National Bank Of Poland Cuts Rates And Signals Longer Pause Ahead

Image source: Pixabay

As expected, NBP policymakers delivered their fourth consecutive 25bp rate cut in November, extending the scale of monetary easing this year to 150bp. Rate-setters reacted to lower current inflation, but may pause before a final adjustment to monetary policy. We see two more cuts in the first half of next year, with the target rate at 3.5-4% in 2026,

Another rate cut in November

In line with our expectations, the MPC cut the National Bank of Poland (NBP) rates by 25bp (main policy rate down to 4.25%). In the post-meeting press release, the Council justified the move with a decline in inflation and an improved inflation outlook for the “coming quarters”. In October, the communique referred to improvements in the short-term outlook.

New macroeconomic projection

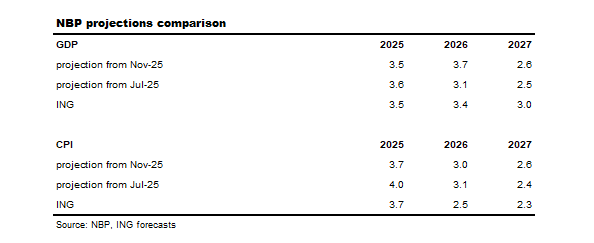

The document also presented the main parameters of the November macroeconomic projection, which could be summarised as a “goldilocks economy”. The NBP revised its 2026 GDP growth forecast up by 0.6ppt, while inflation for 2025 was reduced by 0.3ppt and 2026 CPI inflation by some 0.155ppt (with the more distant 2027 forecast slightly up).

Inflation is expected to amount to 3.6-3.7% in 2025, 1.9-4.0% in 2026 and 1.1-4.1% in 2027. These estimates are compared to 3.5-4.4%, 1.7-4.5% and 0.9-3.8%, respectively, seen in July's projections earlier this year.

At the same time, central bank economists expect GDP growth at 3.1-3.8% in 2025, 2.7-4.6% in 2026, and 1.5-3.7% in 2027 (versus July's respective 2.9-4.3%, 2.1-4.1% and 1.3-3.7% estimates). The biggest change was the 0.6ppt upward revision in the 2026 GDP growth forecast. The inflation path, meanwhile, is similar to the July projection.

Monetary policy outlook

The MPC has communicated in recent months that it is executing “adjustments” to monetary policy, but the recent series of moves perfectly fits into the narrative of a full-blown easing cycle. Policymakers' decisions were mainly driven by declines in current inflation and improvement in its outlook.

Many of the risks flagged by the MPC have not materialised. The upside risks to CPI inflation from higher electricity prices that rate setters saw for the fourth quarter of this year, for instance, have not materialised as broadly expected by the market. The MPC is probably aware that the beginning of 2026 is unlikely to bring any significant upswing in electricity prices, either, as the new Energy Regulatory Office (URE) regulated prices will be lowered from the current ones. Upside risks to mid-term inflation from the ETS2 implementation in 2027 have also been pushed forward as European Union member states wish to delay the process. The new system extends the carbon emission curbing system to transport and housing. That is probably why policymakers decided to stress improvements in the inflation outlook for the “coming quarters” in the November press release.

Taking into account the scale of monetary easing so far this year (150bp), the fact that the Council traditionally refrains from policy moves in December, and the blurred inflation picture at the beginning of the year, we may witness a pause in monetary adjustment in the coming months. The data on January CPI released in February will have a narrower scope than regular monthly reports and will be revised in March, when the StatOffice publishes February data and updated CPI basket weights. Given this context, we expect another cut to take place in March and see the target rate between 3.5-4% to be achieved in mid-2026, rather than in 2027 as we had expected previously.

More By This Author:

Food Prices Drive Czech Inflation As The Economy Sings

FX Daily: Equity Correction Casts A Shadow Over FX

Rates Spark: The Drama Is In The Plumbing

Disclaimer: This publication has been prepared by the Economic and Financial Analysis Division of ING Bank N.V. (“ING”) solely for information purposes without regard to any ...

more