Natural Gas Forecast: Can Prices Continue To Rise?

Summary

- Natural gas prices reached all-time highs and are expected to be erratic in the future

- Geopolitical factors increased the volatility of gas supply and price

- Covid-19 may continue to impact the supply and consumption of natural gas

- Tight supply and increasing demand may boost the price of natural gas even higher

Commodity Overview

Natural gas is normally extracted from the Earth’s surface by drilling wells vertically. For years, as shown in the graph below, the global supply of natural gas has been greater than global consumption. Natural gas is constantly oversupplied due to the difficulty in reducing production. Turning off a well risks cutting off the supply entirely. Oversupply has kept natural gas prices stable over the last five years. Most of the global natural gas is transported by pipeline and the rest is shipped as liquefied natural gas (LNG).

(Figure 1: Global Supply and Consumption of Natural Gas)

2019 – 2020: Mild Weather and Covid-19 Pandemic Impacts

Europe had a warm winter in 2019/2020. Heating degree days declined by nearly 5% across its major gas-consuming regions compared to the previous year, reducing space-heating requirements. During the first quarter of 2020, gas demand in the residential and commercial sectors fell by about 2.6% year-over-year.

As the Covid-19 pandemic lockdown started in March 2020 globally, global natural gas consumption dropped dramatically. Most commercial activities were halted, causing commercial natural gas consumption to fall. Restaurants, shopping malls, and, in some cases, factories have been closed to prevent the virus from spreading. Though more people stayed at home than ever, the increase in residential natural gas consumption did not outweigh the decline in the commercial segment, resulting 30 billion cubic meters loss together. According to IEA’s Global Energy Review Report 2020, “Data covering half of the global demand suggest that gas consumption fell by more than 3% in the first quarter of 2020”.

(Figure 2: Natural Gas Demand Decline per Region, 2019 – 2020)

(Figure 3: Natural Gas Demand Decline per Sector, 2019 – 2020)

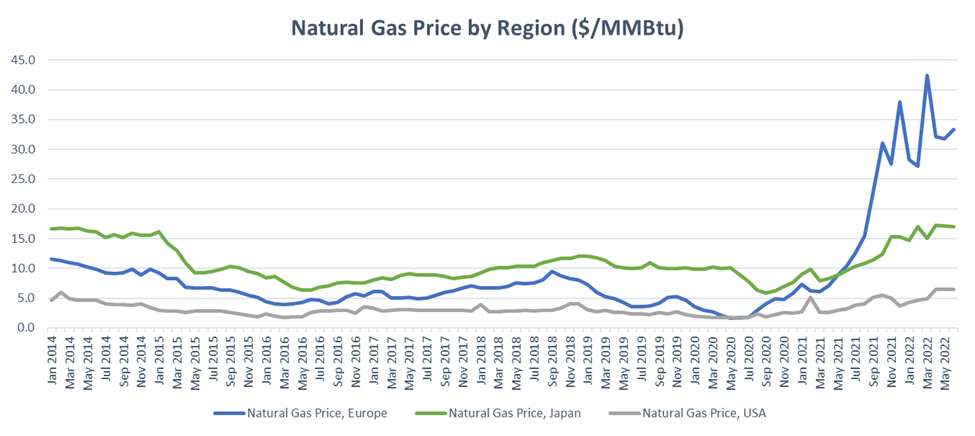

The prices of natural gas in Europe reached the lowest point in May 2020, due to the low consumption in the first half of 2020, as shown in Figure 4.

(Figure 4: Natural Gas Price by Region)

2021 – Present: Why Russia Matters

When we talk about natural gas supply, we must mention Russia, a worldwide energy behemoth in the natural gas market. The supply from Russia is crucial for the commodity price forecast of natural gas.

(Figure 5: Primary Production of Natural Gas by Country)

Russia is the world’s second-largest natural gas producer, trailing only the United States. As shown in Figure 5, last year, Russia produced 614 million tonnes of oil equivalent, accounting for 18% of global production of natural gas.

(Figure 6: Natural Gas Proven Reserves by Countries in 2021)

Russia also has the world’s largest gas reserves. The top 10 countries with the largest natural gas reserves are listed in the figure above. As shown in Figure 6, Russia held one-fifth of global natural gas reserves by the end of 2021.

