Negative Carry Properties Increase Downside Risks

Even when we don’t owe a mortgage, personal use of real estate is negative-carry–we spend money to maintain it rather than it paying us.

As an investment property, real estate is supposed to generate enough cash flow to carry itself. If it doesn’t, owners are out of pocket to keep it afloat. This is the definition of speculation– where you own the asset because you hope it will go up in price enough over your holding period to pay back carrying costs and then some. It’s a risky business for individuals because rental income and our income from other sources can fluctuate with the economic cycle, making negative carry harder and sometimes impossible to maintain during periods of stress.

In October 2019, I noted that a poll by investment-research firm Veritas found that only half of would-be real estate investors in Canada (primarily polled in the GTA and Vancouver) were earning net positive rental income. Of the other half, 18% said they were breaking even, and a third said they were losing money. See: Canadian Real Estate Investors are losing money, pose a risk to the system: Veritas.

With median prices doubling in the past two years, the math for many investment properties has grown even more negative. Now interest rates have moved sharply higher. An estimated 15% of property buyers across developed markets are all-cash buyers (anecdotally, in Canada, it seems to be less), with 85% dependent on financing. No wonder the Globe is reporting this week that Some new landlords are losing money, as shown in the charts below.

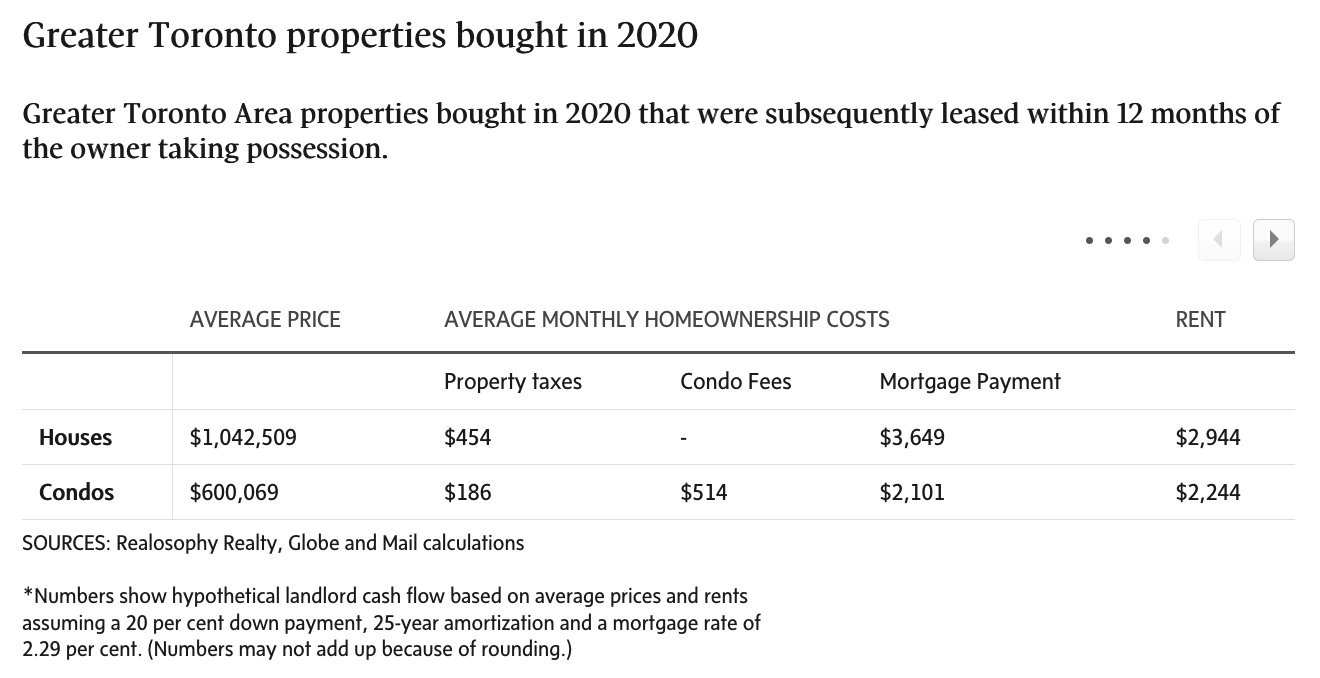

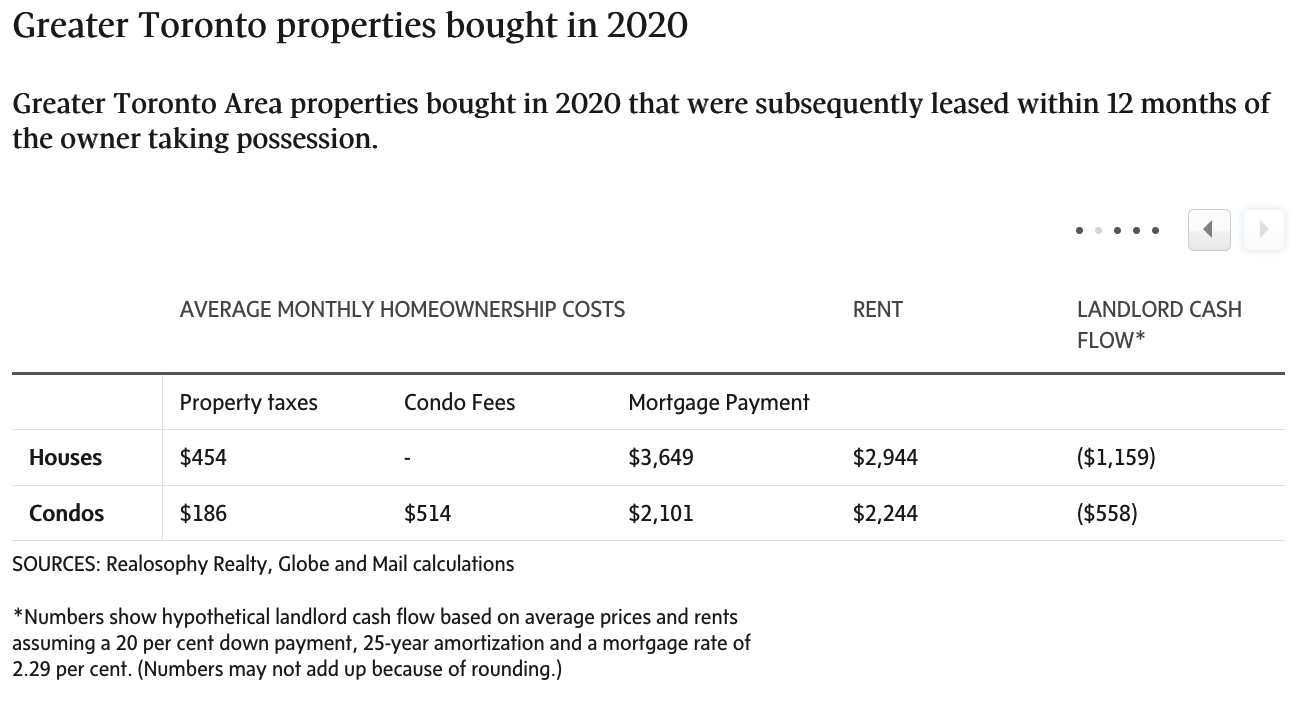

(Click on image to enlarge)

The average price of condos sold in 2020 that were subsequently leased within 12 months of the owner taking possession was just over $600,000, with an average annual property tax bill of $2,235 and average condo fees of $514 a month.

With a down payment of 20 percent and what was then a competitive five-year fixed mortgage rate of 2.29 per cent, the average monthly carrying cost of an average-priced property would work out to around $2,800, according to calculations by The Globe and Mail. But the average rent for the group properties tracked by Mr. Pasalis was less than $2,250, yielding a monthly loss of over $550.

It’s an even grimmer picture for investors who rented out homes, who could face an average monthly cash flow shortage of nearly $1,160, according to Mr. Pasalis’ data and Globe and Mail calculations.

When many people have negative carry, it magnifies the downside for the property market, lenders, and the economy.

Disclosure: None.