Moody's Cuts France In Surprise Downgrade Amid Mounting Political Chaos

Image source: Pixabay

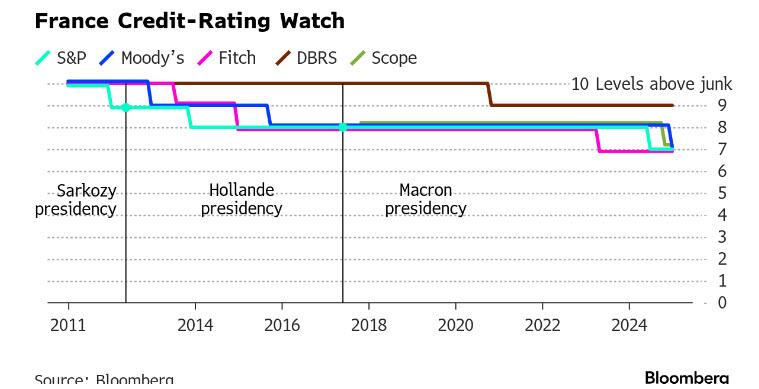

Two weeks ago, at the end of November, when many were expecting Moody's to downgrade France's Aa2 rating (after it was put on negative outlook in October), the rating agency chickened out as there was still hope that Macron might salvage some of the political chaos engulfing Europe's second biggest economy, and well aware that telling the truth in Europe is very costly. Alas, after Marine Le Pen toppled Barnier's government in a dispute over deficit reduction one week ago, Moody's no longer could pretend that France is anything but a flaming dumpster fire of a political circus, and late after the Friday close, in a downgrade that came outside of Moody's regular review schedule for France, Moody’s cut its rating of the euro area’s second biggest economy to Aa3 from Aa2, three levels below the maximum rating, and with a "stable outlook", for now. Moody's was the last holdout: France has already been cut to equivalent levels by Fitch and S&P.

The downgrade comes hours after President Emmanuel Macron named on Friday veteran centrist politician and early ally Francois Bayrou as his fourth prime minister this year. His predecessor Michel Barnier failed to pass a 2025 budget and was toppled earlier this month by left and right-wing lawmakers opposed to his 60 billion euro belt-tightening push that he had hoped would rein in France's spiraling fiscal deficit.

The political crisis forced the outgoing government to propose emergency legislation this week to temporarily roll over 2024 spending limits and tax thresholds into next year until a more permanent 2025 budget can be passed.

The decision “reflects our view that the country’s public finances will be substantially weakened over the coming years,” Moody’s said in a statement. "Looking ahead, there is now very low probability that the next government will sustainably reduce the size of fiscal deficits beyond next year."

"As a result, we forecast that France's public finances will be materially weaker over the next three years compared to our October 2024 baseline scenario," it added.

Barnier had intended to cut the budget deficit next year to 5% of economic output from 6.1% this year with a 60 billion euro package of spending cuts and tax hikes. But a majority of lawmakers were opposed to much of the belt-tightening drive and voted a no confidence measure against Barnier's government, bringing it down.

Bayrou, who has long warned about France's weak public finances, said on Friday shortly after taking office that he faced a "Himalaya" of a challenge reining in the deficit.

Outgoing Finance Minister Antoine Armand said the downgrade reflects the recent parliamentary developments and uncertainty around the budget. “The nomination of Francois Bayrou as prime minister and the reaffirmed will to reduce the deficit will provide an explicit response,” Armand said in a social media post.

The government’s collapse and the scrapping of France’s 2025 budget added to months of political upheaval that has already hammered business confidence, with the country’s economic outlook steadily deteriorating.

Barnier’s budget foresaw significant belt tightening by historical standards to bring the deficit to 5% of economic output from 6.1% this year. The next government will likely have to pare back those ambitions in order to get support from some of the lawmakers who toppled Barnier, but economists say the final outcome may even be no improvement. Plans to repair public finances were already derailed this year by poor tax revenues as consumer spending and corporate profits disappointed.

The political crisis put French stocks and debt under pressure, pushing the risk premium on French government bonds at one point to their highest level over 12 years, with the yield on French bonds surpassing that of Greece.

*FRANCE 10-YEAR YIELD PREMIUM WIDENS 8BPS, THE MOST SINCE JUNE

— zerohedge (@zerohedge) December 2, 2024

Congrats, Greece is now less risky than France! pic.twitter.com/xK2rdZ8b1h

Ironically, back during the peak European sovereign debt crisis, it was France that was among the countries that came to Greece's rescue. Alas, nobody in Europe is big enough to rescue France. Expect the EURUSD to tumble when trading reopens on Monday, on its way to parity with the dollar.

More By This Author:

Canadian Dollar Tumbles After Turdeau Reportedly Weighs Export Tax On Uranium, OilProducer Price Inflation Comes In 'Red Hot' In November

Exxon Plans Large Nat Gas Plants To Supply Electricity To Data Centers

Disclosure: Copyright ©2009-2024 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more