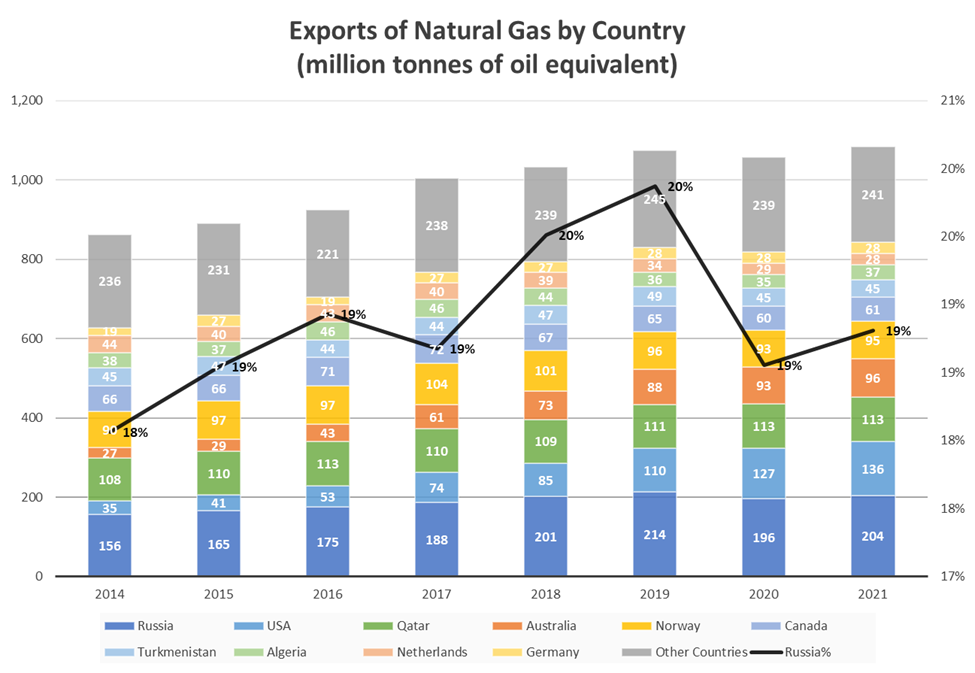

(Figure 7: Exports of Natural Gas by Country)

The large reserves and low production costs of natural gas enable Russia to become the world’s leading natural gas exporter for many years. As shown in Figure 7 above, in 2021 alone, it exported 204 million tonnes of oil equivalent, about one-third of its production and one-fifth of global exports in 2021, primarily to Europe and the UK as well as other countries. In 2021, Russian natural gas supply accounts for one-third of EU and UK natural gas demand as shown in the figure below.

(Figure 8: Share of Russia in European Union and United Kingdom Gas Demand, 2001-2021)

Why do the EU and UK need to import natural gas? In order to achieve carbon neutrality to fight climate change, the EU reduced its energy dependence on coal to reduce greenhouse gas emissions. Natural gas, emitting 50% to 60% less carbon dioxide than coal, became the primary source of energy consumption for the EU, supporting 25% of the EU’s energy use. As natural gas resources and reserves deplete in Europe, the EU and UK are heavily dependent on natural gas imports. In Figure 8, the domestic production of natural gas in Europe decreased dramatically and the share of Russia in EU and UK gas demand increased over time from 2001 to 2021.

(Figure 9: Gas Imports from Russia in 2021)

Natural gas accounts for about one-third of total energy consumption in Hungary and Germany as shown in Figure 9. More importantly, the majority of the natural gas for the two countries is imported from Russia. Since so many countries depend on Russia for natural gas imports, any geopolitical factors could significantly impact the price of natural gas in those countries.

As the economy recovers from the Covid-19 pandemic, the demand for the energy sector, including natural gas, increased, leading to rising natural gas prices in 2021. The outbreak of the Russia-Ukraine War in February 2022 further increased the volatility of natural gas prices in Europe.

At the beginning of 2022, European natural gas inventory storage was lower than last year as well as the five-year average level as shown in the figure below. The main reason for the lower than usual storage is because of the higher demand for natural gas from Asia and tighter supply from Russia.

