My Top Pick In Mining

“Tin is essential to an industrial society and in many applications for which there are no completely satisfactory substitutes.” —United States Geological Survey (USGS)

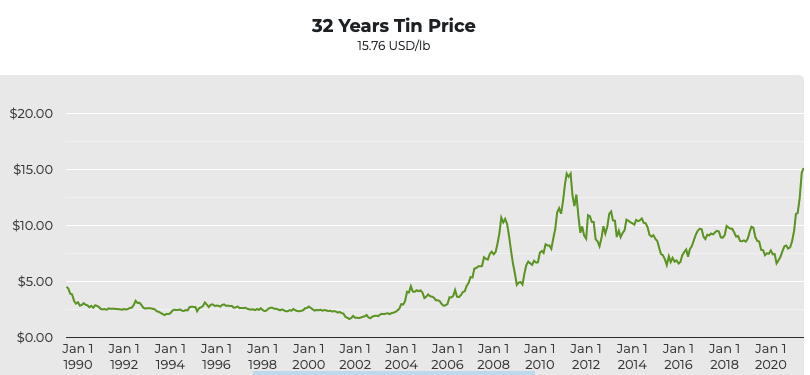

Tin: The Industrial Minefinder Called It

Although it seems like 10 years ago to me, it was only a little less than 2 1/2 years ago that I wrote a post for Industrial Minefinder (since retired and now an aspect of this Letter) called Tin Appears Ready For Liftoff where I laid out the case for the price of tin taking off in 2020. This happened and tin is now in rocket mode making new all-time highs.

View fullsize

View fullsize

source: Mining.com

Normally, new all-time highs in the price of a metal signals caution to me but, as we will see, the tin supply situation is weak and will not be easily remedied.

I will be the first one to tell you that mining is a crappy business unless you have a well run miner in a unique situation where there is serious scarcity of supply alongside solid demand. Too many mining investors are focused on metal over margin. You need to be focused on margin over metal and a tight supply situation is an important element of this. You want higher margins that are sustainable over time and insulated by poor supply fundamentals for the underlying metal(s). Many mining investors are overly focused on gold but something like 60% of all exploration dollars go into gold. There are many miners spread out over every continent looking for gold. There is a lot of competition.

