Nasdaq 100 Futures Drop On Mixed Tech Earnings, Hang Seng And ASX 200 May Fall

US Tech Earnings, US GDP, Pandemic, Asia-Pacific at Open:

Nasdaq 100 index futures fell slightly during early APAC trading hours after gaining 0.49% on Thursday. Investors are assessing stronger-than-expected US data and a mixed set of tech earnings. Meanwhile, a viral resurgence in India remains a key concern for Asia-Pacific investors.

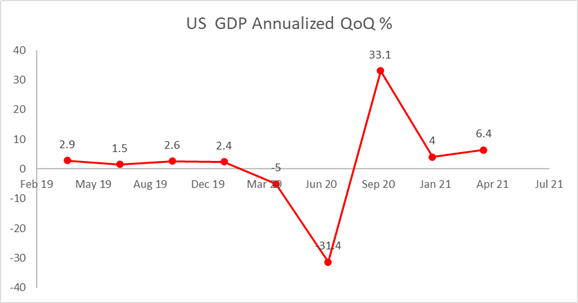

US GDP grew at 6.4% in the first quarter this year, beating market expectation of 6.1%. Data showed that demand is outpacing supply as consumption picked up strongly, signaling that a healthy recovery is underway. Meanwhile, the Federal Reserve remained dovish-biased at the FOMC meeting, showing no rush to adjust its monetary policy at the moment. An accommodative central bank may continue to support the stock market’s record rally.

The Nasdaq 100 index appeared to be facing a “reality check” as strong earnings have likely been baked into its lofty valuation. Last night, Facebook rallied 7.3% to a record high after releasing robust earnings. Apple’s share price erased profit-driven gains as chip shortage concerns weighed on its outlook. eBay declined 10% after an earnings miss while Amazon climbed 2.5% during the after-hour trade on strong revenue gains. Twitter tumbled 11% in afterhours amid a tepid outlook.

A mixed set of tech earnings pointed to the risk that the rapid growth of technology companies during the pandemic era may have reached an inflection point, and their growth is expected to normalize as people gradually return to the office.

US GDP Annualized Growth Rate QoQ

Source: DailyFX

Asia-Pacific markets are facing a challenging day ahead, with futures across Japan, Australia, Hong Kong, South Korea, Taiwan, Singapore and India pointing to open mildly lower. A viral resurgence in India remains a major concern for Asia-Pacific investors as the country’s daily Covid-19 cases surged to a record high of 379,308 on April 28th, showing no signs of abating anytime soon. This may post a major growth and reopening risk to neighboring economies in the South and South East Asia region.

The Hang Seng Index (HSI) looks set to pull back slightly on Friday, with futures pointing to a 0.25% decline. Chinese regulators summoned 13 technology companies, such as Tencent and ByteDance, for a “supervision interview” on Thursday. This marked a step further to tighten regulations on the technology sector amid a wave of anti-monopoly campaigns. Australia’s ASX 200 index looks set to retreat slightly from a 14-month high.

On the macro side, Chinese NBS Manufacturing PMI headlines the economic docket alongside Euro Area GDP and US core PCE price index readings. Find out more from theDailyFX calendar.

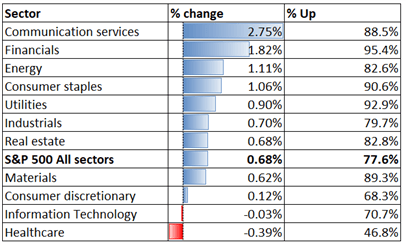

Looking back to Thursday’s close, 9 out of 11 S&P 500 sectors ended higher, with 77.6% of the index’s constituents closing in the green. Communication services (+2.75%), financials (+1.82%) and energy (+1.11%) were among the best performers, while healthcare (-0.39%) and information technology (-0.03%) trailed.

S&P 500 Sector Performance 29-04-2021

Source: Bloomberg, DailyFX

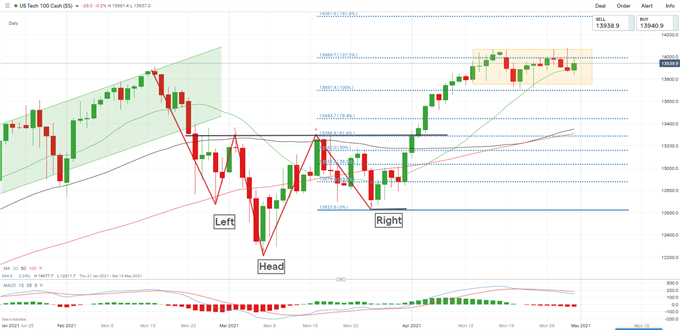

Nasdaq 100 Index Technical Analysis

The Nasdaq 100 index has likely entered a consolidative period after hitting a record high on April 16th. Upward momentum appears to be fading as indicated by the MACD indicator. The index has likely formed an inverse “Head and Shoulders” pattern, which is commonly perceived as a strong bullish reversal indicator. The pattern suggests that there could be more room to go up after finishing the consolidation. An immediate support level can be found at the 20-day SMA line (13,895).

Nasdaq 100 Index – Daily Chart

Hang Seng Index Technical Analysis:

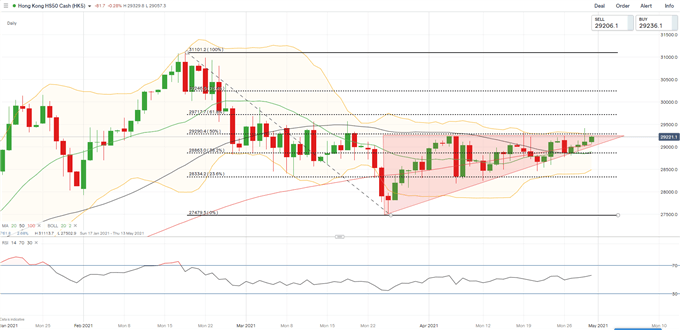

The Hang Seng Index (HSI) has likely formed an “Ascending Triangle” as highlighted on the chart below. A successful break above the “Ascending Triangle” may signal further upside potential with an eye on 29,171 – the 61.8% Fibonacci retracement. An immediate resistance level can be found at 29,290 – the 50% Fibonacci retracement. The RSI indicator is trending upwards, suggesting that bullish momentum may be building.

Hang Seng Index – Daily Chart

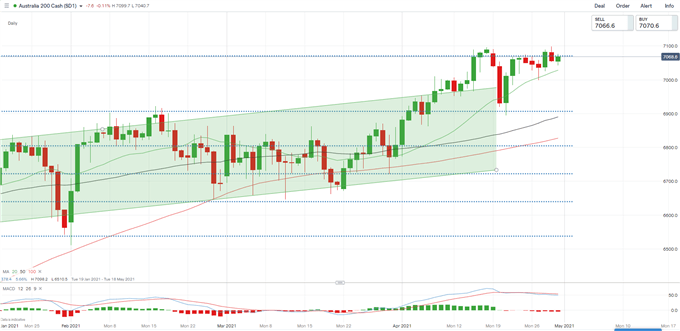

ASX 200 Index Technical Analysis:

The ASX 200 index appears to be facing strong selling pressure at 7,070 – the 100% Fibonacci extension. A successful breach above this level may open the door for further upside potential with an eye on 7,260 – the 127.2% Fibonacci extension level. An immediate support level can be found at 7,030 – 20-day SMA line. The MACD indicator has formed a bearish crossover, suggesting that near-term momentum has turned downward.

ASX 200 Index – Daily Chart