(Figure 10: Current European Natural Gas Storage)

Due to Russia’s invasion of Ukraine and the sanctions on Russia, Russia is reluctant to provide more natural gas to European countries by pipeline and requires energy companies to open both euro and ruble accounts. Additionally, European countries are reducing imports of natural gas from Russia as well. Most EU countries are expected to stop importing from Russia by the end of this year. In the figure below, the EU has cut natural gas imports from Russia significantly since the start of the Russia-Ukraine war. The imports amount dropped below the historical minimum level. To reduce stress from energy shortage, the EU turns to the US for natural gas supply.

(Figure 11: EU Natural Gas Imports from Russia)

According to EIA, the US exported 74% of liquefied natural gas (LNG) to Europe for the first four months of 2022, a 40% increase from last year’s average. The growing demand for US liquified natural gas from overseas markets caused a rise in domestic natural gas prices. The US natural gas price reached the highest record in the last five years.

(Figure 12: Monthly US Liquefied Natural Gas Exports by Destination)

Sanctions imposed on Russia regarding technology and equipment for natural gas transportation also harmed Russia’s ability to produce and supply both natural gas by pipeline and liquefied natural gas (LNG). Russia’s current LNG output is about 30 tonnes and plans to expand its annual LNG output to 120 million to 140 million tonnes, reaching 20% market share by 2035. However, due to the sanctions, Russia is not able to retain the technology to liquefy natural gas nor to scale up its production.

Furthermore, equipment, which Russia uses to produce gas, is from abroad, and sanctions that Russia cannot import new equipment or even foreign companies refuse to serve current ones can have a significant impact on decreasing gas production in the short future. For instance, a gas compressor unit from Siemens Energy, a German company, sent for repair was stuck in Canada due to Western sanctions. As a result, Russia cut a significant amount of supply by the Nord Stream pipeline to Europe last week.

Additionally, Nord Stream 2, completed last September, is still not operating because of no approved license. Both Nord Stream pipelines can deliver 110bn cubic meters of gas to the EU annually, representing more than 25% of total annual natural gas consumption in the EU. Germany put the pipeline license on hold considering the political factors and the desire to reduce dependence on Russian energy.

(Figure 13: Nord Stream Pipelines from Russia)

Moreover, Ukraine announced that it would cease the flow of gas at a transit point that it claims transports over a third of the fuel piped from Russia to Europe through Ukraine. GTSOU, operating Ukraine’s natural gas system, would halt shipments via the Sokhranivka route, which delivers about 30% of natural gas from Russia to Europe through Ukraine. This action led to an increase in natural gas in Europe and will impact the supply negatively even more.

Commodity Price Forecast: Supply & Demand Outlook

In the near future, the supply of natural gas will still be tight. According to a survey in nine EU member states and UK, “58% across the 10 countries – rising to 77% in Finland – wanted the EU to reduce its dependence on Russian energy, even at the expense of the bloc’s climate goals, suggesting public support for a new round of EU sanctions, including on oil.” The sanctions imposed on Russia have already constrained the supply of natural gas to Europe, and new sanctions may further increase the volatility of natural gas prices. Even US is exporting LNG more than ever to the EU to support the supply shortage, the shortage is expected to stay for a while. It takes time for US companies to drill more wells and boost production. The energy companies also face pressure from investors for dividends as well as environmental regulations from authorities.

US national unemployment rate is about 3.6% in May 2022, the lowest number since the pandemic. With more commercial and economic activities in the US, the domestic demand for natural gas will increase or bounce back to a similar level before the pandemic. As the number one country for natural gas consumption as shown in the figure below, the US will experience consistent pressure from both domestic and international demand for natural gas. As China eases its lockdown, the demand for energy usage will rise in the Asian market as well.

(Figure 14: Final Consumption of Natural Gas by Country)

Commodity Price Forecast: Conclusion

Based on all the analysis above, I give a bullish commodity price forecast for natural gas. The restrained supply will lead to a higher natural gas price. While the expensive natural gas will reduce consumption to a certain degree, the effect cannot outweigh the impact of low supply.

Disclosure: This article originally appeared on Iknowfirst.com, a financial services firm that utilizes an advanced ...

more