The New Technology Metal

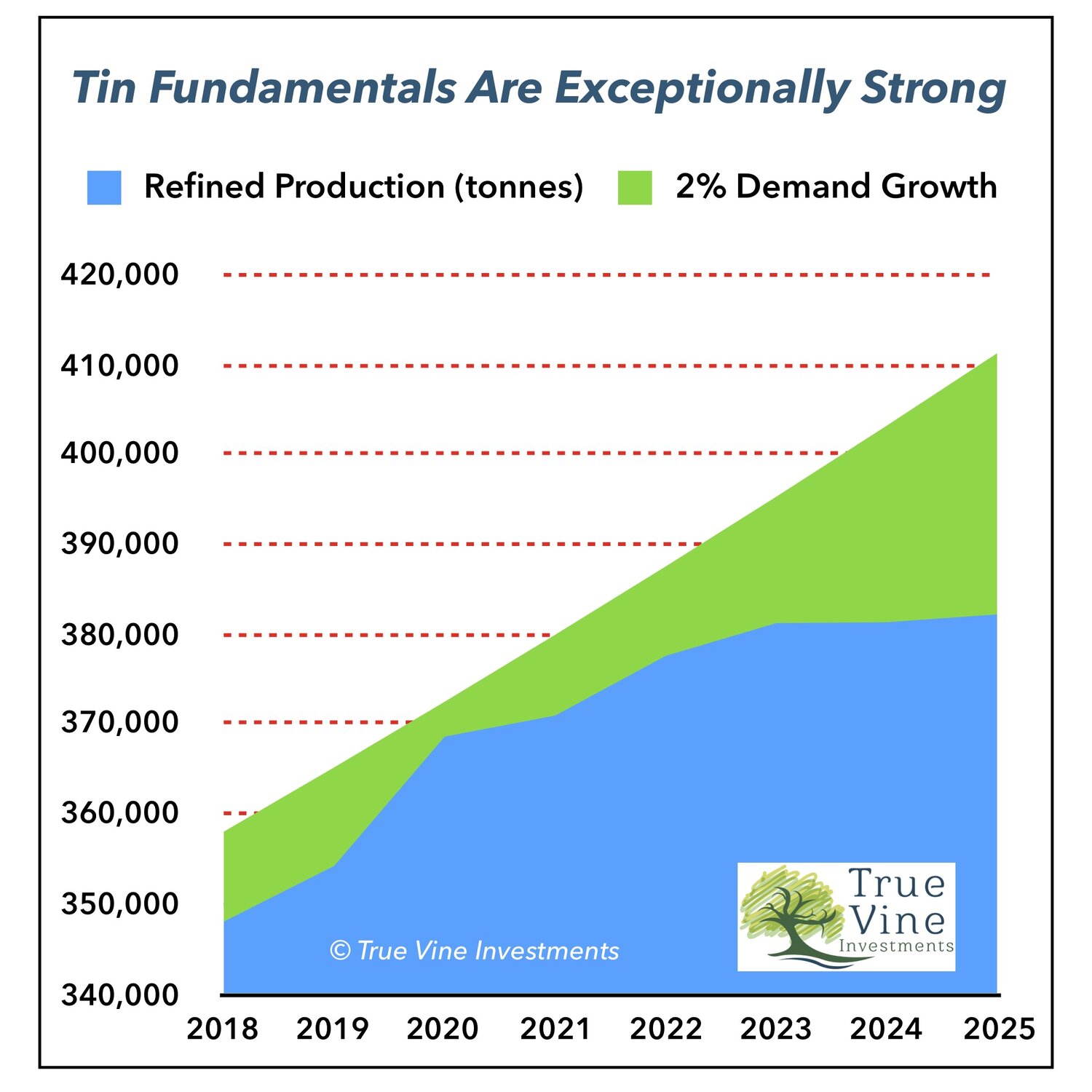

Then we have tin (Sn in the Periodic Table)—the forgotten base metal that is part of our everyday lives. Here is the fundamental chart of tin that I published with that February 2019 post:

As you can see from this chart, there was, and still is, simply not enough new tin production set to come online to supply the growing demand for what is now truly a technology metal. Actually, the supply picture for tin is even worse now. The major new development projects have not moved forward. They are still stagnant even with the price of tin soaring.

source: International Tin Association (ITA)

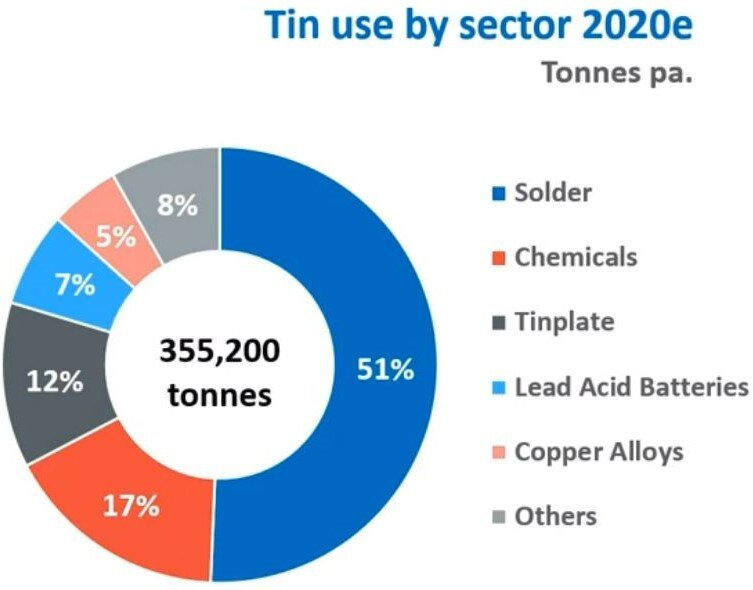

Roughly half of tin demand comes from soldering electronics. The trend of miniaturization of electronic components that has been a headwind for tin demand is coming to an end and the continued replacement of lead in solders with tin is also expected to support demand growth.

