate where the unintended consequences make the cure worse than the disease. We don’t know where this line resides, but we’re liable to find out in the next downturn.

At that point it’s not clear that fiscal policy — bigger government deficits and more central bank asset purchases — will be enough to stop the downward momentum. If they’re not, then it’s game over for the world’s hyper-leveraged economies.

As a Deutsche Bank economist put it recently, “It’s just not a great starting point to already have negative interest rates … It’s getting more and more difficult for policy makers to respond to headwinds.”

Europe’s sudden lurch to the downside also explains the recent rise in the dollar’s exchange rate (illustrated in the following chart with the DXY index). Current US bond yields, being low but positive, look increasingly attractive compared to, say, the German Bund’s -0.4% yield. And America’s relative stability makes it possible for bond and real estate investors to still find assets that offer returns both on and of capital.

But in a fiat currency world it’s all relative. The US is making the same mistakes as Europe, accumulating an ever-larger mountain of debt, keeping interest rates so low that the next recession will be hard to fight with monetary policy, and electing politicians with “free stuff for everyone” platforms. It’s just moving a little more slowly than most other major economies.

Looked at this way, Europe is the “proof of concept” experiment for negative interest rates. In the next (maybe imminent) recession, we’ll find out how far down rates can go, and what happens when they get there. And we almost certainly won’t like the result.

Excellent article. Definitely worth the read.