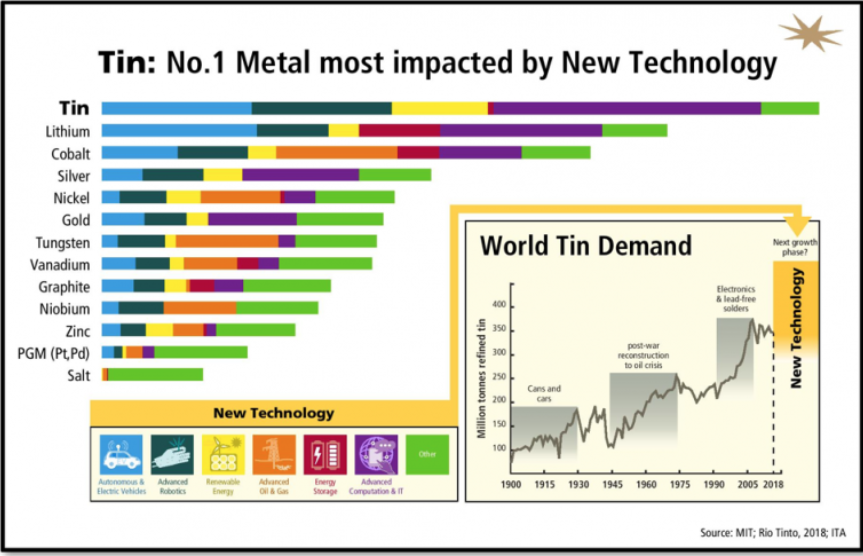

The Massachusetts Institute of Technology (MIT) did a study on the needs of new technologies versus the properties of various metals and tin came out on top:

Tin’s properties have it well suited for electric vehicles, robotics, renewable energy, and advanced computing hardware.

Tin may find adoption in lithium-ion batteries. According to Stellar Resources, the International Tin Association (ITA) noted:

“The main focus for tin is in the positive anode electrode of lithium-ion batteries, usually made today of graphite on a copper foil. Next-generation products are already adding silicon into the graphite to increase capacity. Some will probably use tin, either as an alternative or in addition to enhance silicon performance. For example, China’s largest electric vehicle producer, BYD, recently patented a tin-cobalt technology for anodes.”

What I like about tin is the current market fundamentals are strong, the future supply outlook is weak, and there is the possibility for a landmark new technology adoption in something like lithium-ion batteries that could get the focus of investors like cobalt did a few years ago.

Tin production is relatively opaque. The majority of it is mined and produced in Burma (Myanmar), China, and Indonesia. The U.S. does not produce any tin. The main players outside of Southeast Asia are Alphamin Resources’ (AFM.V; AFMJF) Bisie mine in the DRC, Minsur’s Pitinga and San Rafael mines in Peru, and the Renison project in Tasmania (an Australian island territory) which is a 50/50 joint venture (JV) between Metals X (MLX.AX; MLXEF) and China’s Yunnan Tin, the largest producer of refined tin in the world.

The most promising tin junior is Cornish Metals (formerly Strongbow Exploration; CUSN.L; CUSN.V; SBWFF). Its South Crofty project in the historic mining region of Cornwall in Southwestern England is the highest grade undeveloped project. The only problem I see with Cornish Metals is that it is undercapitalized. The company is working on expanding the existing defined Resource which may eventually help get the stock moving.

South Crofty is a project that should have been acquired already but most mid-tier mining companies are strategically inept. It has high grade exposure to a new technology metal, has quality economics, significant Resource expansion potential, and is located in a jurisdiction where the locals are hungry to see it put into action.

There are very few tin producers that are investable. Shares of Minsur only trade in Peru. Only shares of Alphamin Resources and Metals X are available to most investors. I am not interested in investing in the DRC. That leaves Metals X in a solid mining jurisdiction positioned to benefit from the soaring tin price.

A Potentially Explosive Price Situation At Hand

I want to emphasize that the supply of tin is fragile. A major negative event at one of the main mines and/or smelters could lead to a tremendous price spike. At present, exchange inventories are at bare bones levels in London and Shanghai. Producers are just barely supplying the market and scrap production is undoubtedly running at full throttle with prices at record highs. To my knowledge, there are no new projects being developed (i.e., under construction). There are some out there with pre-feasibility or feasibility studies, but I am not aware of anything under construction outside of Burma, China, and Indonesia. The International Tin Association (ITA) is recommended for investors looking to follow the situation going forward. They also put out a nice monthly newsletter that summarizes key tin related news items.

My investment case for Metals X (MLXEF) does not require tin prices at the current level, in fact, it assumes a gradual reduction in the tin price over the next several years which is prudent. However, I expect the rise of global inflation and ongoing tightness in the tin market to lead to a higher incentive price for new mines and a higher long-term average price moving forward. A few years ago I was assuming a $20,000 to $21,000 per tonne long-term average price but I have recently raised this to $23,000.

Metals X

Ever since I finished researching the tin market in-depth in early 2019, I had my eyes on Metals X for the tin. However, I first came out as a bear due to issues the company was having in the past with the Nifty copper mine in the Eastern Pilbara region of Western Australia. After (1) new management took over, (2) management made it clear that they wanted to sell the copper asset(s) and focus on tin, and (3) further equity dilution was unlikely, I finally bought it and introduced it to Premium subscribers on January 9 of this year (2021) after which the stock roughly doubled in just a few months. After telling Premium subscribers to consider taking some profits in April I just recently wrote that it is a good time to add to positions. I did so myself. After what proved to only be a pause, the price of tin has resumed its climb higher. Notably, this also transpired at a time when the broader base metals complex continued consolidating. Tin moving higher to its own beat without the broader industrial momentum is a further bullish sign.

Renison

Metals X controls 50% of the Renison (SRCWF) tin mine in Tasmania through a 50/50 joint venture with Yunnan Tin (Bluestone Mines Tasmania Joint Venture - BMTJV). Renison is one of the world’s largest and highest grade tin mines. It currently has about 120,000 tonnes of Proved & Probable Reserves of tin at a 1.4% grade. It’s Measured & Indicated Resources are more than twice this much. The mine is currently producing about 8,500 tonnes per annum so the Reserve life is about 14 years and the Resource life is much longer. Furthermore, Renison has been producing for over a century and the greater Heemskirk district where it is located remains highly prospective for tin discoveries. Case in point is the fact that the company had an exploration drill result a few years ago of 20 meters grading 6.27% Sn. Tin trades for more than 3 times the price of copper so this is like drilling 19% Cu over 20 meters. This is the equivalent of 631 g/t (22 ounces) of gold per meter. There are also juniors in the Heemskirk district, such as Stellar Resources (SLROF), with quality projects that a company like Metals X could someday invest in or acquire to expand its tin footprint.

Outlook

Metals X came out with a new company presentation a few months ago where they outlined their updated tin production plans. This enabled me to develop a detailed financial outlook for the rest of the decade which my current outlook is based on. However, this outlook does not include the potential development of their Rentails Project (re-processing of the Renison tailings) and Thermal Upgrade project that could increase tin recoveries by 10% to 15% and boost operating margins by almost 10%.

C1 costs for Renison are running a little above $14,000 per tonne. Management expects to get these down to the $12,000 per tonne level in a few years as production expands by about 10%. Given my long-term average tin price outlook of $23,000, this would put free cash flow margins around the 20% level and returns on invested capital in the 13% to 14% range (above average for a miner). Moreover, at the current share price, this would put the stock at about 6 times free cash flow. This is what I think we have if tin slowly descends to $23,000 over the next 2 years. This is sort of my base case and I think the stock is worth AUD $.30 (7.5 times $.04 per share earnings) based on this. My 12-month forward looking price target is higher at AUD $.34 which reflects the current higher tin price environment boosting the company’s results. This represents 36% upside from the current price.

As the tin price is elevated and continuing to climb, the business is generating strong free cash flow and will likely be debt free by the end of the year. The cash from the current tin bull is positioning Metals X now to be in the pole position for what will likely be an extended bull market in tin throughout the rest of the decade—a period of time where quality management decisions have the potential to deliver outsized returns to shareholders. This is the key investment thesis for Metals X and it comes with a unique call option on tin if this technology metal soars and/or remains highly elevated beyond current market expectations. The stock is currently priced for an outlook similar to what I laid out in the previous paragraph with the potential for significant additional upside from a fragile tin market.

We will have to see what management’s capital return policy is as the cash account is repleted. Executive Director Brett Smith, who is presently running the company, is a representative of APAC Resources, one of the 2 largest shareholders (15.3%) along with the Old Peak Group (15.4%). This should bode well for shareholders. My preference would be for management to (1) selectively repurchase shares under a certain valuation threshold (such as 10 times earnings) and (2) invest in either production expansion at Renison or a wholly-owned tin development project in Tasmania (whichever is more promising).

Strategic Conclusion

Metals X is a unique opportunity here in mining and still moderately priced given the trajectory of the tin price and the fragile supply picture. I think this stock is poised to outperform its mid-tier base metal piers in the near future as tin soars while the price of other metals flounder around at current levels.

Management has done an excellent job getting this company turned around and is now spinning off the nickel assets so it can remained focused on tin which I think is clearly the best strategy. I think the future is bright for Metals X and it is currently my top pick in mining.

The information presented in the True Vine Letter is general in nature and designed for do-it-yourself and professional investors. It does not have regard to the investment objectives, financial ...

more